Jack Colreavy

- Mar 17, 2022

- 5 min read

Diversifying our transportation fuel options

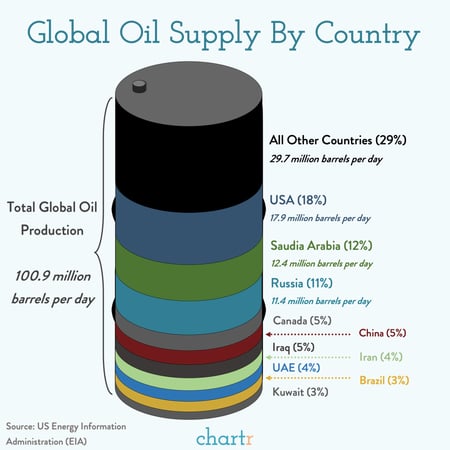

You don’t need to be told that energy inflation is running rampant. Just take a look at local fuel prices which are currently as high as $2.50 for premium options. This supply shock is hitting the hip pocket of consumers hard, reiterating the need to diversify our transportation fuel options.

The biggest drawback of BEVs is not their range or charging time but the resource intensity of the batteries. The world’s largest BEV manufacturer, Tesla Inc, utilises a lithium-iron-phosphate (LFP) chemistry for its budget cars and a lithium-nickel-cobalt-aluminium-oxide (NCA) for its premium models. Breaking down the raw materials required, the rapidly growing BEV market requires increasing amounts of lithium, nickel, cobalt, graphite, iron, and phosphate.

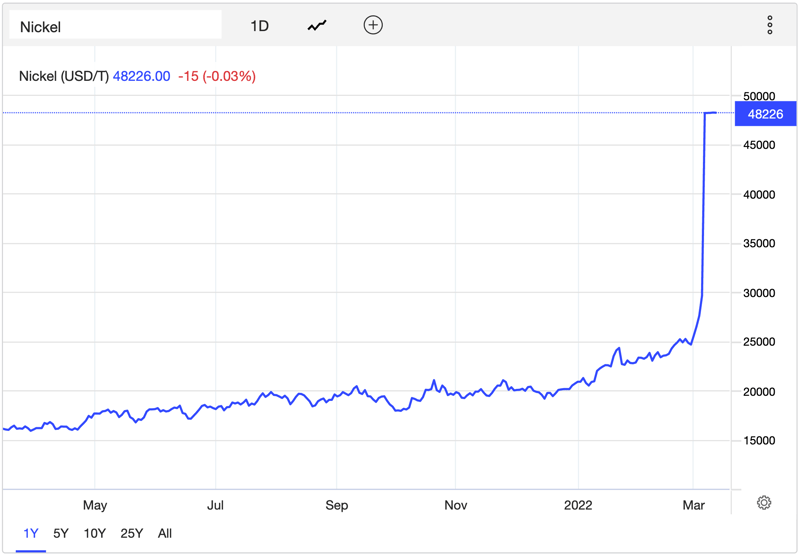

Year-on-year most of these material prices are up significantly, primarily due to demand inflation but also, in part, due to the Russian/Ukraine supply shock. Nickel is the component in the spotlight currently due to Russia being the 3rd largest producer and the proceeding short squeeze that saw the price spike to over US$100k/T. Trading on the LME was paused due to these events but it will be interesting to see how it trades when it resumes on March 16. Nevertheless, the exchange is currently showing YoY gains of over 200% at a US$48k/T price level.

Furthermore, approximately 50% of the BEV cost is in the battery powertrain so these rising raw material costs are going to significantly impact the price competitiveness of BEVs unless a major increase in supply comes online.

Fuel cell electric vehicles (FCEVs) are the lesser known alternative to ICE cars. The reason being, they’re vehicles that run on hydrogen which is a fuel source that isn’t currently commercialised for that purpose and that 95% of current hydrogen production is derived from natural gas, not from renewable sources such as water (electrolysis) or biomass (pyrolysis).

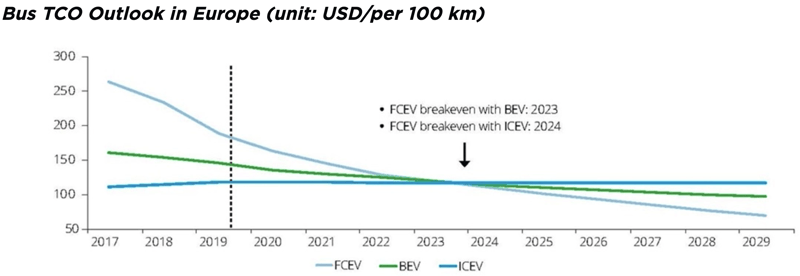

The biggest advantage FCEVs have over BEVs is that the electrical energy isn’t stored in a battery but in the hydrogen molecules. This means that a battery is replaced with a storage tank; a much lighter component that is significantly less resource intensive. FCEVs aren’t at the mercy of soaring lithium or nickel prices because it isn’t required. Thus, at current fuel prices and taking into account a total levalised cost of ownership, FCEVs will likely hit parity with ICE before BEVs.

Unfortunately, FCEVs aren’t a silver bullet with major valid criticisms around the efficiency of hydrogen, plus the lack of hydrogen production and infrastructure. However, significant investment is being made in the industry and FCEVs should become a viable alternative in only a few short years. Finally, like Tesla and Rivian, the emerging FCEV category also provides an opportunity for emerging new auto companies such as H2X Global, a BPC client, to take an early market share over the traditional incumbents.

H2X Global is an Australian fuel cell company on the cusp of making a big splash in EV and power unit markets. They will be targeting light commercial vehicles as the early adopters of hydrogen fuel cell technology and their first FCEV model, the Warrego ute, is due to launch in April 2022. H2X has a huge opportunity to become a market leader whilst potentially bringing auto manufacturing back to Australian shores.

At the end of the day, the current oil shock has come too early to shield global economies from its wrath. However, the positive that has emerged from this crisis will be an acceleration in the transition away from oil. This will result in greater investment into battery metals and into the commercial development of green hydrogen production and FCEV manufacturing.

H2X Global

H2X Global is an Automotive and Power Unit Company founded on absolute sustainability. The Company is focused on the growing hydrogen fuel cell transport markets which are emerging in the key regions of China, North America, Europe, North Asia and Scandinavia.

H2X has established two key operating divisions within the Company to focus on the current market opportunity which exists in designing and delivering powertrain systems to heavy equipment and stationary power applications, as well as developing and delivering multiple light equipment vehicles using a proprietary H2X fuel cell and power train system which are set to enter the market in coming years as more hydrogen related transport infrastructure is established.

If you would like to learn more about H2X Global or the hydrogen sector as a whole, please subscribe below.

Share Link