Barclay Pearce Capital

- Oct 30, 2023

- 4 min read

Beatles, Consumer Spending, BOJ Week and Barron's Curses - Market Map with James Whelan

New job, new firm but the same Free Whelan. I thank you for your continued support. Speaking of support, on the 28th of November I'll be speaking at the Ensombl All Licensee Professional Development Day. Link available here and I look forward to seeing you there.

Good afternoon,

This week I will be dropping in and out of IMARC (International Mining and Resources Conference) from the 31st October to the 2nd November in Sydney. If you'd like to reach out and say g'day and talk about core samples or copper grades, please reach out. I can't promise I'll be able to talk about them, but I love hearing stock stories and people's outlooks on various sectors.

Saturday night event of a lifetime just passed. Seeing Sir Paul McCartney with my father at Allianz. Just an amazing experience. Something stuck with me though as he commented,

"there's fans who come to all our concerts, and that's not cheap. We still haven't figured out how they're paying for it..."

*laughter from the stadium crowd*

There's me thinking about US Consumer data being up 0.7% in September vs 0.5% forecast.

Image Source: Reuters

"STOP SPENDING MONEY" says Area Man live from an ex-Beatle rock concert.

The US Consumer simply will not stop, doesn't know how to stop and yet every bullish consumer number that's come out has always been attached to "but it's expected to slow down soon" in the media. When? WHEN? it's been a year of this. Maybe it needs to go on Baron's cover.

Japan Reiteration

A happy BOJ week to all who celebrate! Remember that the Band of Japan have a two day meeting Monday - Tuesday with the monetary policy decision appearing out of that. My pick is for a proper direction on abandoning Yield Curve Control. There's debate on this call, and there's debate on what happens following. As a standard, buying Japanese banks wouldn't be the worst idea. Higher yields = better for banks, all things being equal.

I'm happy to be more of a generalist and happy to back the index while being long Yen. This is a reiteration of the theme pointificated by Blackrock a few weeks ago that there is a massive pit of money sitting in Japanese savings accounts that has to go to work and will do it in the easiest way there is to beat persistent (but not super high) inflation and that's plowing head long into Japanese equities.

Yields will rise so money will go into Yen too so it's a perfect cacophony.

If you'd like to know more about this sort of idea please let me know.

The Curse...

Image Source: Barron's

Image Source: Barron's

The Barron's Cover Curse is a well known, very funny, yet partially true phenomenon in which Barron's Monthly will run a cover that is almost always calling the exact wrong direction in a moving market. (I.E. Europe rallies for a few months and they run a cover "Europe and why the smartest guys have to be there" and as sure as God wears sandals there'll be a 15% correction in Europe by the time the week is through.

They've just run this on bonds and it makes me think yields have a way to go higher.

Still, if you have a set retirement objective then actually buying a government bond with a fixed date is a great way to go. If you were looking to trade them and pick the bottom in bond prices then thanks a bunch Barron's.

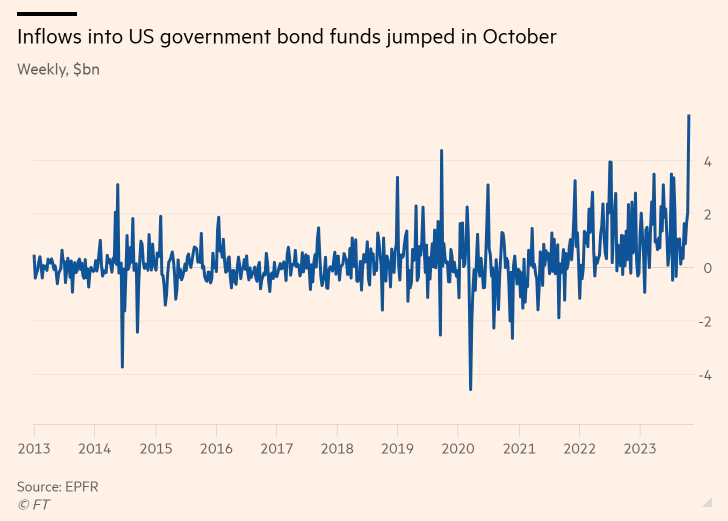

Image Source: Financial Times

That being said, inflows by the big end of town into bonds has been extraordinary.

Despite what Sir McCartney says the economy is still seen as slowing and yields set to decline a little. Don't get in the way of a freight train of money.

Theory of Thing Podcast link is here with more of these types of ideas so have a listen and let me know what you think.

Also Albo is on his way to China this week. First PM to do so since Turnbull in 2016. I wrote then about the emerging phenomenon of the "Beijing Bikini" and after 7 years I'm happy to report it's still very much in use. I'm not sure if your social credit score drops in China if you're caught doing this but it should.

Living the dream...

But seriously look for further thawing of the China/Oz relationship, especially in the wine trade.

Until then all eyes on the BOJ!

All the best and stay safe,

James

Share Link

-BPC%20Desk%20Note.png?width=767&name=Castile%20Resources%20(ASX-CST-OCTQB-CLRSF)-BPC%20Desk%20Note.png)