Jack Colreavy

- Apr 16, 2024

- 5 min read

ABSI - The Silver Lining from Gold’s Record Run

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

Last week ABSI discussed gold and record highs continued to flow with the US$2,400 level being breached for the first time and a new bar set at US$2,431. Less spoken about is gold’s poor cousin silver which is up ~21.5% in the last 3 months to US$28.34/oz at the time of writing. What is most interesting about silver is the changing nature of the commodity which is rapidly transitioning from a precious to an industrial metal. ABSI will discuss this change and what it may mean for the price moving forward.

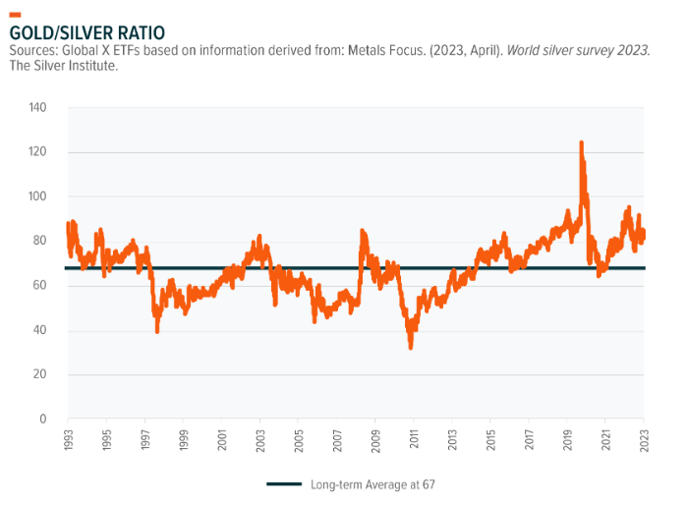

Historically, silver has tracked the gold price relatively closely so when the gold price is having a good year, it's safe to assume the silver price is having one too. This is best manifested in the gold-to-silver ratio, the measure of how many ounces of silver to buy one ounce of gold. At the time of writing, the gold/silver ratio is 83.4 which is the lowest it's been in 3 months. A print of 83.4 means it takes 83.4 ounces of silver to buy one ounce of gold. Over the past 5 years, the low-80s range has been about average for the ratio but looking out further you can see that this is high with a 30-year average of ~67.

Source: Global X ETFs

While gold is resetting record highs, silver is far from that milestone currently trading at ~US$28.34/oz. The all-time high for silver was recorded in April 2011 at US$49.51/oz. Back then, there was no single contributor to the surge from US$18.50 in June 2010 to the peak in April less than a year later. The price was a result of fallout from the GFC and QE, increasing industrial demand, and classic speculative trading. During that period, the gold/silver ratio hit an all-time low of 30.7.

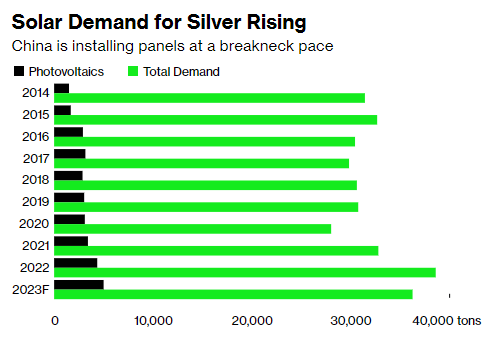

What is most interesting about silver is the bridge it plays as a precious and industrial metal. Whilst more prolific than gold and platinum, silver is still relatively rare, and treated as such, but is also the world’s best conductor of electricity making it the preferred choice for a number of industrial applications. The fastest-growing industrial use of silver is in solar photovoltaic panels. Back in 2014, 5% of silver consumption was for solar but this has grown to 14% in 2023 and is forecasted to go higher. One of the reasons for the potential higher consumption from solar is that new solar cell technologies are utilising higher silver content to materially improve efficiency. The current passivated emitter and rear contact (PERC) cell uses ~10mg of silver per watt but new technologies such as tunnel oxide passivated contact (TOPCon) and heterojunction (HJT) structures require 13mg and 22mg respectively.

Source: Bloomberg

Source: Bloomberg

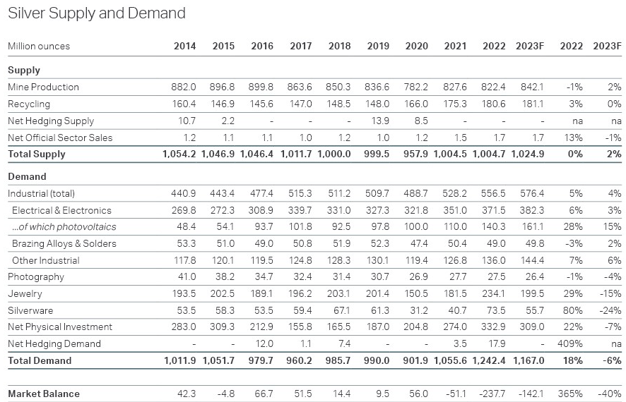

Moving the focus from demand to supply reinforces the picture of higher silver prices. According to the Silver Institute, the market has been in a supply deficit the last few years including a deficit of 237.7 million ounces in 2022. This is due to the aforementioned surge in demand for silver which miners have yet to respond to; prior to 2021, silver was regularly balanced. Numbers haven’t been officially crunched for 2023 but the Silver Institute forecasts another 142.1 million ounce deficit which would take the cumulative deficit to 430.9moz.

Source: Silver Institute

It is important to appreciate that only 28% of mined silver derives from “silver mines”. The other 72% is a result of by-products from mining other metals, namely copper, lead, and zinc. Miners cannot respond quickly enough to the changing dynamic in silver because most aren’t specifically looking for silver and therefore there will be a lag in new mine supply.

So what does this all mean?

In a nutshell, price appreciation in silver.

Silver has to find a new equilibrium price in the face of surging demand and the fact that there will be a significant delay in new supply coming to market. Moreover, I believe higher silver prices will deter silver demand in jewellery and silverware, meaning a change of the guard from silver the precious metal to silver the industrial metal powering the green energy future.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link