Jack Colreavy

- Mar 29, 2022

- 9 min read

ABSI - The New Bond Bear Market

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

In the land of financial markets, the majority of “air time” is given to equity markets due to the storied nature of the investment and the volatility allowing daily news headlines. Bond markets rarely get a mention, despite being a larger asset class in terms of market capitalisation. The low-risk and low-volatility nature of the bond market makes it akin to the turning cycle of a supertanker - so slow in fact that there has only ever been two bond bear markets.

This ABSI segment looks at previous bond bear markets and analyses why experts believe we’re on the precipice of entering a third.

To start, let’s review bond investment returns. If a bond is held until maturity, the return is the original yield when the bond was purchased. However, bonds can be traded on the secondary market and most long-dated bonds are rarely held to maturity. Given that the yield curve is dynamic, this gives rise to capital gains and losses in bond trading. Yield and price have an inverse relationship, so when the yield goes up then bond prices go down, and vice versa.

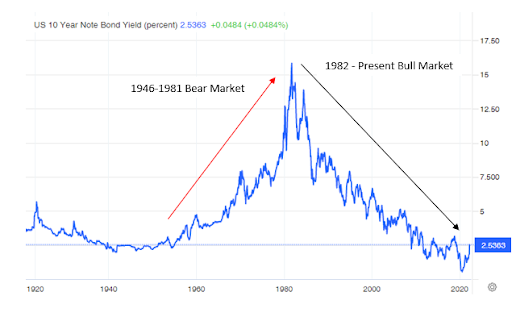

Furthermore, it is important to appreciate the long cycles of bond dynamics. The two previous bond bear markets occurred from 1899 to 1920 (21 years) and from 1946 to 1981 (35 years). However, since 1981 there has been an overall downward trend in bond yields resulting in higher bond prices. This bond bull market has been spurred along thanks to a cluster of recessions, particularly in 2008 and 2020, that resulted in unprecedented monetary policies keeping yield curves down.

Turning to the current macroeconomic environment, we can see that the deflation cycle has run its course and the global economic movement is heading towards materially higher inflation. This means higher interest rates and therefore lower bond prices. Continually, this is further exacerbated by the end of QE which gave investors a liquidity guarantee on their T-bonds as the government would buy them effectively at any price.

The peak of the bond market hit in August 2020 when yields on the US 10Y hit an all-time low of 0.5%. Since then, yields have been steadily tracking higher and have exploded in March 2022 with inflation continuing to surge and the US Fed starting the tightening cycle by raising rates - yields were 1.72% March 1st and now sit at 2.54% at the time of writing.

Year to date, the S&P U.S. Aggregate Bond Index is down 6.35% and the story is similar for all other bond indices making this the worst quarter for bonds in over 40 years. This is a worrying trend that could spiral out of control given that generally bonds are held for their “risk-free” status and low volatility. If neither of these objectives are being met, then this could lead to a complete reassessment of bond portfolios. Most concerning is that bond portfolios are usually highly leveraged and so rising volatility could create a domino selling effect across the board.

S&P U.S. Aggregate Bond Index

The trillion dollar question is, where will it be reallocated to?

If history is anything to go by, we’ll have 20-35 years to watch this saga unfold. Regardless, despite the upcoming weakness, bonds are a vital asset class and will continue to form a part of efficient portfolios.

The Latest from BPC Research

A$34.52 Share Price | A$1.96b Market Cap

PPT is a financial services company involved in portfolio management, financial planning, and other complimentary services. Its four core businesses are: Perpetual Investment, Perpetual Private, Corporate Trusts, and Group Support Services.

Source: Google Finance

In its recent half year results the Company announced a 113% increase in NPAT to A$59.3m due in part to a 37% increase in revenue to A$384.9m stemming from a 15% increase in FUM and 74% of all funds outperforming their benchmark. The strong financial performance saw a 33% increase in the interim dividend to a fully franked $1.12 per share.

Moving forward, PPT is positioning itself for long term sustainable growth and returns. The ESG investment in Trillium has proven to deliver results and sustain high investor interest in the space. Furthermore, a strong balance sheet and ongoing progress with their global distribution strategy, PPT are well positioned to drive organic growth, and to capitalise on further acquisition opportunities that will deliver shareholder returns.

PPT currently trades on a one-year forward P/E of 12.7x and has a gross yield of 8.9%.

BPC Research holds a BUY recommendation for PPT, with a target price of A$42.15.

A$2.01 Share Price | A$5.79b Market Cap

AWC engages investment in bauxite mining, alumina refining and selected aluminium smelting operations, through its 40% ownership of Alcoa World Alumina and Chemicals (AWAC). AWAC also has a 55% interest in the Portland aluminium smelter in Victoria, Australia.

In February, AWC announced its 2021 full year results with a 28% increase in NPAT to US$187.6m and a final dividend of US2.8 cps. Looking at the performance of AWAC, EBITDA grew 28% to US$1,146m and NPAT grew 10.4% to US$444m. While production was down and costs were up in 2020, the aluminium realised price was up almost 50% for the year.

AWC is positioning for a long term ESG focussed future. AWC’s CEO, Mike Ferraro, stated in 2021 that AWAC average cash cost was on the lowest quartile of the global cost curve and their portfolio of refined alumina has the lowest CO2 emissions intensity on average amongst major refiners. Whilst higher freight costs via the global shipping disruptions impacted the API, the realised alumina price for the year remained higher.

AWC currently trades on a one-year forward P/E ratio of 11.3x and has a gross yield of 10.5%.

BPC Research holds a BUY recommendation for AWC, with a target price of A$2.58.

H2X Global Secures An Alliance With Swedish Waste Company

H2X Global Limited has recently announced that it has signed an agreement with Renova, one of Sweden's major municipal-owned waste companies. H2X will provide Renova with hydrogen fuel cell powered trucks and light vehicles.

Read the Conversation:

Jack Colreavy:

“Recently I've been looking into bond bear markets because this is a phenomenon I'm not too familiar with. Now, the reason for this is officially there have only been two recorded bond bear markets. The first was 1899 to 1920, a span of 21 years, and the second was 1946 to 1981, a span of 35 years. Now that speaks to the bond market being very slow moving, low volatility asset class, and so the bull and bear markets have a long time horizon. So now in August 2020, we had a peak in the bond market when yields hit a record low 0.5%. Since then, yields have been trending higher, and in March alone, they are up almost 1%. Now you need to remember there's an inversion between yield and price. So when yields are up, prices are down, and this has resulted in over a 6% loss in bond portfolios year to date. So the question remains, are we in a new bond bear market? To learn more, please subscribe to, As Barclay Sees It, by clicking the link in the description.”

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link

-BPC%20Desk%20Note.png?width=767&name=Castile%20Resources%20(ASX-CST-OCTQB-CLRSF)-BPC%20Desk%20Note.png)