Jack Colreavy

- Aug 1, 2023

- 4 min read

ABSI - Electricity Transmission Bottlenecks are Sending Power Prices Higher

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

It almost feels like a distant memory, but last year Australia’s energy grid was in crisis which resulted in the suspension of the pricing system after prices regularly hit the ceiling of A$15,100/MWh and subsequently had to be capped at A$300/MWh. One year after the unprecedented suspension, the Australian Energy Market Operator (AEMO) released its quarterly energy dynamics report demonstrating that while the worst is behind us, higher prices will stagnate longer than expected. ABSI this week analyses the report and what it means for power prices.

As a refresher, the AEMO manages the interconnected National Energy Market (NEM) comprising energy grids for QLD, NSW, VIC, SA, and TAS, helping to ensure the grid remains balanced. The market operates on an auction system with prices updated every 5 minutes based on supply and demand. Every 3 months the AEMO publishes these pricing dynamics which industry stakeholders use for various purposes.

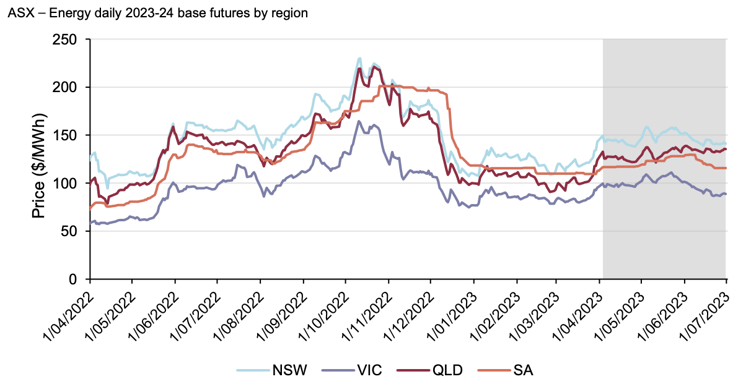

Source: AEMO

As a summary, the key findings from the report signal good news in that average power prices have reduced to A$108/MWh, a 59% year-on-year reduction from Q2 2022’s A$264/MWh, thanks to lower fossil fuel prices, less unplanned outages, and cheaper renewable energy capacity. However, this trend lower is forecasted to cease with energy futures pointing to the FY24 average to be A$124/MWh due to the unreliability of coal plants in the system and a lack of firming power.

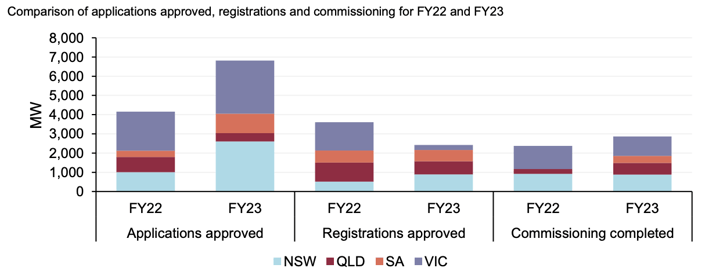

On renewables, approvals for new zero-emission capacity in FY23 have tripled to 7GW, however, connection and transmission bottlenecks continue to build as the grid continues in its quest to transition from fossil fuels to renewables.

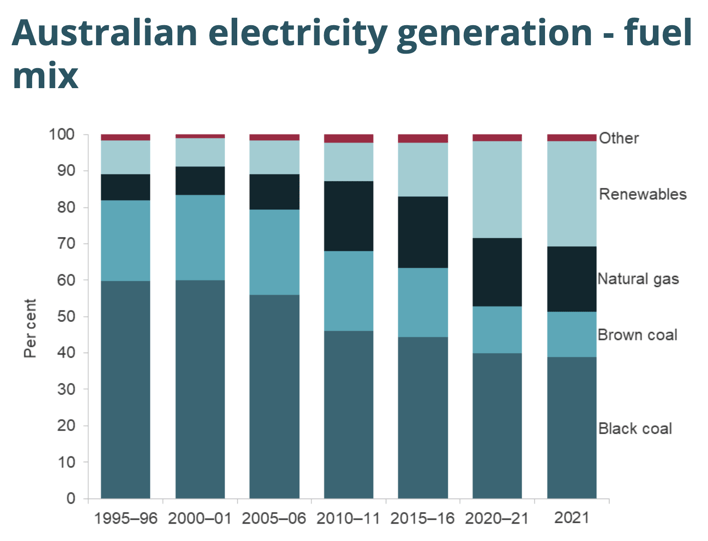

Source: Energy.gov

The Australian government has a target to reduce GHG emissions by 43% by 2030 which requires the coal-dependent energy grid to be 82% renewable by this time. According to government sources, renewables contributed to 29% of energy generation in 2021. Progress is being made, but not at the pace required due to a number of reasons with a lack of transmission infrastructure and a burdensome connection process being critical.

The AEMO Report states that there is 30GW of new capacity progressing through the connection process, an increase from 25GW YoY, but only 3.9GW is from new applications which suggests that bottlenecks continue to build. This is further evidenced by the 32% reduction YoY in registrations approved to commence commissioning.

The MacIntyre wind precinct in QLD is an example of connection delays resulting in issues for the energy transition. While the 923 MW MacIntyre wind farm, majority owned by Acciona Energy, is still proceeding, a proposed 103 MW wind farm from CleanCo has been placed on hold with a spokesperson expressing in a statement:

“As a result of significant delays to the connection process for the Karara Wind Farm, and subsequent impact to costs, CleanCo is pausing the development of the project.”

Given the vast size of Australia, it is unsurprising that the AEMO is encountering transmission delays, however, this isn’t a problem unique to Australia with many countries experiencing transmission gridlock. The UK is probably the worst example with many being informed of wait times of up to 15 years for grid connection to new generation projects due to supply shortages of cables coupled with insufficient skilled labour.

It is a fact that solar and wind energy are the cheapest forms of energy generation but the transition of the grid from centralised to decentralised is creating new challenges for infrastructure planners to overcome. Besides the need to build new transmission infrastructure, there is also the issue of firming (baseload) power for peak periods. These are the two most important challenges to overcome for Australians to experience clean, reliable, and cheap power prices in the future.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link