Jack Colreavy

- Aug 2, 2022

- 4 min read

ABSI - Evaluation of GDP as a barometer of economic health

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

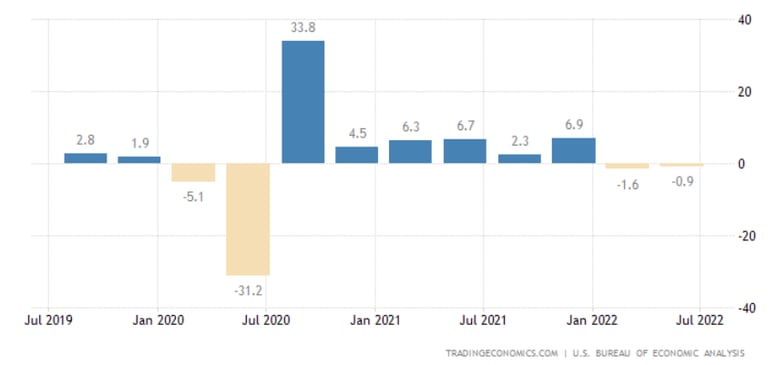

United States Q2 GDP figures were released last week to show the world’s biggest economy shrinking by an annualised rate of 0.9%, on real terms. This marked the 2nd consecutive quarter of negative real GDP, Q1 was negative 1.6%, which is commonly referred to as a recession. Interestingly, what got the most attention was not that the US was experiencing stagflation (high inflation, low growth), but a release from the White House in the days prior that sought to redefine what a recession is.

United States Q2 GDP figures were released last week to show the world’s biggest economy shrinking by an annualised rate of 0.9%, on real terms. This marked the 2nd consecutive quarter of negative real GDP, Q1 was negative 1.6%, which is commonly referred to as a recession. Interestingly, what got the most attention was not that the US was experiencing stagflation (high inflation, low growth), but a release from the White House in the days prior that sought to redefine what a recession is.

ABSI this week takes a closer look at GDP and why it is and isn’t a good barometer of economic health.

Gross Domestic Product (GDP) is a financial representation of the total monetary value of goods and services produced by a country within a given period. Broadly, it functions as the most important indicator of the economic health of a nation. Going into economics 101, the calculation of GDP is the sum of private consumption, private investment, government spending, and net exports. It is expressed as: GDP = C + I + G + (X - M).

Source: The Balance

It is important to distinguish between nominal and real GDP, especially when discussing GDP growth. Nominal GDP is the absolute number while real GDP deducts the effects of inflation on the increase in the underlying. For example, if nominal GDP was $100m in year 1 and $150m in year 2, things appear pretty great with 50% growth. However, inflation that year was 100% meaning, on a real basis, the economy experienced a real decline in GDP by 50%. Due to this nuance, real GDP growth is the most cited metric used when referring to GDP growth.

United States GDP Growth Rate

Source: Trading Economics

This brings us to recessions and their relationship with GDP. While there isn’t a single reputable definition of a recession, it is widely regarded as two consecutive quarters of negative real GDP growth. This was plunged into doubt though when the US White House released a statement seeking to redefine what a recession is claiming: “assessment of economics are based on a holistic look at the data…it is unlikely that the decline in GDP in the first quarter of this year - even if followed by another GDP decline in the second quarter - indicates a recession”. While clearly this is a political spin from the US government, their argument is understandable the limitations of GDP calculations.

There are numerous criticisms of the measurement of GDP. The most cited limitations include the inability to measure non-market transactions (i.e. the black market), failure to measure income inequality, the treatment of replacement capital the same as new capital, and the ineptitude to account for negative externalities, such as environmental impact.

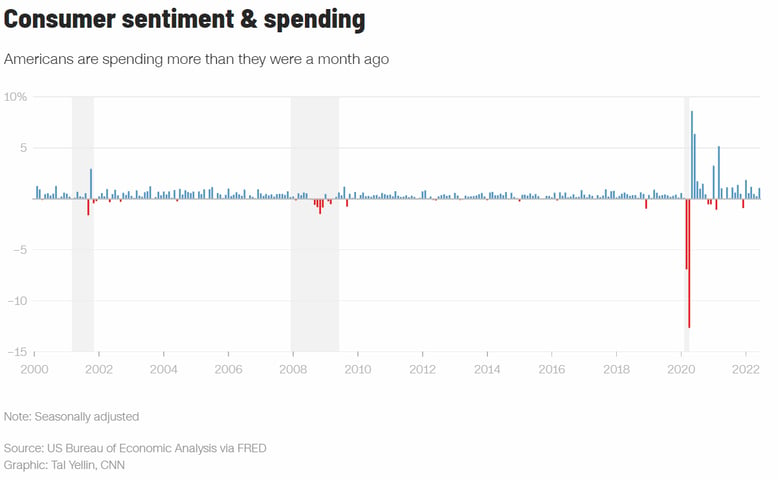

Source: CNN

Looking specifically at the latest US GDP data, the biggest detractors were residential home sales and a slowdown in inventory accumulation. The housing figures are straightforward given the rise in interest rates, but the inventories could be a result of the supply chain issues causing a delay/inability for businesses to acquire stock to sell to willing US consumers (consumer spending added 1% but is slowing). On the other hand, it may be an indication that businesses might be overstocked or that consumer demand may be weakening as a result of the rising cost of living. Couple that sentiment with declining business spending and private saving and this could easily snowball into a 3rd quarter decline if inflation doesn’t start to recede soon.

It’s an imperfect world but it’s the only one we’ve got. The measurement of GDP isn’t perfect but there isn’t a better alternative to measure the economic output of a country. The US experienced 5.7% in real GDP growth in 2021, off the back of an unprecedented and somewhat irresponsible pandemic stimulus. Therefore it is understandable that with the removal of such tailwinds that there will be a readjustment in economic growth. Unfortunately, while the White House sentiment towards the definition of a recession has its validity, it doesn’t change the inevitability that inflation will cause a serious recession if it isn’t contained soon.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link

/components-of-gdp-explanation-formula-and-chart-3306015_FINAL-969ea5e7cfdf4348a628c5dc70a2f4f6.gif)