Jack Colreavy

- May 9, 2023

- 4 min read

ABSI - The Debt Ceiling Showdown: A High-Stakes Financial Spectacle

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

In what is becoming a regularly occurring event, like the Superbowl, the US government is fast approaching its self-imposed debt ceiling of US$31.4 trillion. Last month, the Republican Congress passed a bill raising the debt ceiling but only in exchange for spending cuts across the board. The Democratic controlled Senate will unlikely pass the bill meaning that we’re in for the usual game of chicken between political parties whereby if neither party blinks the US defaults on its debt repayments causing a global financial crisis. ABSI this week discusses the US debt ceiling.

Created in 1917 when the US government started borrowing money in order to finance the war effort, the U.S. debt ceiling is the maximum amount of money that the US government is authorised to borrow to meet its financial obligations. It is a statutory limit set by Congress on the total amount of debt that the U.S. Treasury can issue to fund government activity. If the debt ceiling is reached, it cannot issue additional Treasury securities to borrow more money, which can lead to a potential default on its financial obligations.

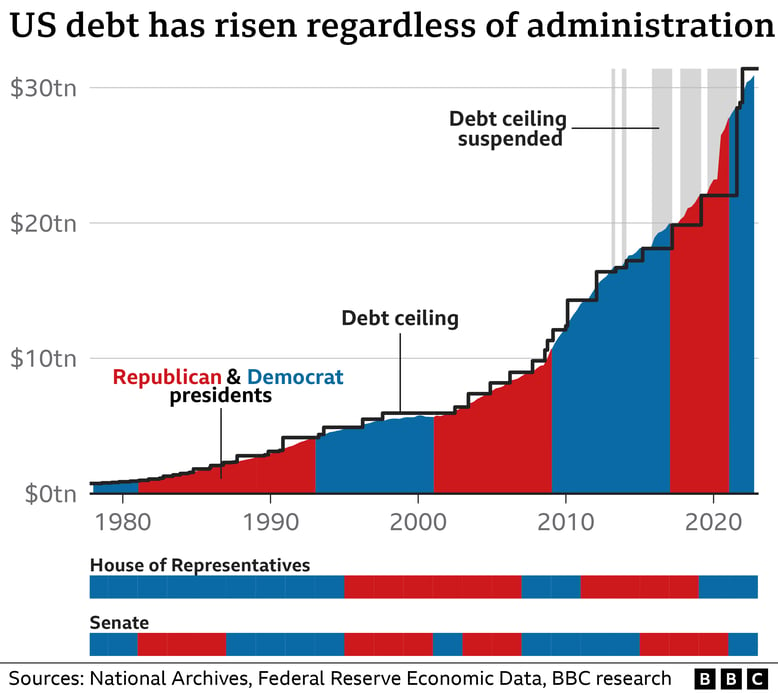

Source: BBC

Originally set at US$49 billion, the debt ceiling was first raised in 1941 to US$65 billion and since then the ceiling has been raised 114 times allowing the US government to amass a debt level of US$31.4 trillion and counting. Most of the time, these increases cop political criticism but they pass without too much political wrangling. The last raise occurred in Dec 2021 when the Biden administration signed a US$2.5 trillion increase passed by a Democratic controlled Congress and Senate. However, with the Republicans now controlling Congress the latest increase is at a political stalemate with Democrats wanting an unencumbered increase whilst the Republicans want to see spending cuts in exchange for passing the necessary legislation.

The game of debt ceiling jostling between the two major parties isn’t new and there have been numerous historical examples. The most recent, and one of the more extreme examples was in 2013 when Tea Party Republicans refused to pass the debt increase without major fiscal cuts. The situation got so dire that many public services had to shut down and furlough staff due to lack of approved funding. While essential services such as national security and air traffic control continued to operate, many non-essential services were shut down such as national parks, museums, Federal courts, the IRS, and other federal offices. Eventually, after 16 days of political deadlock and mounting pressure from the public and the business community, a bipartisan agreement was reached on October 16, 2013, to reopen the government and raise the debt ceiling.

The fallout from the 2013 debt ceiling crisis had several significant impacts on the economy, government operations, and public perception. The key consequences were economic with the US government debt rating downgraded by some ratings agencies, a slowdown in economic growth, increased financial market volatility, and an overall diminished confidence in the US government raising concerns about the stability and reliability of the US as a global economic leader.

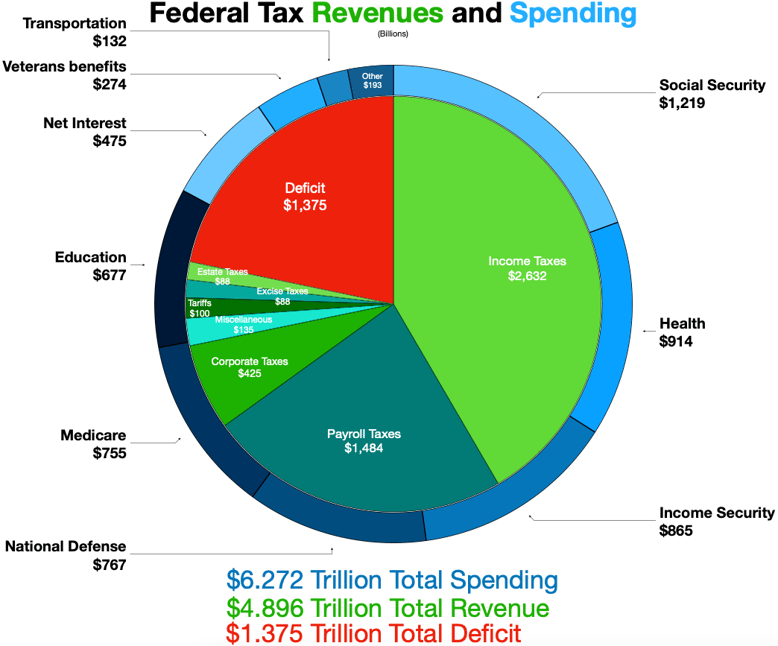

Source: Wikipedia

Ten years since this event we’re on the cusp of history repeating. It is difficult to recall the last time American politics has been so divisive and this is setting the stage for an increase in the debt ceiling to come down to the wire again. Back in 2013, the Republicans were largely blamed for the shutdown and it appears they have learnt from history by being proactive in passing a bill through Congress to raise the debt ceiling provided certain cuts are made to government spending. It is likely that the Senate will reject the bill framing the Democrats as the “bad guys” and reason for the inevitable fallout that will come if the world starts to raise the probability of the US defaulting on its debt obligations.

Given the catastrophic outcome on global financial markets that such a scenario will entail, a compromise will be found. However, even if a default is avoided, the unwanted spotlight of a US debt crisis might just cause irreversible damage and potentially add another nail to the coffin of the US Dollar’s status as the global reserve currency.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link