Jack Colreavy

- Oct 27, 2022

- 5 min read

ABSI - What's going on in the Japanese monetary system

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

What is going on in the Japanese monetary system? Two weeks ago the benchmark 10Y Japanese Government Bond (JGB) didn’t trade for three straight days, a highly unusual circumstance for a market with ~US$9.5 trillion in face value outstanding. ABSI this week takes a look at the unusual financial activity in Japan.

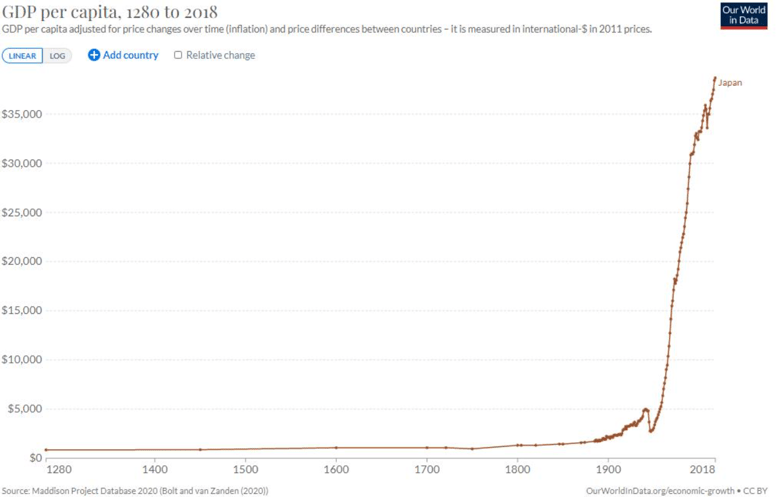

Japan is an interesting financial market. Up until the Meiji Restoration in the mid-19th century, when the economy opened its borders to Western commerce, the country was still operating under a feudal system and lagging behind the rest of the world in terms of technological and economic development. However, in the space of just ~150 years, the Japanese economy grew to be the 2nd largest developed economy, boasting a GDP of ~US$5 trillion.

Source: Wikipedia

A key contributor to the phenomenal growth experienced by Japan is debt. As of 2022, Japanese public debt is estimated to be US$12.2 trillion, which equates to 266% of GDP. Japan’s debt problem really took hold financing World War 2 and in the 1980s as part of an asset bubble in real estate and stock market, which burst in 1991 and started what is termed “The Lost Decade”; a period in which it took 12 years to recover to pre-crash levels. Government debt levels soared during this period as policy makers attempted to stimulate the economy, a playbook emulated by the world in the wake of the 2008 GFC. As a result, today almost 50% of public debt is owned by the Bank of Japan (BoJ).

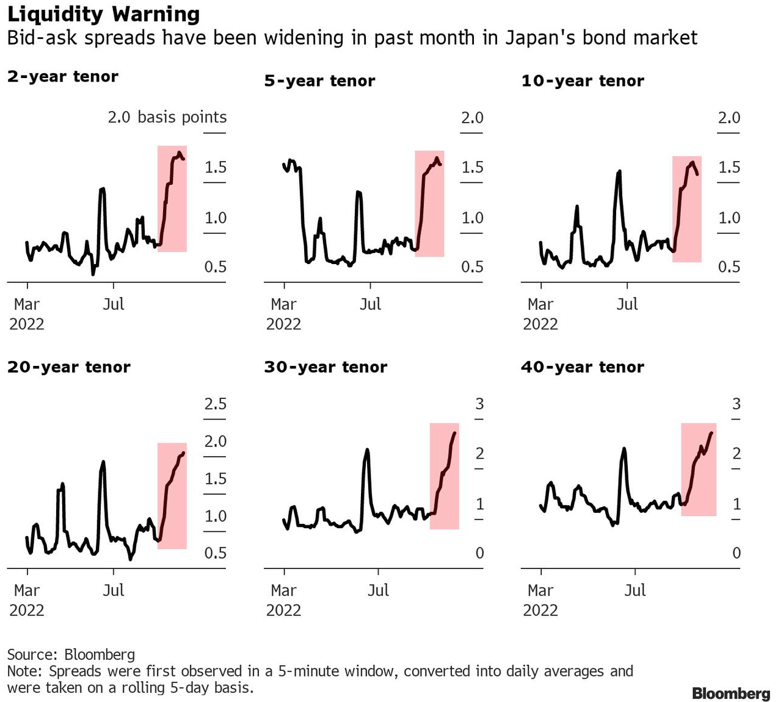

This socialising of debt by the Japanese central bank is the reason for JGB trading volumes drying up. Traders complain that there is no longer a cash market, with bid-offer spreads exploding for market makers. Consequently, the secondary market for 10Y JGB didn’t trade for 3 consecutive days. The writing may also be on the wall for the Japanese stock market due to the BoJ also purchasing Japanese ETFs as part of its experimental ultra loose monetary policy. The BoJ owns over US$430 billion in equities making it the biggest single owner of Japanese stocks and the owner of 63% of all locally listed ETFs.

Source: Zero Hedge

It is important to appreciate that the Japanese approach to monetary policy has been unconventional for over 30 years. The BoJ has been buying JGBs since the 1990s and equity ETFs since 2010, in an attempt to stimulate a deflationary economy with major demographic issues as a consequence of a historical xenophobic immigration policy. Alarmingly, they have little to show for it except for unsustainable debt levels.

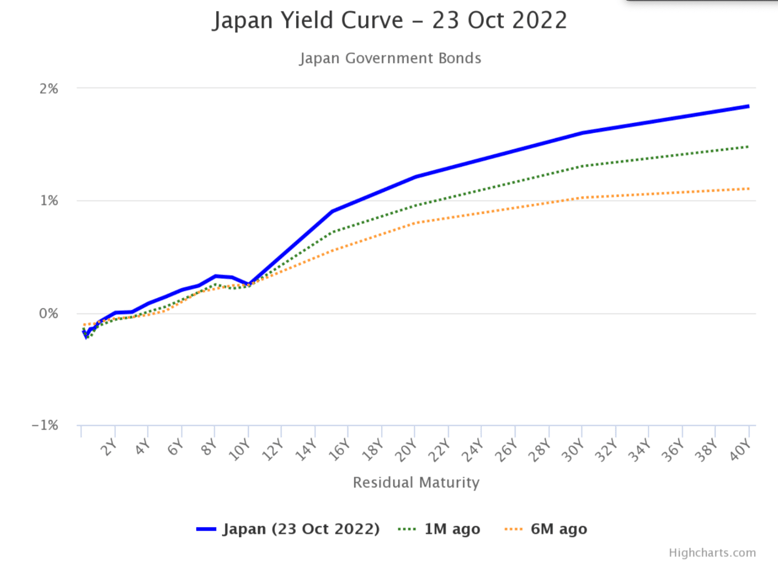

The level of Japanese debt today is impacting the BoJs ability to raise interest rates for fear of economic collapse due to spiraling interest payments. While most global central banks are raising interest rates to fight inflation, Japan is keeping interest rates at negative 0.1%. Moreover, the BoJ continues to conduct QE, vowing to keep the Japanese 10Y yield at 0.25%. Naturally, this has seen the Yen depreciate significantly against global currencies, however, the BoJ continues to attempt to strengthen the Yen whilst maintaining the current monetary policy - a preposterous and impossible task. So far in October, the BoJ has intervened in foreign currency markets twice by selling foreign currency reserves and buying the Yen in order to strengthen demand and value for the out-of-favour currency.

Source: World Government Bonds

The monetary madness gripping the Japanese economy is not a new story but one that has been developing for decades. The government, in conjunction with the BoJ, have been trying to keep the party going and are now stuck in an unsustainable loop of market intervention with no prospect of unravelling. It is difficult to predict how it will all end but the only solution is for the BoJ to withdraw itself slowly from the market and the interventionist policies that it has enacted for the past 30 years. Sadly, this is a perilous task fraught with the danger of market collapse and economic inflation.

In the meantime, make the most of the weak Yen by booking a trip to Japan; they have great ski slopes around this time of year.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link