Jack Colreavy

- Nov 30, 2021

- 8 min read

ABSI - The Ominous Omicron is Nothing to Fear

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

Financial markets are selling off around the world as fears the ominous Omicron variant will derail the global recovery. ABSI this week aims to allay fears around new variants and denounces the fearstorm narrative promoted by media companies.

Black Friday is known for retail sales but it appears the share market has also gone on sale this year as news broke of the Omicron Covid-19 variant breaching international borders and being recorded in a swath of countries including Australia.

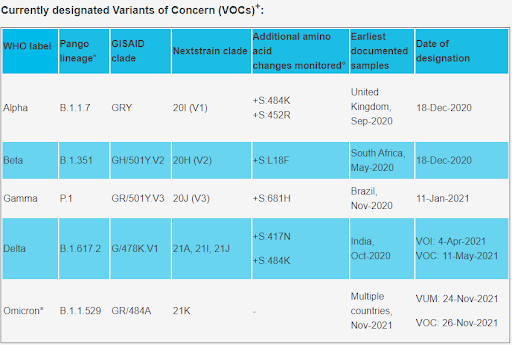

Omicron is the 15th letter of the Greek alphabet and continues to follow on from the WHO’s policy of adopting Greek letters to identify new strains of Covid-19. It is important to note that there have only been 13 variants listed to date and that the WHO has decided to skip the 13th and 14th Greek letters, Nu and Xi. Something tells me that having a Covid-19 variant named after China’s president wouldn't go down too well with the CCP. Continually, the WHO classifies variants one of three ways:

- Variant of interest (VoI) - genetic characteristics that predict greater transmissibility, stronger vaccine resistance, or more severe disease.

- Variant of concern (VoC) - data observed to be more infectious to those who are vaccinated or previously infected.

- Variant of high consequence (VoHC) - current vaccines do not offer protection.

Source: World Health Organisation

Looking at the WHO website, Omicron has been upgraded to VoC and joins a list of five including the Delta-variant. All other variants fall under VoI and thankfully we have yet to experience a VoHC so far.

Virus mutation isn’t a unique characteristic of Covid-19 but is a common trait of RNA viruses; every time the virus replicates, it evolves. Not all evolutions are beneficial to the virus but the changes that increase its transmissibility are the changes scientist’s notice as the new variant spreads to the wider community. Additionally, it is common that in order to become more transmissible, the virus becomes less deadly as increases in host mortality will eventually result in the virus running out of hosts.

The Omicron-variant originated in Africa which has low vaccination levels so it's difficult to decipher the impact it will have on vaccinated populations such as Australia. In South Africa, it is reported that ~3,200 people have contracted this version of the virus but all cases have been mild according to a Sky News interview with Barry Schoub, Chair of the Ministerial Advisory Committee on Vaccines.

The reaction by financial markets to Omicron has been a knee-jerk reaction and there may be good opportunities for investors to buy the dip here. Last Friday, along with other major exchanges, the ASX was down 1.7%, while the Dow was down 2.5% and Nasdaq closed down 2.2%. All the base metals sold off but the biggest losses were in energy with WTI and Brent down 13% and 11.7% respectively. Unsurprisingly, bond yields reversed tack from the inflation cycle, and plummeted as investors sought out safety in bonds and gold.

The Covid-19 virus isn’t going anywhere anytime soon and will continue to mutate until we’ve run out of Greek letters. Given the history of virus mutation, it is highly unlikely that the virus will alter itself significantly to alter the efficacy of vaccines currently available. It appears the biggest risk to financial markets is not the virus but government reactions to the virus but given the lockdown-fatigue experienced by citizens around the world, there would need to be compelling evidence for governments to restart lockdowns and close international borders again.

The Latest from BPC Research

Gentrack Group Limited (ASX:GTK) -

A$1.74 Share Price | A$174m Market Cap

GTK provides design, development, implementation and support of specialist software solutions for energy utilities, water companies and airports mainly in Australia and New Zealand. Gentrack offers two principal products being Gentrack Velocity and Airport 20/20.

Source: Google Finance

Recently, GTK reported strong FY21 results with EBITDA slightly ahead of guidance at NZ$12.7m – up 5.0% on FY20, and statutory NPAT up from a loss in FY20 to NZ$3.2m. Revenue growth was driven by an 8.8% increase in the Utilities business to NZ$89.0m with new customer wins and growth from existing customers offsetting previous years’ losses. Veovo revenues were down 10.7% due to continued impact of Covid-19 on the aviation industry, but annual recurring revenues (ARR) were up 7.7% as new customers moved into live operation and this business segment should see good growth as the world reopens.

GTK continues to deliver against the three strategic growth pillars outlined in its ‘Strategy Presentation’ to the market in June – creating a strong customer base, winning new logos and growing its managed services business. GTK advised that it anticipated an increase in FY22 group revenues, although this may be tested due to a turbulent UK energy market and the possible resurgence in Covid-19 with fears the new ‘Omicron’ variant may spread around the world.

BPC Research has a price target of A$1.40 and a UNDERPERFORM recommendation for GTK.

Select Harvests Limited (ASX:SHV) -

A$6.80 Share Price | A$817.5m Market Cap

SHV is an almond producer which grows, processes, packages, sells and distributes almonds from its almond orchards. They also manufacture and market edible nuts, dried fruits, seeds, and a range of natural health foods to the Australian, Asia, Europe and the Middle East retail and industrial markets.

SHV is an almond producer which grows, processes, packages, sells and distributes almonds from its almond orchards. They also manufacture and market edible nuts, dried fruits, seeds, and a range of natural health foods to the Australian, Asia, Europe and the Middle East retail and industrial markets.

In their latest FY21 results, SHV reported A$15.1m NPAT, down 39.6% on FY20, but A$25.3m NPAT from continuing operations due to the sale of the Consumer Foods division. Other results include reported EBITDA down 30.1%, EPS of 12.7cps, and a fully franked final dividend of 8cps - down 5cps from FY20.

Following a record Californian almond crop and aggressive selling program, the export almond price dropped to historic lows. However, SHVs focus on delivering high yields, price realisation and cost management has helped to offset the impact of $0.70/kg reduction in the almond price to $6.80/kg. This has achieved strong sales volumes and margins for the Industrial Value-Add Almonds business with opportunity for further growth in this area despite lower almond prices.

The impacts of global shipping and logistics issues have seen almond market pricing soften to between $6.75/kg and $7.25/kg, with ongoing concerns that logistic issues are unlikely to be resolved until the New Year. SHV anticipates that market pricing is unlikely to change until the size of the current U.S crop is confirmed and there is a better understanding of the impact of the ongoing California drought.

BPC Research has a price target of A$11.71 and a BUY recommendation for SHV.

Locksley Resources Maiden Exploration Program

Locksley Resources Limited's (ASX:LKY) recent announcement has sparked a conversation with the Company’s Corporate Communications Manager, Neil Gill, and our Senior Mining Analyst, Alex Sutton.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link