Morgan McGuire

- Jul 7, 2022

- 10 min read

Investing During Global Uncertainty

Our Equities Trader, Morgan McGuire, discusses the key themes entering the emerging bear market.

At present, there are a significant number of macroeconomic and geopolitical movements that are creating an environment for investors to be understandably defensive or “risk-off” (sic).

Throughout the past 2 years, economic indicators have signalled there were issues. Coming off the back of the pandemic, fuel has been added to the infernos of already embattled economies, by way of supply chain constraints. The issues with supply have had a flow on to nearly every sector and industry globally, creating supply chain-led inflationary concerns taking the UK, USA and Australia into account as examples.

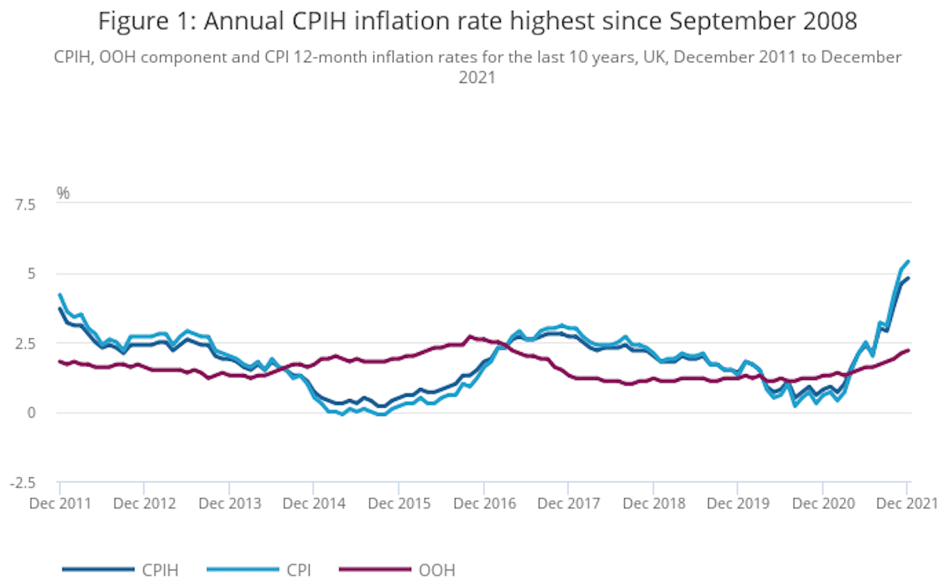

In December 2021, the UK saw consumer prices 5.4% higher than in December 2020, as measured by the Consumer Prices Index (CPI).

Source: Office for National Statistics

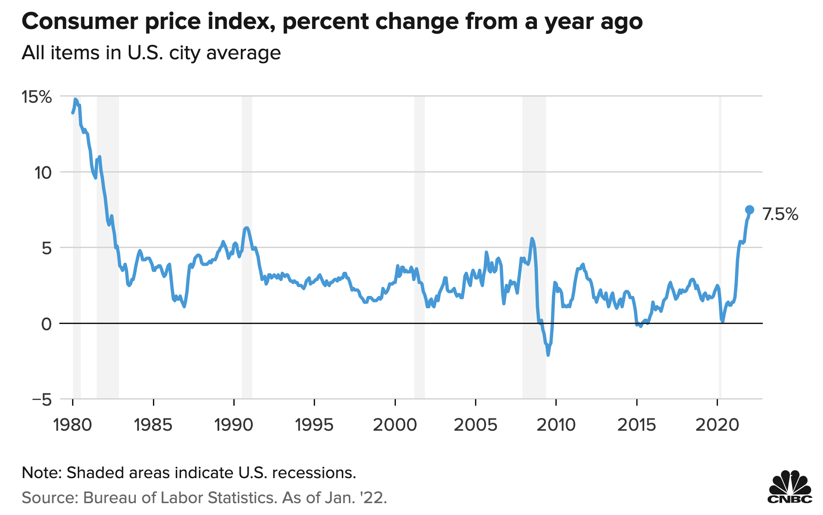

US inflationary figures surpassed the median estimate of 7.3% in January 2022 and marked the strongest inflation since February 1982.

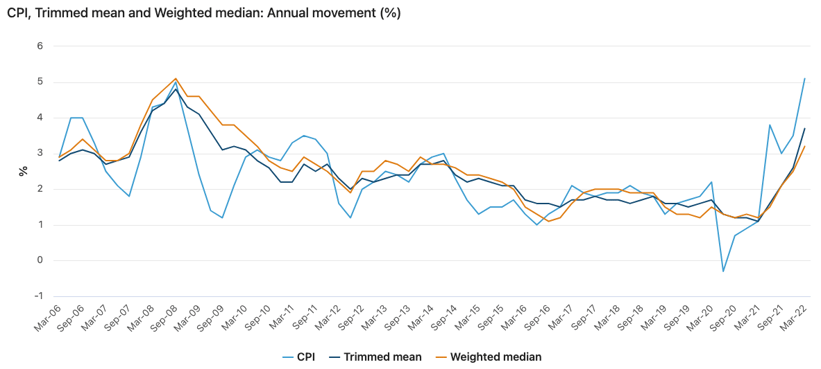

In Australia, CPI rose 2.1 per cent in the March 2022 quarter and 5.1 per cent annually, according to the March Quarter data from the Australian Bureau of Statistics (ABS).

Source: Australian Bureau of Statistics

Energy Sovereignty

Many nations (particularly in the northern hemisphere) are grappling with an energy crisis that is showing some stark and frightening similarities to those of the top 5 energy crisis of the past. Circumstances with energy are motivating countries to look at solutions for their own energy security. Australia is set to brace itself for the change in governmental policy over climate change which will have a direct effect on energy prices.

Households and businesses should brace for higher power prices over the next few years after the Australian Energy Regulator approved price increases of up to 18 per cent in NSW and 12.5 per cent in Queensland from July 1. With soaring global commodity prices, Russia’s war on Ukraine and unplanned outages of coal-fired power stations, AER chairwoman Clare Savage warned pressures on the wholesale market would stay for some time.

Currency

BRICS – The economic conglomerate; Brazil, Russia, India China and South Africa, and the looming perspective of a currency underpinned by gold, is threatening the US dollars standing as the dominant global currency. Russia is ready to develop a new global reserve currency alongside China and other BRICS nations, in a potential challenge to the dominance of the US dollar as highlighted by a recent TASS article.

Although this may become an issue for the US dollar; our trade ties with China will provide Australia with some level of insulation against a potential downturn in the value of the US dollar.

ESG

In accordance with BNP Paribas ESG Global Survey, a substantial number of institutional investors are gearing their portfolio allocations toward ESG-aligned businesses. The directional shift comes in line with the intergenerational wealth transfer and the heightened awareness and appetite for ethical investment from millennials and the general population. According to a recent Morgan Stanley Report – Among Institutional Asset Owners - 95% are integrating, or considering integrating sustainable investing in all or part of their portfolios; 57% envision a time when they will only allocate to managers with a formal ESG approach; 88% want to drive impact at the global level, through their thematic investments.

Recession

The economic commentators around the world are now in chorus singing songs about the very real threat of recession. America is looking down the barrel of a, 'not if, but when' scenario in relation to the potential for an economic recession. Former Treasury Secretary Larry Summers said a recession could be looming as a self-fulfilling process, "The risks of a 2022 recession are significantly higher than I would have judged six or nine weeks ago."

All these factors contribute to a significant level of confounding information for making clear investment choices. Compounded by the fact that we are coming off the longest bull markets in history, which lasted from 2009 to 2020, and resulted in stock growth of more than 400%. Now more than ever making sound investment choices requires making calculated and informed decisions. Day trading in this climate (for the retail traders brave enough to be doing so) is akin to catching a falling knife and requires more than a sentiment-driven or anecdotal approach. Investors are increasingly seeking out institutions like Barclay Pearce Capital for support when making investment choices.

Opportunities

Taking all the aforementioned factors into consideration, there are areas such as gold, energy and rare earth minerals for investors to research for opportunities. A few examples of stocks that provide exposure to such commodities are as follows:

Pilbara Minerals Ltd (ASX:PLS)

Pilbara Minerals is the leading ASX listed pure-play lithium company, owning 100% of the world’s largest, independent hard-rock lithium operation. Located in Western Australia’s resource-rich Pilbara region, our Pilgangoora Project produces a spodumene and tantalite concentrate.

Northern Star Resources (ASX:NST)

Northern Star Resources Limited (ASX:NST) is a global-scale Australian gold producer with world-class projects located in highly prospective and low sovereign risk regions of Australia and North America. Since the acquisition of the Paulsen’s mine in July 2010, Northern Star has assembled a portfolio of high-quality, high-margin gold mining operations. The Company has been able to significantly grow production, earnings and cash flows, and Resources and Reserves through operational excellence and aggressive investment in exploration. This approach has resulted in an enviable track record of paying sustainable dividends. Northern Star’s industry-leading, highly experienced Board and Management team is firmly focused on sustainable ESG performance and delivering superior Shareholder returns.

Woodside Energy (ASX:WDS)

Woodside are a global energy company, founded in Australia with a spirit of innovation and determination. We provide energy the world needs to heat and cool homes, keep lights on and enable industry.

Read the Conversation:

Morgan McGuire:

“At present, there are a significant number of macroeconomic and geopolitical movements that are creating an environment for investors to be understandably defensive or risk off. Throughout the past two years, economic indicators have signalled there were issues. Coming off the back of the pandemic, fuel has been added to the infernos of already embattled economies by way of supply chain constraints.

The issue with supply have had a flow on to nearly every sector and industry globally, creating supply chain led inflationary concerns. Many nations, particularly in the Northern Hemisphere, are grappling with an energy crisis that is showing, in my opinion, some stark and frightening similarities to those of the top five energy crises of the past.

Households and businesses should brace for higher power prices over the next few years after the Australian Energy regulator approved price increases of up to 18% in New South Wales, and 12 and a half percent in Queensland from July one. BRICS, the economic conglomerate consisting of Brazil, Russia, India, China, and South Africa, and the looming perspective of a currency underpinned by gold, leading to a potential threat to the US dollar, no longer being the dominant global currency.

Russia is poised and at the ready to develop a new global reserve currency alongside China and the other BRICS nations. In accordance with the BNP *inaudible* ESG Global Survey, a substantial number of institutional investors are gearing their portfolio allocations towards ESG aligned business.

The directional shift comes in line with the intergenerational wealth transfer and the heightened awareness and appetite for ethical investment from millennials and the general population. The economic commentators around the world are now in chorus singing songs about the very real threat of recession.

America is looking down the barrel of a, not if, but when scenario in relation to the potential for economic recession. Former Treasury secretary, Larry Summers said a recession could be looming as a self-fulfilling process. With all these factors contributing to a significant level of confounding information for making clear investment choices, compounded by the fact that we are coming off the longest bull markets in history, which lasted from 2009 to 2020 and resulted in stock growth of more than 400%.

Now more than ever, making sound investment choices requires making calculated and informed decisions. Day trading in this climate for the retail traders brave enough to be doing so, is akin to catching a falling knife and requires more than a sentiment driven or anecdotal approach. Investors are increasingly and rightly so, seeking out institutions like Barclay Pearce Capital for support when making investment choices. To learn more, please click the link in the description below.”

Where to from here?

Trading equities is all about having access to the right investment opportunities and making decisions based on accurate, unbiased information. Often, this means hours of research on a daily basis, keeping up with several ASX announcements, understanding economy-impacting events and regularly consuming broader news updates. If you're not an equities trader by profession, then it can quickly become rather overwhelming, especially once you have built a considerable-sized investment portfolio.

Our Equities Trading team, backed by our independent research department is the ideal solution for said situation. Our clients receive access to exclusive investment opportunities, daily ASX research reports, our expert weekly outlook on the Australian markets and direct access to our equity traders.

Trading with Barclay Pearce Capital is about building long-term returns, trust, confidence and a mutually beneficial relationship.

Trading with Barclay Pearce Capital ensures the needs of investors of all magnitudes are met by our highly skilled and attentive trading professionals.

~ Trent Primmer, Director of Trading, Barclay Pearce Capital.

Share Link