Jack Colreavy

- Aug 8, 2023

- 4 min read

ABSI - Do Sovereign Debt Ratings Matter?

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

In what once would’ve been major economic news, global ratings agency Fitch downgraded US Government debt from AAA to AA+, 12 years after S&P made the same move in the wake of the GFC. This leaves Moody’s as the only rating agency to rubber stamp US Treasuries with the top tier Aaa rating. However, the response has been muted which begs the question, do sovereign debt ratings matter? ABSI this week will explore this question.

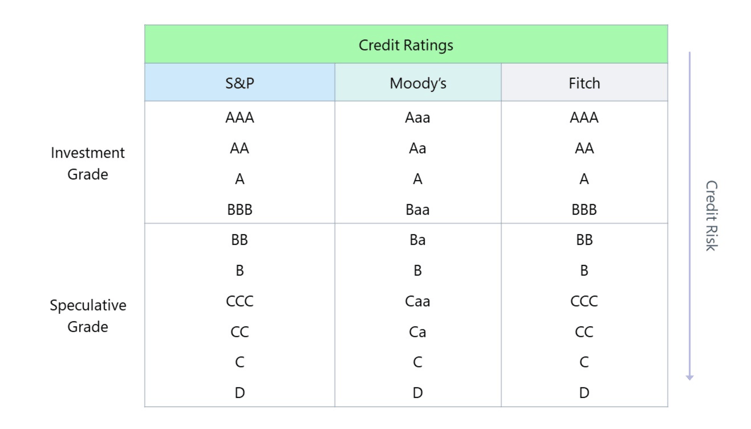

Debt ratings are assessments provided by credit rating agencies to indicate the creditworthiness or credit risk associated with a particular debt instrument or issuer. These ratings help investors, creditors, and other market participants make informed decisions about investing in or lending money to various entities. The most common types of debt ratings are assigned to bonds issued by governments, corporations, or other entities.

The most well-known credit rating agencies are Standard & Poor's (S&P), Moody's Investors Service, and Fitch Ratings. Each agency has its methodology and rating scale, but they generally follow similar principles to assess credit risk and offer AAA as their highest rating with ratings at or below BB+ or Ba1 considered junk.

Source: Wall Street Prep

On August 3, 2023, Fitch surprised the market by downgrading the rating on US debt from AAA to AA+. The agency cited a deterioration in fiscal health and the recent debt ceiling debacle as the primary reason while also noting mounting debt at the federal, state, and local levels, which has occurred over the past two decades.

Prior to the Fitch downgrade, America was on a very exclusive list of countries that held a AAA rating with at least two of the three major rating agencies. That list includes Germany, Denmark, Netherlands, Sweden, Norway, Switzerland, Luxembourg, Singapore, Canada, and Australia. It’s important to note that, with the exception of Canada, all the countries on the list have AAA ratings from all three agencies.

But really does this matter?

In my opinion, no.

To put it succinctly, the credit rating gives investors an indication of an issuer's ability to repay their debts. A country that is able to issue debt in its own currency should never default on its debts because they can always print money to repay debt.

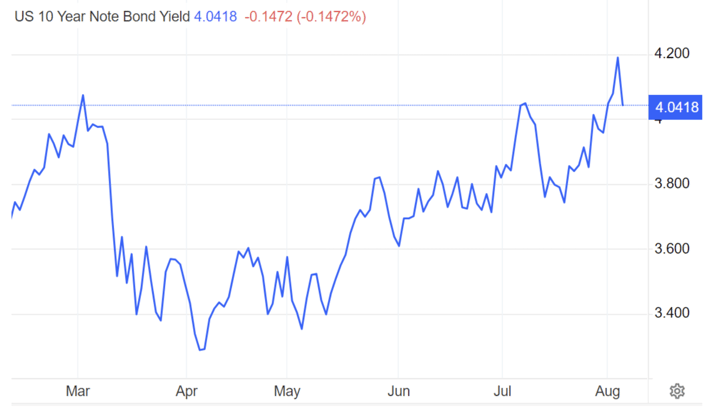

Source: Trading Economics

By now, I think most are familiar with the repercussions of money printing, inflation, but my point is that a debt rating for bonds issued in a country’s own currency is essentially pointless. The market seems to agree. While the initial reaction to the downgrade was a small spike in the US 10y from 4.08% to 4.19%, this has since reversed, and then some, to 4.04% by August 4.

Unsurprisingly, the downgrade caught the wrath from the White House with Treasury Secretary, Janet Yellen, saying “Fitch's decision is puzzling in light of the economic strength we see in the United States…I strongly disagree with Fitch's decision, and I believe it is entirely unwarranted." She went on to argue that their methodology was flawed and based on outdated data and flawed assumptions.

At the end of the day, the biggest impact this will have is politically with Republicans using the news as ammunition that the Biden administration is fiscally irresponsible and incapable of managing the world’s largest economy.

What I will be keeping a close eye on is the repercussions to Fitch from the US Government. Previously, S&P was the only major ratings agency to downgrade US sovereign debt from AAA to AA+ back in August 2011. Coincidentally, in 2013 S&P was also the only ratings agency to be subject to a lawsuit from the US Department of Justice for the fraudulent ratings assigned to MBS and CDOs leading up to the GFC. The case was settled for US$1.375 billion.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link