Jack Colreavy

- Jul 25, 2023

- 4 min read

ABSI - Demystifying Inflation, Disinflation, and Deflation: A Financial Market Overview

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

The week ahead is a major one for financial market data with interest rate decisions from the US Fed and EU, along with CPI readings for Q2 in Australia. Around the speculation on these macroeconomic decisions has been the discussion of falling inflation but there appears to be some confusion on the terminology. ABSI this week will aim to clarify the meaning of inflation, disinflation, and deflation.

By now everybody is very aware of what inflation is; it's pretty much all we’ve been talking about for the past 18 months. Inflation refers to the general increase in the prices of goods and services over time, resulting in a decrease in the purchasing power of a currency. In most countries, inflation is measured by calculating the percentage change in a price index, such as the Consumer Price Index (CPI) over a specific period.

According to economic theory, a small amount of inflation is good for an economy primarily because it encourages spending, investment, and risk-taking. It is why most central banks mandate an inflation target of circa 2%. Too much inflation and…well we have all been experiencing the issues of too much inflation recently.

Source: Currency Trader

Through the execution of aggressive contractionary monetary policy, i.e. raising interest rates, global central banks with inflationary issues are slowly bringing the issue under control. In the US, inflation has peaked (so far) at 8.5% in July 2022 and since then has been on a steady trajectory down to 3% as of June 2023. This inflation action is known as disinflation, a period whereby prices are still rising but the rate at which is decelerating. Disinflation is good, it’s inevitable after a period of very high inflation, and it's what we need right now to get our economies back into the right place of price and currency stability.

It is important to note that disinflation is regularly confused with a different price-period called deflation. Deflation refers to a sustained decline in the general price levels of goods and services in an economy. In other words, it is negative inflation and this is the boogeyman under the bed of central bankers.

Deflation can sound like a good scenario. Prices are going down and a dollar today is worth more than a dollar tomorrow. This would result in higher saving rates and better long-term planning as purchasing power increases over time. Moreover, people will shy away from massive debt accumulation as the amount to be repaid will be higher in purchasing power terms, so much so that debt would attract a negative interest rate to encourage.

Ultimately these deflationary actions will result in wages decreasing over time, lower investment as people shy away from risk, and existing debt burdens would become overwhelming to manage. All of this results in negative economic growth and recessions.

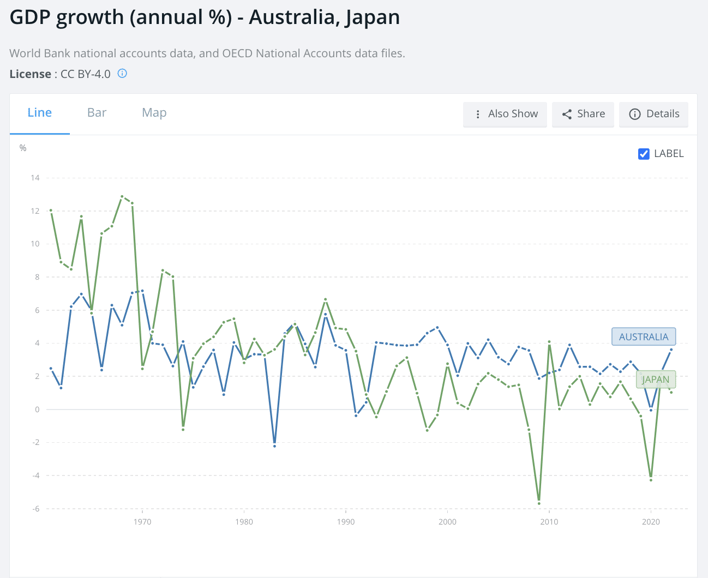

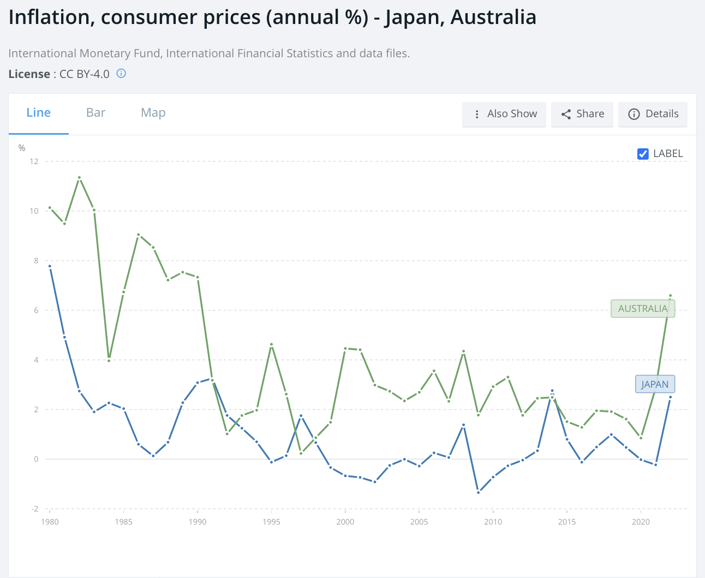

Source: World Bank

Japan is the best example of an economy grappling with systemic deflation starting from the 1990s. Post World War II, Japan’s economy underwent a remarkable transition period that quickly turned it into the world’s 2nd largest economy by the 1980s and forecasts for it to surpass the US by the end of the 1990s. Unfortunately, the rapid GDP growth caused asset bubbles, particularly in real estate and the stock market, that inevitably burst in the 1990s resulting in what is termed “The Lost Decades” for Japan - a period of low economic growth due to deflation. The Japanese Central Bank has attempted to stoke the inflation fires by introducing low to negative interest rates and conducting QE by purchasing bonds and stocks but this has failed to gain traction - the reasons for which are beyond the scope of this piece.

As the year progresses, we will all continue to closely monitor monthly and quarterly CPI data. Keep wishing for disinflation as we all need inflation to slow down to ~2% for the central banks to start to look at easing the financial pain of higher interest rates. Finally, don’t be afraid of deflation either, there is an extremely low probability of that happening in our current macroeconomic environment. I am more concerned about inflation reigniting.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link