James Whelan

- Dec 12, 2023

- 5 min read

Goodbye/buy for now - Market Map with James Whelan

New job, new firm but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market every week with me!

Good morning,

Home stretch and the last note for the year.

Christmas plans are well underway with hams being looked at and glazes being decided. I'll be opting for:

1- The biggest ham i can find and,

2- Honey glaze

I've not done a ham before but the confidence is there to charge in after the wild success of my turkey at Thanksgiving.

Speaking of wild confidence, energy levels are at a high here at BPC HQ, having successfully completed the rights issue and shortfall for Wellnex to acquire Pain Away. Little things like the work done last week show that if it wasn't for the hard work of some determined people then a lot of good things wouldn't happen to some deserving companies.

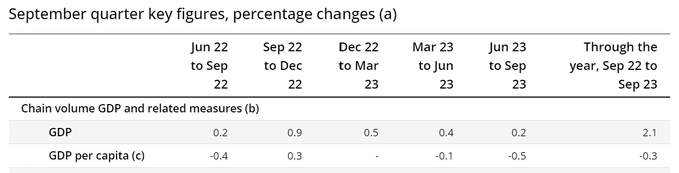

We cover that and many more things on the podcast this week which I am proud of. We go into the Last Days of Rome being played out live from Ryan's Bar as we see more data showing that while Australian GDP is still fine we're experiencing a per-capita GDP.

Source: Frontiers

That being said it's still a madhouse in the Sydney pubs as we continue to wait for the recession which seemed so inevitable a while ago.

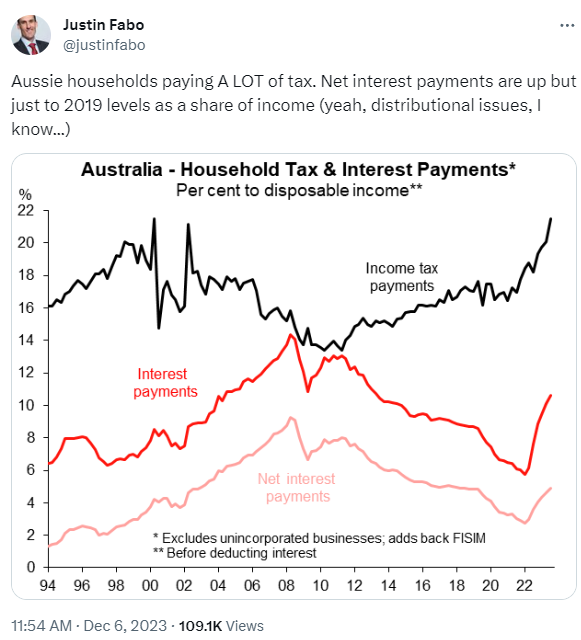

Source: Justin Fabo - X

WE PAY TOO MUCH TAX. We should be paying less tax.

Meanwhile, overseas we will reiterate the numbers for November.

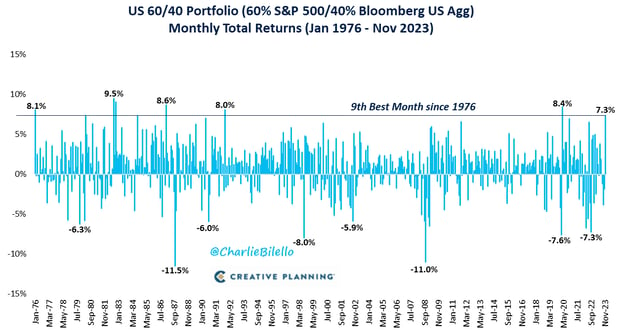

Source: Charlie Bilello - X

9th best month for the 60/40 portfolio since January 1976. That's remarkable. Go find my old notes from the end of 2022 and you'll see a lot that I was writing about how good the 60/40 would do, against the consensus of the BofA Fund Manager Survey crowd who did not see it going very well at all.

Now over to India which is still my favourite Emerging market and one that all should have a really good look at for a potential investment.

It's about to overtake HK in market size.

Source: Financial Times

Keep the faith in India there's no reason for what has happened there to stop any time soon. Remember the market and economy are, in a rare example in the history of global markets, linked. The growth of the Indian middle class will continue to fund the Systematic Investment Plan which in turn goes right into the local market. Amazingly the net flow of foreign buying has turned positive again so that's something to embolden you.

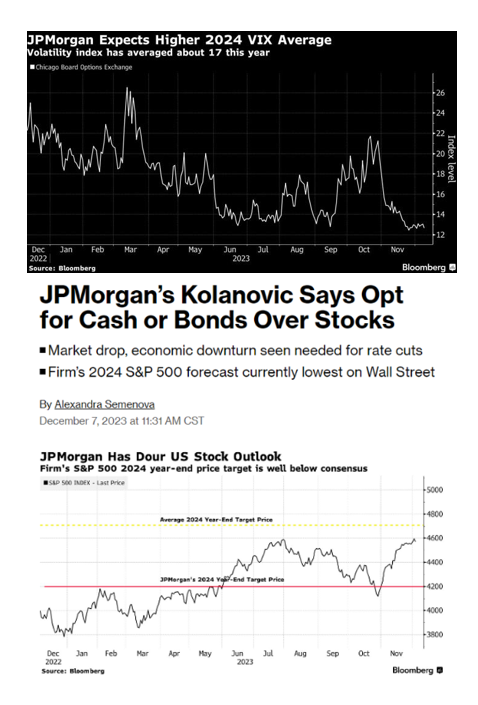

That being said when it comes to developed markets I'd be happy to ease back on the allocation to equities somewhat. A strong November and some overbought signals.

Also, the VIX is low and cheap, so if you want to buy some insurance then that's where it's at.

Source: Bloomberg

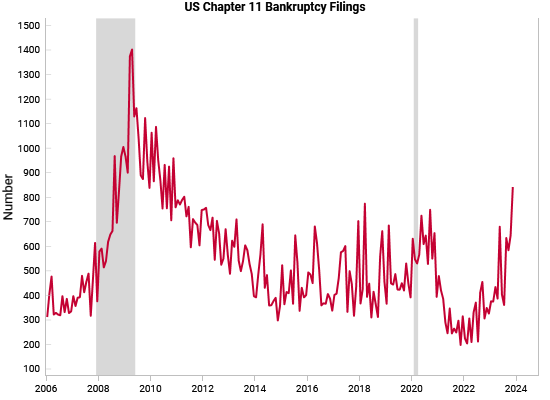

The US economy is...interesting.

Source: Stockhead

That's all for now and the last note for the year.

We've had a great run being bullish and I'm confident that careful management will see further protection of portfolios and increases of growth.

Just beware of the crash callers.

They mean well, but lots of grains of salt when they speak,

Source: Kenneth Dredd - X

All the best,

James

Share Link