Jack Colreavy

- Aug 23, 2022

- 6 min read

ABSI - The Relationship Between Interest Rates and Inflation

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

After hitting lows in June, stock markets around the world are rallying. Is the recent appreciation in share prices warranted or merely a dead cat bounce fuelled by the speculation that the inflation tide is turning and interest rates won’t go as high as initially feared? ABSI this week weighs in on this debate.

On Monday 20th June 2022 the ASX 200 closed at 6,433 off the back of extremely negative sentiment due to geopolitics and rising inflation. Unbeknownst, it turned out this was the low and the market has since rallied ~10% to close 7,047 on Monday 22nd August. Specifically, the rally culminated despite Australian interest rates rising another 1% and inflation rising to 6.1% for Q2 during the coverage period. Noteworthy, this isn’t an isolated incident with other global stock markets showing similar price action despite even more dire macroeconomic outlooks. The US Dow Jones, for example, bottomed around the same time and has since rallied ~11% to date.

Source: Google Finance

It goes without saying that there is never one reason for market sentiment, but there is always a primary driver and at the moment that driver is market consensus for central bank monetary policy action moving forward. The current rally is based on the sentiment that central banks won’t raise interest rates anywhere near as high as initially feared and that interest rates will peak in H1 2023 before we start to see cuts in H2 2023. This assumption is evidenced by the inverted US yield curve which is pricing 1Y bonds at ~3.3% but 5Y at ~3.1% and 10Y at ~3%. Further credence to this hypothesis is the reversal in US inflation which reversed from 9.1% in June to 8.5% in July. If the bulls are correct, with record low unemployment, supply chains continuing to normalise, and (god willing) peace is agreed in Ukraine, then we have the perfect recipe for the markets to go higher.

Source: World Government Bonds

Source: World Government Bonds

On the other side of the equation are the bears who are roaring that the rally is baseless optimism and that the bulls are significantly underestimating the stickiness of inflation and the central banks tenacity to ensure that, above all else, inflation returns to their mandated target of 2-3%.

Source: BPC using data from RBA and ABS

Source: BPC using data from RBA and ABS

In an attempt to make sense of the whole situation we turn to the historical spread between inflation and the RBA cash rate. It is important to note that the RBA only published a firm guide on interest rates in January 1990. Furthermore, it is important to account for the implementation of GST in 2000 and the abolishment of the carbon tax in 2014. Having said that, looking at the chart above, for most of the past ~32 years there has been a clear positive spread between the cash rate and inflation. It has only been since 2016, coinciding with the appointment of current RBA governor Dr. Lowe, that there has been a persistent negative spread. Moreover, with the continued acceleration of inflation, the negative spread is the largest in history currently sitting at -4.25%.

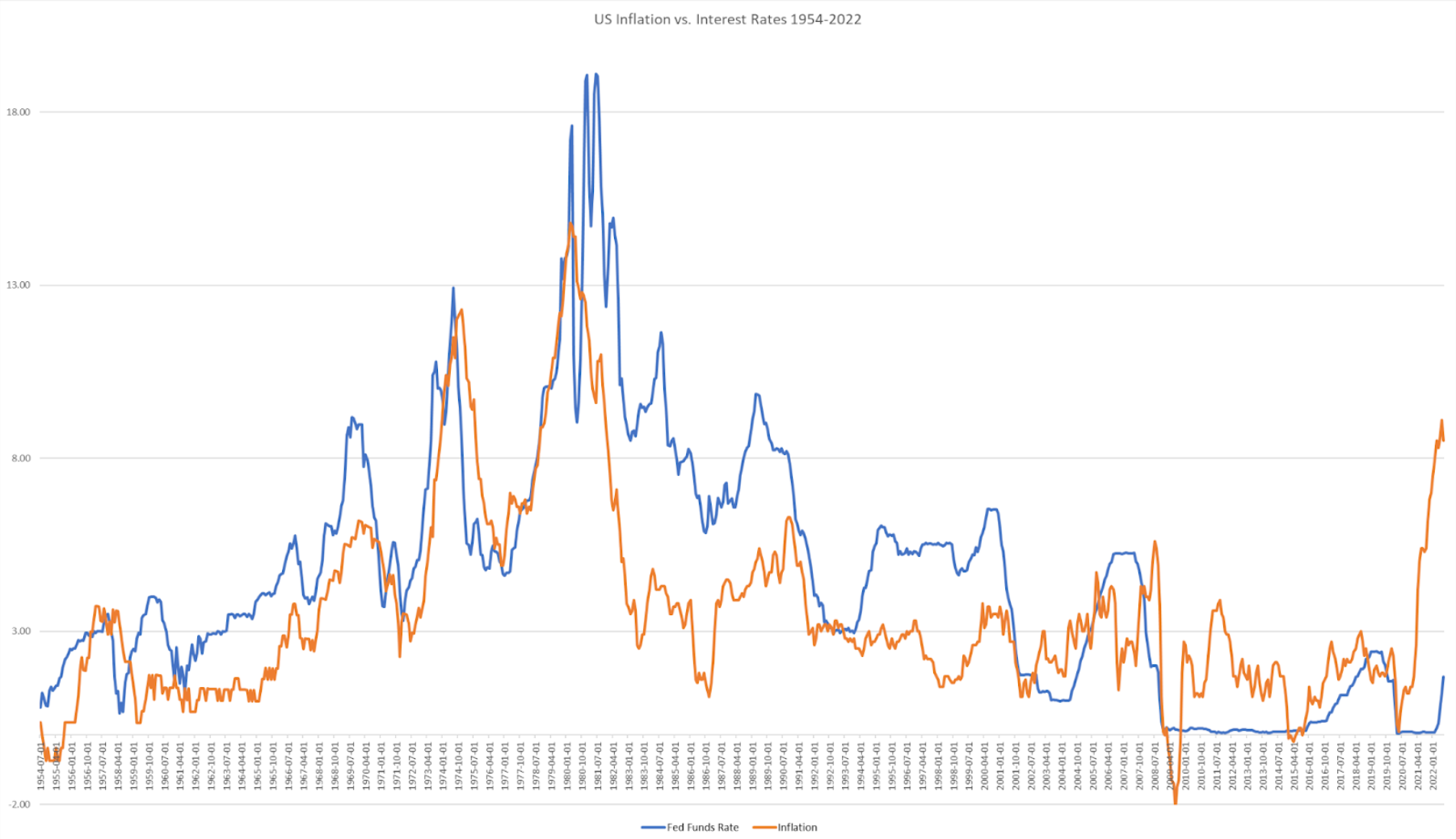

Taking a look at the Australian yield curve, the 1Y is yielding ~2.8% while the 10Y is priced at ~3.6%. Taking this data, and imposing it against the historical need for a positive spread, indicates that the market is underpricing how high-interest rates will need to go in order to tame inflation even at the current level; remembering that Australian CPI data is released quarterly. Most importantly, Australia isn’t alone with many other countries demonstrating a very similar historical record. Taking a look at the US data, which is more robust, we see the exact same positive spread between interest rates and inflation. Critically, every time inflation in the US has moved above 5%, the Federal Reserve has had to move interest rates above the inflationary peak in order to get inflation under control. The only exception is 2008, but we all know what happened then.

Source: BPC using data from St Louis Fed and Macro Trends

As coined by investing godfather Benjamin Graham, in the short term the stock market is a voting machine, but in the long term, it is a weighing machine. Currently, the bulls are outvoting the bears, but time will tell if they’re right or if they will be weighed down by the pressures of inflation and the contractionary monetary policy that is required to contain it.

Read the Conversation:

Jack Colreavy:

“ The rally in the stock market of late has really caught my attention. In June, we bottomed out, and since then, the stock markets have risen roughly 10% despite interest rates continuing to go up, and inflation also still remaining stubbornly high. Now, the sentiment behind this rally is the notion that central banks won't need to raise interest rates as much as initially feared, and in fact, we are looking at cuts in 2023.

This led me to look at the relationship between interest rates and inflation, and specifically, I noted something in the US data, which was every time inflation in the US moved above 5%, the Federal Reserve had to move interest rates above the inflationary peak in order to get inflation under control.

Now, having said that, inflation currently is peaking at 9.1%, so if this holds true, we would need to see interest rates in excess of 9% in order to tame inflation, but only time will tell. To learn more, please subscribe to, As Barclay Sees It by clicking the link in the description.”

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link

-BPC%20Desk%20Note.png?width=767&name=Castile%20Resources%20(ASX-CST-OCTQB-CLRSF)-BPC%20Desk%20Note.png)