Roberto Russo

- Sep 9, 2022

- 5 min read

ASX Market Recap - Market Movers

Our Trading Operations Manager, Roberto Russo, discusses stand-out companies in the month of August.

August has been a tough month for a lot of investors, with reporting season trading being one of pure difficulty. Surprises came left, right, and centre with strong BUY’s proving to be disappointing, and strong SELL’s surprising us all with outstanding numbers.

Let's take a look at the highlights in August.

Mineral Resources (ASX:MIN)

Despite MIN putting out somewhat disappointing 2022FY results, this month they have reached an all-time high off the back of this extraordinary lithium run continuing for these large-cap producers, as investors ‘shoo’ away the results and continue to pile in.

*07/09/2022

City Chic Collective (ASX:CCX) / Accent Group Limited (ASX:AX1)

Two retail stocks, two very different results. CCX showed that growth has slowed despite their comments moving into FY23 to be in line, with AX1 putting out mixed results due to Covid-19 store closures, but sales growth looks to have continued strong despite this.

*07/09/2022

McMillian Shakespeare (ASX:MMS)

MMS went into reporting season with question marks around them, a mixture of overweight reports and holds. The standout of their report which looks to have set the share price rocketing was their new dividend policy. Their dividend is now 100% fully franked and 70-100% of UNPATA, with a variance of +145% compared to their FY21.

*07/09/2022

Cobre Limited (ASX:CBE)

On 01/08, CBE announced that their second diamond drill hole intersected abundant chalcocite mineralization. After this intersection, their third drillcore also hit, followed by infill drilling. This looks to be a significant high-grade discovery pushing the share price from 0.05c to what it is today at 0.50c.

*07/09/2022

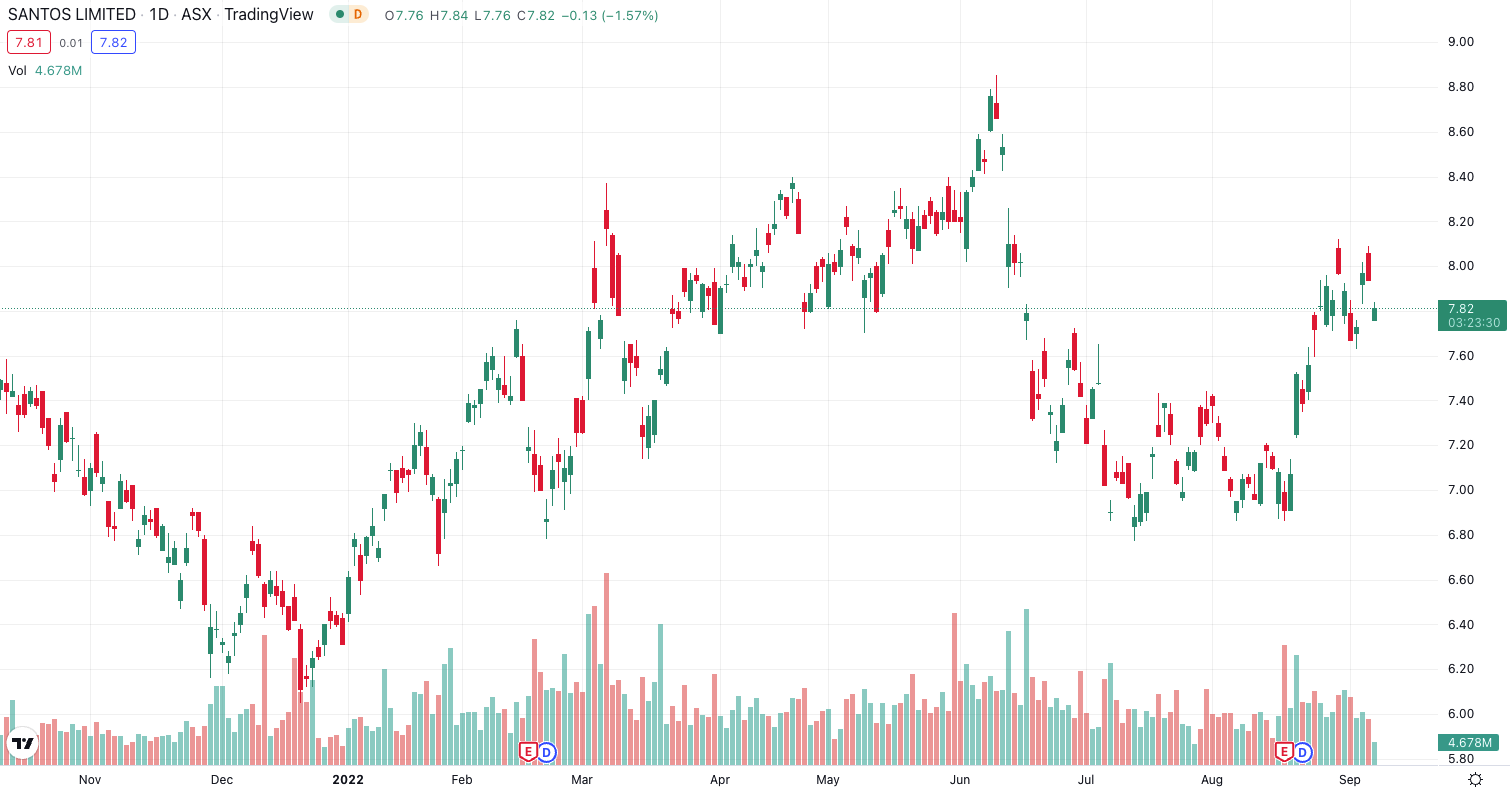

Santos Limited (ASX:STO)

Santos beat expectations vs Factset across the board and included a much stronger buyback into the mix, despite results day not being rewarding, Santos has found themselves situated as a strong player in the energy space after a strong report.

*07/09/2022

Feel free to contact me directly about any of the mentioned stocks or pop into our Adelaide Office!

Where to from here?

Trading equities is all about having access to the right investment opportunities and making decisions based on accurate, unbiased information. Often, this means hours of research on a daily basis, keeping up with several ASX announcements, understanding economy-impacting events and regularly consuming broader news updates. If you're not an equities trader by profession, then it can quickly become rather overwhelming, especially once you have built a considerable-sized investment portfolio.

Our Equities Trading team, backed by our independent research department is the ideal solution for said situation. Our clients receive access to exclusive investment opportunities, daily ASX research reports, our expert weekly outlook on the Australian markets and direct access to our equity traders.

Trading with Barclay Pearce Capital is about building long-term returns, trust, confidence and a mutually beneficial relationship.

Trading with Barclay Pearce Capital ensures the needs of investors of all magnitudes are met by our highly skilled and attentive trading professionals.

~ Trent Primmer, Director of Trading, Barclay Pearce Capital.

Share Link