Jack Colreavy

- Jul 27, 2021

- 6 min read

As Barclay Sees It talks positioning for an Olympic economic boom

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

The Tokyo Olympic Games officially kicked off last Friday to great fanfare. Australian’s had added reason to celebrate with news that the Queensland South-East bid for the 2032 games was successful. Hosting the Olympic Games can bring economic prosperity and ABSI takes a look at the likely benefactors from the event.

It’s official! Australia will host the Olympics for the third time with the 2032 Olympics coming to South-East Queensland. The announcement recalls euphoric memories from back in 1993 when Sydney was awarded the games -

“ and the winner is...Sydney! ”

However, the jubilation this time around was muted in comparison, which may be a sign of the Covid-times, or it may be a reflection of the realisation that hosting the Olympics is a costly exercise that often leaves host cities in financial turmoil in the aftermath; just ask Athens or Rio.

In response to the changing attitudes to hosting the Olympics, the IOC has evolved its requirements and bidding procedures by favouring more sustainable bids which played into the hands of the Queensland bid. According to the proposal, 84% of venues used will be existing or temporary, with facilities spread more geographically from the Sunshine Coast down to the Gold Coast.

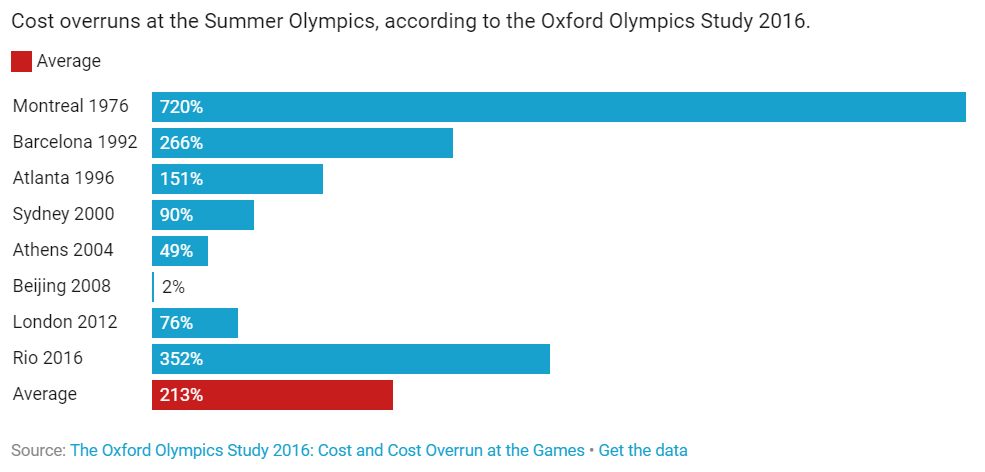

The Queensland bid committee says that the games will be cost-neutral at A$4.5 billion but this costing fails to take into account critical costs such as new road infrastructure, public transport, security, and staff. Moreover, according to researchers from Oxford, the avg. cost overrun for the games is 213% and even if you look solely at Sydney, the budget almost doubled from initial estimates.

The major infrastructure excluded from the costings include a complete redevelopment of The Gabba at a cost of A$1 billion, the new “Brisbane Arena” cost at A$2.1 billion, A$5.4 billion Brisbane cross-river rail tunnel, the Brisbane metro for A$1.3 billion, and the A$1.5 billion Coomera Connector project. While it is important to note that these projects would’ve proceeded without hosting the games, there will be a need to accelerate their development which should burden them with additional costs.

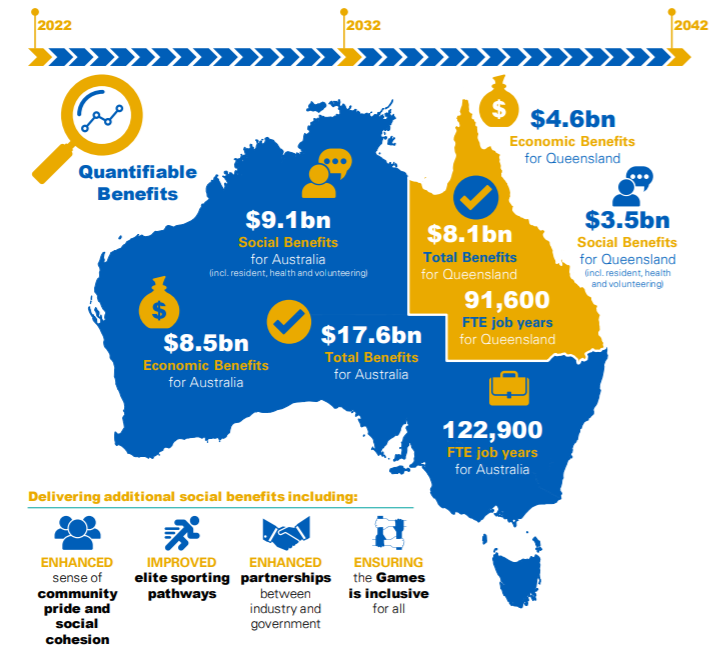

Importantly, like the cost side, the revenue side of the ledger has benefits that extend beyond ticket sales and sponsorship. A study by KPMG found that the quantifiable economic and social benefits to be A$8.1 billion for Queensland and A$17.6 billion for Australia with 122,900 full-time equivalent jobs created over a 20-year evaluation period.

So where are the best places to invest in order to capture the economic benefits of this once-in-a-generation opportunity?

Infrastructure

Infrastructure is the most obvious sector that will benefit from a Queensland Olympic Games. The prosperity from these investments is wide reaching throughout the entire supply chain including engineers, construction, materials, miners, and even potential owners of the infrastructure. In its most recent budget, the QLD state government has announced A$27.5 billion in infrastructure spending over the next four years.

DOW provides services to customers in Transport, Utilities; Facilities; Engineering, Construction and Maintenance; and Mining in ANZ. While there haven’t been any major contracts awarded at this stage, DOW will be in the mix for the tenders who have a strong track-record of producing for government infrastructure projects including the Gold Coast light rail.

In their most recent half-year results, revenue clocked in 10% lower from the prior period at A$6.1b with EBIT at A$162.4m and NPAT of A$73.9m. While there can be some volatility in earnings as contracts start and end, the biggest risk for DOW moving forward is the labour skills shortage currently being experienced by closed borders. Nonetheless, the company has the track record and expertise to benefit from the infrastructure stimulus not only from the QLD but Australia-wide. DOW currently trades on a 4.4% dividend yield.

BPC Research has a HOLD recommendation with a price target of A$5.21.

Our Recent Wins

Barclay Pearce Capital secured an allocation for its clients in the IPO of Best & Less Group. Best & Less Group, led by Bell Potter, raised a total of $60M at $2.16 share price for a valuation of $271M. Best & Less had a successful listing day announcing its FY report which saw a closing gain of 11%. Congratulations to our clients for the gains.

Barclay Pearce Capital secured an allocation for its clients in the IPO of Best & Less Group. Best & Less Group, led by Bell Potter, raised a total of $60M at $2.16 share price for a valuation of $271M. Best & Less had a successful listing day announcing its FY report which saw a closing gain of 11%. Congratulations to our clients for the gains.

Lynas was recently featured by us in AuzBiz and As Barclays Sees It. The price of REE has seen recent strong gains and LYC reporting has shown this on paper with impressive revenue and receipts. Our clients experienced a 10% gain on the announcement with impressive gains since we first discussed the company.

Lynas was recently featured by us in AuzBiz and As Barclays Sees It. The price of REE has seen recent strong gains and LYC reporting has shown this on paper with impressive revenue and receipts. Our clients experienced a 10% gain on the announcement with impressive gains since we first discussed the company.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link