Jack Colreavy

- Oct 26, 2021

- 8 min read

ABSI - The DeFi Future is Here

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

The merits of cryptocurrency are hotly debated around the world but while bitcoin may go to zero one day, the underlying blockchain technology is here to stay and is disrupting industry around the world. ABSI this week explains how blockchain technology is disrupting the world of finance, giving rise to Decentralised Finance.

Humanity is quickly progressing to a digital age which will effectively see the redundancy of paper-based products. Currencies, books, contracts, even art are all on a path to an almost exclusive digital existence. It is important to appreciate that this transition has been enabled by blockchain technology. The blockchain is a decentralised digital ledger of transactions distributed across a network of computer systems that verify and add transactions to the ledger as they occur; for a more in-depth explanation of the blockchain check out this video.

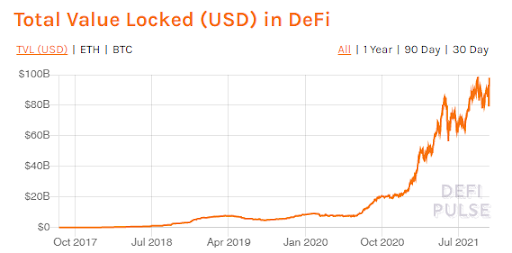

Decentralised Finance (DeFi) is still very much in its infancy but is growing at a phenomenal rate and has a huge range of applications for the finance industry. A May 2021 report by the Wharton Business School found that the value of DeFi digital assets grew from less than US$1b in 2019 to over US$80b by May 2021. While this is a drop in the ocean of the trillion-dollar global financial services industry, it's encouraging signs of what is to come.

The term DeFi is relatively generic in what activities it can cover but the most relevant categories include exchanges, derivatives, credit, asset management, insurance, and stablecoins. A DeFi future will see, among a raft of things, equity exchanges settle transactions instantly, loans issued through stablecoins, custody of assets held directly by the user instead of a regulated service provider, and audits streamlined due to public ledgers verifying activities. But to best understand DeFi, I think it's best to look at some of the most innovative case studies to emerge to date.

A start-up backed by VC firm Apollo Capital, called prePO, is making headlines recently due to its innovative idea of bringing liquidity to the pre-IPO market through token exchanges. Investors typically don’t have access to the hottest private companies in the world, these investments are generally reserved for professional venture capital and private equity firms. The prePO platform will enable speculation on private businesses, such as SpaceX or Canva, by converting equity to tokens which are then traded in a specific valuation range and with a specific expiry date for the business to go public. If the company successfully IPOs, a settlement price, based on the first day of trading, is paid out to the investor. Moreover, prePO enables an acceleration of a liquidity event for VC investors who will be able to convert their equity investments into tokens to leverage to the prePO exchange.

Another exciting DeFi application is a startup called Sorare, pronounced so rare, which is creating a platform for NFT (non-fungible token) sport trading cards. In a nutshell, NFTs authenticate digital art and assign ownership through the blockchain. As a result, Sorare has partnered with major sporting clubs to sell officially licenced player tokens, similar to their physical counterparts. Sorare was recently valued at US$200m but is anticipated to hit unicorn status before long. This comes as no surprise given the addressable market, with the US sports trading card market valued at US$4.7b in 2019 and forecasted to grow at a CAGR of 28.8% till 2027, according to Businesswire.

While DeFi is still in an incubation phase, it is evolving swiftly with new applications emerging every day aimed at disrupting traditional financial markets. DeFi can offer some exciting new investments, but investors need to be wary of the hype and remember that the sector is very volatile. Having said that, the future is here and DeFi will continue to innovate and take market share from the incumbents as the world continues to transition into the digital era.

The Latest from BPC Research

Bank of Queensland Ltd (ASX:BOQ) -

A$9.33 Share Price | A$6B Market Cap

BOQ engages in retail banking, lease finance, and insurance services. It also provides tailored business banking solutions, including commercial lending, equipment finance and leasing, cashflow finance, foreign exchange, interest rate hedging, transaction banking and deposit solutions for commercial customers. The BOQ branch network consists of approximately 98 owner-managed and 61 corporate branches supported by seven transaction centres.

Since the strategy was announced in Feb 2020, BOQ has delivered strong business momentum and improved performance, augmented by the transformative acquisition of ME Bank which enhanced portfolio diversification and further scales in retail. In FY21, BOQ announced a statutory NPAT of A$369m, up 221% from FY20, exceeding market expectations of A$388.1m. Other notable financial highlights include strong cash earnings of A$412m, increasing by 83% from FY21. Net interest margin was also reported at 1.92% up 1bp from FY20.

BOQ’s operational strategies include returning ME Bank to around system growth by year-end, introducing the second phase of Virgin Money Australia (VMA) digital bank to customers – expecting at least 2% jaws- and complete the divestment of St Andrew’s in 1H22. The acquisition of ME Bank is expected to create significant pre-tax cost synergies, along with further potential upsides from revenue benefits, funding savings, and CAPEX synergies.

BOQ is currently trading at a forward PE of 13.1x and offers a gross yield of 5.8%. BPC Research has a BUY recommendation with a target price of A$10.81.

Ramsay Health Care Ltd (ASX:RHC) -

A$66.73 Share Price | A$15.3b Market Cap

RHC is a global network that engages in the provision of healthcare services and the operation of hospitals and day surgery facilities. The company has 72 private hospitals and day surgery units in Australia, admitting more than one million patients annually.

RHC is a global network that engages in the provision of healthcare services and the operation of hospitals and day surgery facilities. The company has 72 private hospitals and day surgery units in Australia, admitting more than one million patients annually.

Despite the capacity and surgical restrictions brought on my COVID-19, RHC continues to grow with revenue up 3.9% to A$12.4b in FY21. EBITDA also increased 11.9% to $2.05b, accounting for increased costs in equipment and operation brought on by the pandemic.

RHC’s FY22 result will be impacted by the effectiveness of the ongoing global response to the COVID pandemic, including the success of vaccination programs in each region in reducing the number and severity of COVID cases. COVID-19 restrictions will lead to further disruptions in 1HFY22, creating volatility in projected revenue. New hospital projects due to be completed in FY22-25 will lead to increased customers and subsequent revenue growth.

RHC currently trades on an adjusted P/E ratio of 34.6x and offers a gross yield of 2.9%. BPC research has a BUY recommendation with a target price of A$86.04.

Top 3 ASX Stock Picks - October 2021

Our Director of Trading, Trent Primmer provides his insights into 3 ASX stock picks that will compliment your investment portfolio in October 2021.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link

-BPC%20Desk%20Note.png?width=767&name=Castile%20Resources%20(ASX-CST-OCTQB-CLRSF)-BPC%20Desk%20Note.png)