James Whelan

- Aug 26, 2024

- 5 min read

After Jackson Hole: What’s Next for Markets, Small Caps and the Cannabis Comeback? - Market Map with James Whelan

New job, new firm but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market every week with me!

Top of the morning to you and a happy post Jackson Hole Monday for all who celebrate.

“The time has come” the Walrus said…to talk of other things.

And I’m just glad Jackson Hole is behind us so we can all obsess over *checks notes* NVDA earnings…ugh.

We actually talk of other things in the latest cut of the TOT Podcast recorded on Friday. Link here.

I thought it prudent to look into the past so that we may best navigate the future, which runs contrary to my usual motto of “don’t bother looking backwards, you’re not going in that direction”.

However, I’ve been on a roadshow the last week and the crystal ball is a little blurry, so better we get back to basics.

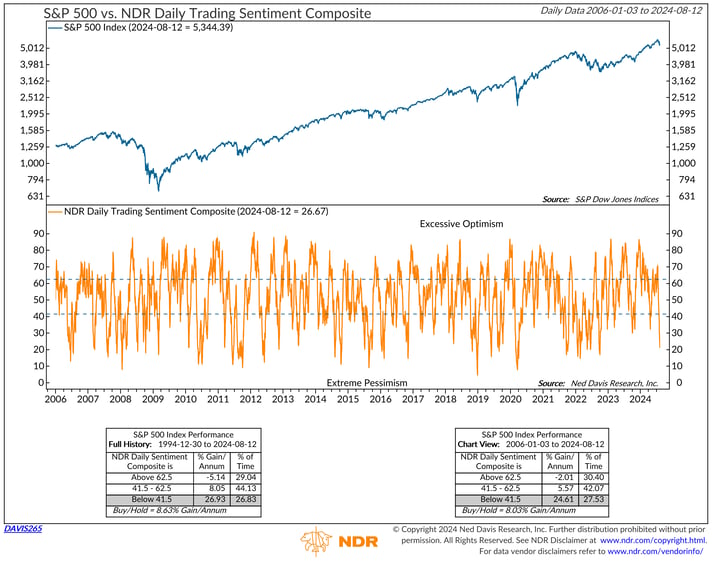

Firstly this and a lesson about buying the dip:

From August 14 – “NDR Trading Sentiment Composite is at its lowest level since late-2022. When short-term sentiment is this washed out, stocks usually rip.” Willie Delwiche, CMT, CFA

This was when everyone was absolutely losing their heads at the perfect storm of recessionary signals in the US and the BOJ shenanigans causing the great unwind of carry.

Source: Willie Delwiche, CMT, CFA

Narrator: Dip buyers were well rewarded.

Now with the absolute show on Friday.

Powell spoke at Jackson Hole and it the only way it could have been more market-friendly is if they’d literally released doves as he was speaking

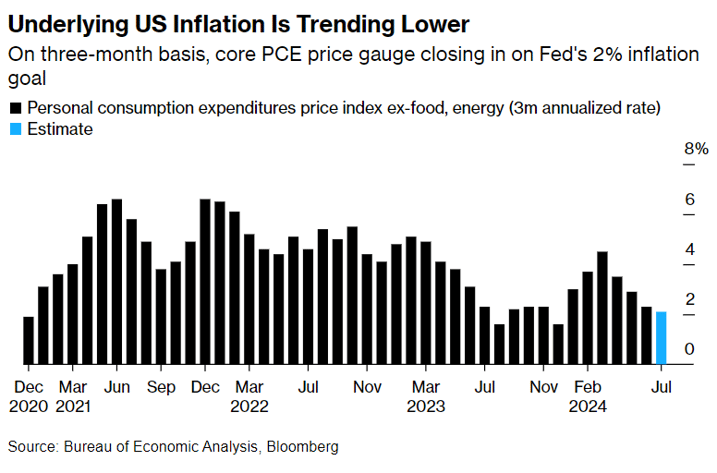

But what happens in rate cut times? Beware a lot of folks who are drawing comparisons to past cut cycles, saying that rate cuts usually signal a market selloff. What they’re missing is that there usually was a recession attached. This from early August as well.

Source: @Mayhem4Markets

And it really does look like the Fed has a handle on it without sending the US into recession.

For now.

Ideas that aren’t just “buy gold”?

Let’s spin this back a bit and again looking to the past to see where we’re meant to be going. Before the BOJ stuff, there was a fairly hefty rotation into small caps out of the Mag 7. In actuality this was a small departure from the Mag 7 which megaphoned the allocation into smalls.

Because the economy was fine and rates were set to come off, small caps were set to get a run.

Then we were distracted by the above.

Tell me why, relatively speaking, this can’t be the case going into the last quarter of the year?

The Van Eck small caps ETF looks like it could be a good slot again.

Source: China's State Administration of Foreign Exchange

Cannabis is back and it’s a new style.

Aside from that I spent last week on the road with Wellnex. Brokers and clients are amazed at a stock with this story trading where it is. On Thursday we spent the day at a cannabis facility in Wonthaggi, owned and operated by Onelife Botanicals. It really was a best in class facility, being the only place in the southern hemisphere making cannabis gel caps. Chemist Warehouse wants a bigger piece of the cannabis pie, hence the reason they’ve gone into a JV with Onelife and Wellnex in the space. Chemist Warehouse dispense ~30% of the national prescription market but only ~1% of the medicinal cannabis prescription market. That’s a gap they’ll be keen to make up. Watch this space.

Aside from that it’s good being back at HQ.

Stay safe and all the best,

James

Introducing BPC Wealth Management

BPC Wealth Management is dedicated to shaping a resilient investment portfolio, empowering you to achieve and sustain your financial aspirations. While the foundation of your portfolio focuses on long-term investments, through BPC, clients will be offered opportunities in equities trading and equity capital markets. This aspect is highly customised, allowing asset flexibility. Discover how our proactive and client-focused approach can help you achieve your financial aspirations by booking your discovery call with James Whelan.

Share Link