Jack Colreavy

- Jul 18, 2023

- 5 min read

ABSI - Annual US Government Interest Expense is Becoming a Trillion Dollar Problem

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

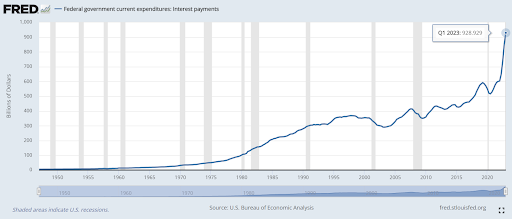

Every month the US Treasury releases a report into the finances of the world’s biggest economy and last week the June report was released marking 9 months into the US fiscal year. There were a number of metrics to highlight but the most notable was interest costs which are on track to almost US$900 billion in FY23. ABSI this week analyses the latest budget report and what it may mean for the future economic prosperity of the US.

It’s no secret that the US finances are in dire straits. Earlier this year the world witnessed US politicians risk US debt default as they bickered over the debt ceiling, in what is becoming a regularly occurring event. At the 11th hour, a deal was consummate which saw an outright suspension of the debt ceiling until November 2024 (after the next presidential election). The old debt ceiling was US$31.4 trillion and according to the June 2023 US Budget report, total federal securities outstanding are ~US$32.3 trillion and rising.

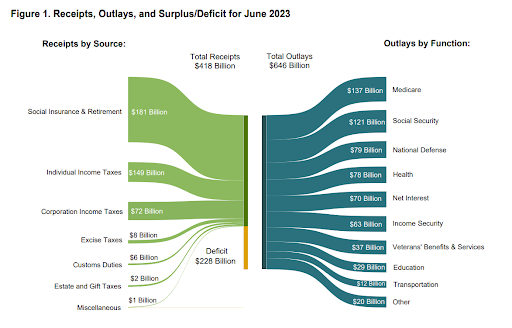

I say and rising because the total budget deficit, just for the month of June, was US$228 billion which takes the deficit to US$1.4 trillion fiscal year to date, with a forecast estimate of ~US$1.6 trillion for the full year 2023. Furthermore, the Treasury estimates the FY24 budget deficit to be US$1.85 trillion which will add more fuel to the debt fire.

Source: US Treasury

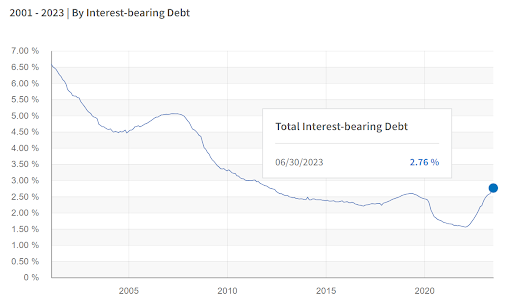

It is important to appreciate that a big part of the increase in deficit spending will be interest expense as the weighted average interest rate on outstanding debt continues to rise thanks to the US Federal Reserve.

According to government data, in January 2022 the average interest rate on federal debt hit an all-time low of 1.56% but since then the rate has been gradually rising hitting 2.76% in June 2023. As a result, interest expense on treasury securities totaled US$122.5 billion in June 2023 taking the FYTD number to US$652.4 billion with estimates that it will hit US$897.7 billion for the full fiscal year. This would make interest expense the 3rd largest outlay for the year at 14% of the US$6.4 trillion in spending; just ahead of defence but behind medicare and social security.

Source: Fiscal Data

Concerningly, with the US cash rate currently set to 5.25% and the intention for the Fed to hold rates “higher for longer” due to sticky core inflation, the weighted average interest rate will continue to rise to levels not seen since the early 2000’s (according to official government data). If in 12 months time, a further ~US$2 trillion is added to the debt load (budget deficit estimates for rest of FY23 and FY24) and the blended rate increases to 4% then annual interest expense will balloon to ~US$1.4 trillion making it the single largest budget item.

The powers within the Biden administration are talking down the issue with Treasury secretary Janet Yellen, pointing to the interest payments to GDP ratio which is at historical lows of 1.5%, without inflation adjustments, and negative if inflation is accounted for.

They’re not wrong in this regard with inflation lowering the real amount that needs to be repaid in the future, however a long-term high inflation environment to “inflate away” the debt isn’t a sustainable strategy and with inflation starting to dissipate we won’t be far away from real interest rates making a comeback. Additionally, an issue arises when the denominator of the ratio, GDP, starts going down rather than up which will ruin the optics of the data point.

Optics aside, the fact remains that the US government is paying increasing amounts of money to service its federal debt load. To date this hasn’t been a major problem, and it is difficult to determine when it and how it will all come to a head. My best guess is that US politicians will be unable to bring a budget to surplus, which means that the issue will only play out once investors refuse to purchase US treasury securities enabling further increases to the debt load. However, in a global economy where the US Dollar is the world’s reserve currency, it might be some time before we see the gravy train halt.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link