Jack Colreavy

- May 26, 2021

- 4 min read

Locksley Resources Limited - Initial Public Offering

Locksley Resources Limited IPO was heavily oversubscribed and has closed.

Barclay Pearce Capital is acting as Lead Manager to Locksley Resources Limited on its IPO capital raise.

A recent Forbes article declared copper was a strong competitor for the title of ‘New Oil’ or "King of the energy sector". The reasoning behind this claim is that copper will play a pivotal role in the global transition to renewable energy. Electric vehicles, wind turbines, and solar panels will all require copper in their constitution with no cheaper substitutes. Moreover, copper has for years been used as an alloy for jewellery, in construction of buildings, for industrial machinery, and even for medicinal purposes due to its bacterial resistance.

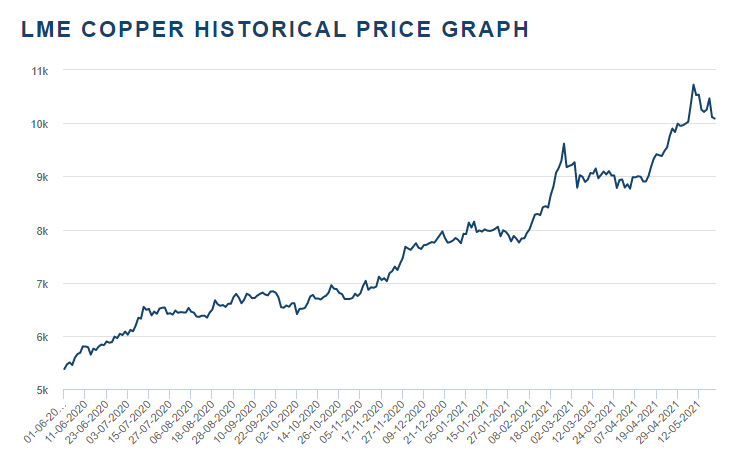

As a result, it comes as no surprise that in May 2021, copper prices reached an all-time record high of US$10,525 per tonne on the London Metal Exchange (LME). Furthermore, inventory levels are low with supply tight primarily due to major copper producer Chile threatening tightening regulation. These factors are indicative of high prices to persist over the short and medium term. Goldman Sachs reinforces this premise with a US$15,000 per tonne price expectation by 2025.

.png?width=1600&name=Global%20Copper%20Inventories%20(million%20tonnes).png)

Australia has the 2nd largest estimated global copper resource but currently ranks 6th in the world for total production. This is set to change over the coming decade as the importance of the resource is realised for the future growth of global economies. An opportunity presents itself to Australian investors to back copper explorers in our country and reap the rewards of the tailwinds behind this global macro trend.

Enter Locksley Resources who are launching their initial public offering (IPO) this week, subject to ASX approval. They are seeking to raise A$5m in capital for the exploration of their copper tenements which have the potential to deliver significant growth for shareholders.

Locksley's flagship asset is the Tottenham Project which is located on an area of 470km2 in the Cobar-Girilambone district in central NSW. The two primary deposits within Tottenham, Carolina and Mount Royal, have a combined current estimated resource target of 86,100 tonnes of contained copper and 90,600 ounces of contained gold but an immediate exploration drilling program planned with IPO funds could result in a significant exploration upside. Moreover, the project has infrastructure already in place with access to roads and rail.

Locksley’s IPO is raising A$5m at $0.20 per share issuing 25m fully paid ordinary shares. This will leave the company with an IPO enterprise value of approximately $6.2m, which in our opinion is well priced within the current market and presents potential blue sky for incoming investors. A similar ASX comparable listing is Helix Resources (ASX: HLX) which has exploration opportunities close to Locksley in the Cobar region. The HLX share price has seen rapid appreciation recently and is up 320% 2021 YTD to a market capitalisation of ~A$45.3m as of 25 May 2021.

Locksley is led by an experienced and dedicated board and management team. Pivotal to that team is Managing Director Steve Woodham who has over 30 years of industry experience and an impressive track record of tenement acquisition, mining investment, and commercial negotiation. Steve was a founding director of Centaurus Resources, YTC Resources (Aurelia), and managing director of Kingwest and Tellus Resources.

The future is paved with copper and the explorers and producers of this key commodity will be the major benefactors of this global trend. In our opinion investor exposure to this asset class will be vital for any portfolio so the Locksley Resources IPO affords a prime opportunity to gain exposure to this burgeoning space.

Contact Barclay Pearce Capital to learn more about this exciting opportunity.

DISCLAIMER: Please note that any advice given by Barclay Pearce Capital is general in nature, as the information or advice given does not take into account your particular objectives, financial situation or needs. You should, before acting on the advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition. You should read the prospectus carefully prior to making an investment decision. A copy of the prospectus is available from 26 May 2021. A subscription for shares must be made using the application form contained in the prospectus.

DISCLOSURE: Barclay Pearce Capital is acting as Lead Manager to this IPO and will receive fees for this role.

Contact Barclay Pearce Capital to learn more about this exciting opportunity

For enquiries regarding Locksley Resources IPO, fill in your details in the form below.

Share Link

.png?width=280&name=Locksley%20Resources%20(LKR).png)

-BPC%20Desk%20Note.png?width=767&name=Castile%20Resources%20(ASX-CST-OCTQB-CLRSF)-BPC%20Desk%20Note.png)