Jack Colreavy

- Aug 22, 2023

- 5 min read

ABSI - Aussie Dollar Depreciation Will Force the RBA’s Hand

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

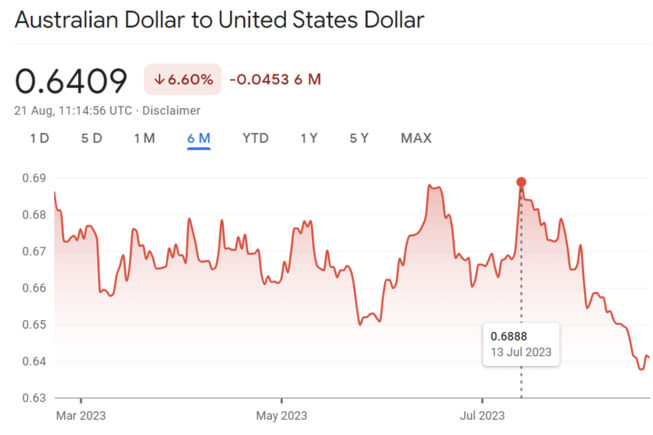

The Aussie Dollar (AUD) is falling sharply (for currency market standards). On July 13th, the AUD was flying high, buying close to 69 US cents per dollar. However, since that peak, the AUD has declined over 7% to trade below 64 US cents. Importantly, it isn’t just against the USD, the AUD has depreciated across a basket of currencies which include the Great British Pound, the Euro, and even the New Zealand Dollar. ABSI this week will look into the reasons why the AUD is under such weakness and what it may mean for the economy.

It is important to appreciate the complexity of currency markets. A currency can only really be valued against the value of another currency, leading to varying fluctuations in values against different foreign currencies. Moreover, the strength of a currency is influenced by a myriad of factors such as economic, political, and market-related. At the end of the day, the strength of a currency is the product of demand and supply.

In reality, the three of the most important factors that influence the demand for a currency are:

- Interest Rates - higher interest rates relative to others promotes currency appreciation as it attracts foreign capital seeing higher returns. A good example of this is a carry trade which is a financial strategy in which an investor borrows money in a low-interest-rate environment and invests it in a high-interest-rate environment.

- Inflation - a country with low inflation is more likely to maintain its purchasing power over time, making its currency more attractive.

- The Trade Balance - exports minus imports is what determines the trade balance and affects demand for a currency. A positive trade balance, indicating higher exports, leads to a stronger currency as foreign buyers need to purchase the domestic currency to pay for goods.

Source: Google Finance

Using the above information, we can turn our attention to the depreciation of the AUD and determine the reasoning for its increasing weakness over the past few months. Firstly, from an interest rate perspective, we can see that the RBA has raised interest rates less aggressively than other advanced economies. Looking specifically to the US, the Fed has raised rates to 5.5% and with the strength of the US economy, that level could increase further over the coming months. Meanwhile, the RBA has paused for the past few months at 4.1% putting it lower than most other advanced economies, with the exception of Japan.

Secondly, we turn our attention to the inflation rate. Australia’s latest CPI figures peg the annual rate of inflation at 6% making it one of the highest rates of inflation amongst advanced economies. Again using the US as a comparison, their most recent figures were at 3.2% annual inflation making it almost half of Australia’s rate and adding another reason why the slide has been so steep for the AUD.

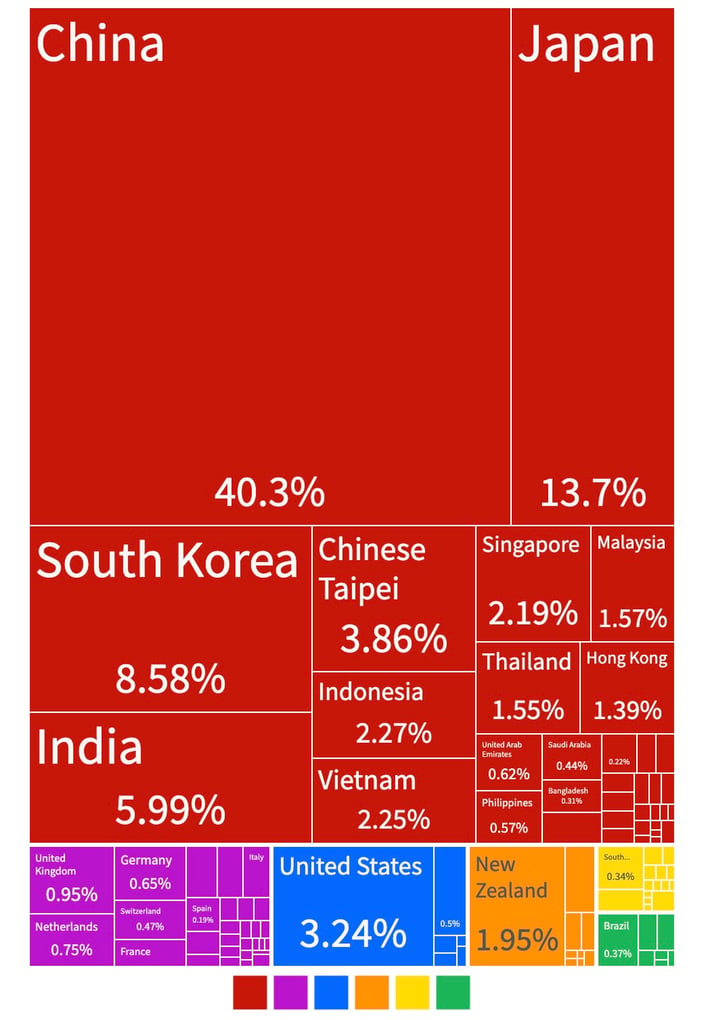

Source: OEC World

Finally, we have the balance of trade which is currently the most talked about in financial markets. I acknowledge that the US hasn’t posted a trade surplus since 1975 and Australia regularly posts a trade surplus but there is further nuance here. The US is the reserve currency, which means most trade is conducted in that currency, thus providing a steady stream of demand for the USD. In contrast, Australia is a commodity-driven economy that is dominated by China. According to OEC data, China accounted for 40% of Australia’s A$343 billion in exports in 2021 while the US only accounted for ~3%. Therein lies the problem for the AUD. China’s recent and well-documented financial turmoil and economic weakness has resulted in forex speculation that Australian exports will decline, therefore decreasing the demand for AUD.

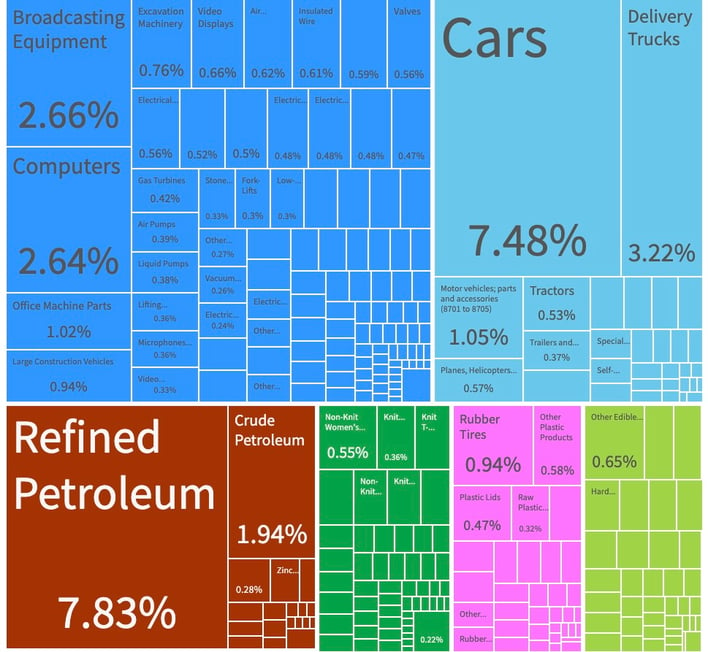

The weakness in the AUD is a double-edged sword for the economy from the RBA’s perspective. A lower dollar makes Australian exports cheaper, increasing demand for our commodities and stimulating tourism, whilst also promoting demand for domestic products from Australians as the price of imported goods increases. On the other hand, the weaker currency also adds to Australia’s inflation burden by increasing the cost of goods imported. Australia’s two biggest imports are cars and refined petroleum so Australians can expect to see the price of petrol at the bowser continue to creep higher for the rest of 2023.

Source: OEC World

The solution to the weak dollar is simple but also complex. The troubles with China are out of Australian policymakers control and they will want to see more stimulus measures to reverse their deflationary spiral. However, what Australian policymakers can control is interest rates. Given the weakness in the dollar, the RBA will have no choice but to raise interest rates to halt this negative trend. Failure to do so will see the AUD drop below US$0.60 before the end of the year.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link