Jack Colreavy

- Aug 29, 2023

- 5 min read

ABSI - From Interest Rates to Emerging Markets and AI: A Financial Week in Review

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

Last week’s financial news proved to be busier than usual with a number of important stories making headlines. Macroeconomics continues to be a hot topic with the annual Jackson Hole Economic Symposium. Geopolitics were highlighted at the 15th Annual BRICS Summit held in South Africa. While in the stock market, all eyes were focussed on the quarterly results from AI darling NVIDIA. ABSI this week will take a closer look at the three most important financial stories from the past 7 days.

Last week’s financial news proved to be busier than usual with a number of important stories making headlines. Macroeconomics continues to be a hot topic with the annual Jackson Hole Economic Symposium. Geopolitics were highlighted at the 15th Annual BRICS Summit held in South Africa. While in the stock market, all eyes were focussed on the quarterly results from AI darling NVIDIA. ABSI this week will take a closer look at the three most important financial stories from the past 7 days.

Goldilocks Powell Speaks at Jackson Hole

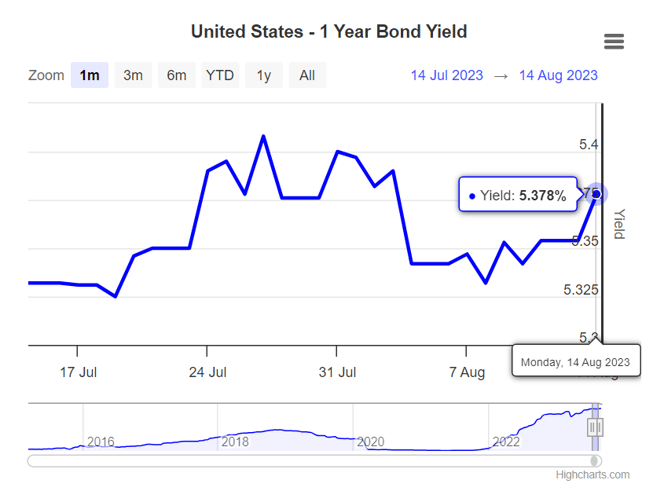

For the uninitiated, the Jackson Hole Economic Symposium is an annual conference hosted by the Federal Reserve Bank of Kansas City and is attended by central bankers, economists, financial market participants, and academics from around the world. The primary purpose is to provide a forum for discussions and presentations on important economic and financial issues facing the global economy. Participants engage in conversations about monetary policy, economic trends, financial stability, and other key topics.

Given the current macroeconomic environment, the crescendo of the 3-day conference was the speech by US Fed Chair Jerome Powell as an insight into where US interest rates will head next. In summary, Governor Powell acknowledged that progress had been made but highlighted the need to stay vigilant on the inflation and indicated that rates might need to go higher for inflation to sustainably reach their objective of 2%.

Source: World Govt Bonds

The market reaction to the speech was interesting and from a well-balanced speech, stocks and bonds focussed on different areas. US bond yields, particularly at the short end, spiked pricing in another rate hike but also pushing out the likelihood of a rate cut from mid-2023 to 2024. While stocks traded higher by the close, choosing to focus on the positives from Powell’s speech around the strength of the US economy. In my opinion, I think the bond traders got this one right and the stock traders might be a little over enthusiastic by failing to account for a potential increase in the discount rate.

BRICS Lays the Foundations for New Members

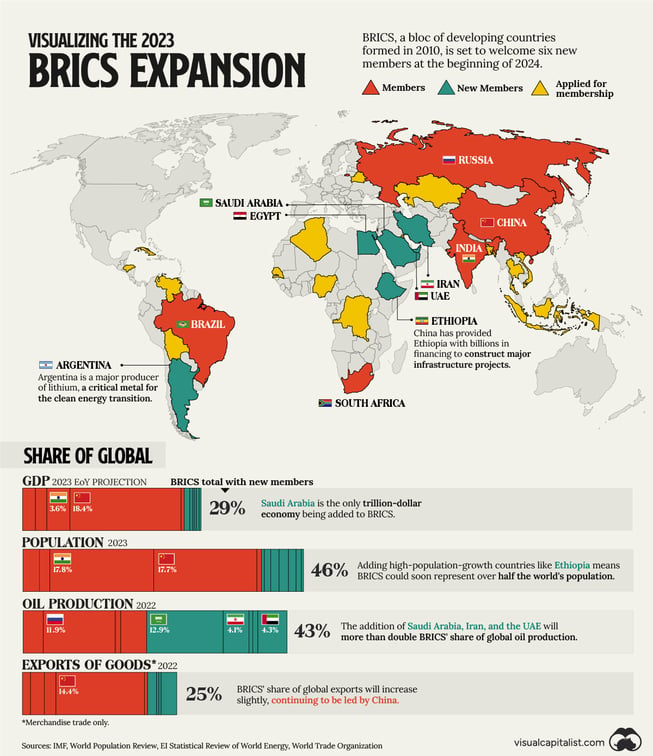

The BRICS Summit is an annual meeting of the leaders of the five major emerging economies: Brazil, Russia, India, China, and South Africa, with the summit providing a platform for these nations to discuss and collaborate on a wide range of economic, political, and strategic issues of mutual interest.

In some ways the outcomes from the Summit disappointed with no confirmation of the rumours swirling in the months prior that the coalition would announce a new currency, backed by gold, for the bloc to utilise in bilateral trade. However, in other ways there was much excitement with the announcement of new members for the first time in the bloc’s history and officially ushering in the new era of BRICS+.

Source: Visual Capitalist

Iran, Saudi Arabia, Egypt, Ethiopia, Argentina and the United Arab Emirates are set to formally join the group on January 1, 2024. While the new BRICS+ will represent ~46% of the world’s population and ~29% of global nominal GDP, this isn’t a huge move of the needle considering the dominance of China and India in these metrics. However, the expansion will double the influence on oil markets with the share of production rising from ~20% to ~43% and it will also expand the footprint in the Global South which has a growing economic and political clout on the world stage.

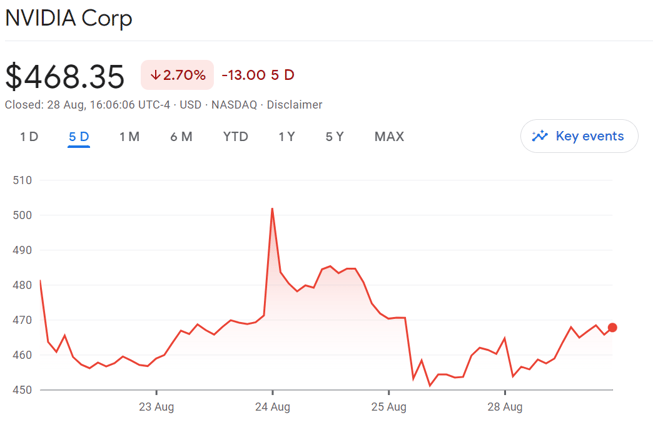

Market Rallies on NVIDIA Outperformance

The most talked about stock over the past 6 months posted much anticipated Q2 earnings last Thursday and they didn’t disappoint. Record quarterly revenue of US$13.5 billion, up 101% YoY and 88% QoQ. Gross margins came in 120 bps higher than consensus estimates at 71.2% helping the company earn a record EPS of $2.70, up 429% YoY and 148% QoQ.

Source: Google Finance

The golden goose for NVIDIA is data centre sales which account for over 76% of sales for the quarter at US$10.3 billion. Growth in this company segment is insane, 12 months ago this number was US$3.8 billion and four years ago it was a rounding error at US$700m. Management states that ~50% of the data centre demand is coming from cloud providers, such as Microsoft and Amazon, who need the NVIDIA GPUs to satisfy the unprecedented surge in demand for AI performance. The +70% gross margins also prove that NVIDIA is the only AI chip game in town. For reference, Intel’s Q2 gross margin came in at ~38%, proving that NVIDIA can pretty much charge what they want and there will still be unprecedented demand.

But will it last?

The market doesn’t think so. Despite outperforming already spectacular analyst estimates and announcing equally impressive guidance, the stock ended up flat for the day, after initially popping 6% to US$502, and has traded ~2.75% lower in the trading days since to ~US$468. This exhaust move was on US$56 billion in stock traded so while there are buyers sold on the sizzle, there are obviously people out there selling the steak. It could be that with the stock up 227% YTD that it's time to take some profits, or it could be that we live in a capitalist world and any industry that makes extreme profits such as these will have competitors gunning for them. I think it's the latter, but that’s just me.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link