Jack Colreavy

- Apr 26, 2022

- 9 min read

ABSI - Supply chain pain continues thanks to Chinese lockdowns

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

Covid hasn’t been in the headlines much recently, which isn’t a bad thing. However, a big news story that isn’t getting a lot of airtime is the lockdowns in China due to a recent Covid outbreak. Since China is still pursuing a zero-covid strategy, the world’s most populous nation is under strict lockdowns, which is impacting every industry, especially manufacturing. ABSI this week discusses the Chinese lockdown and the next supply chain shock that will result from this antiquated lockdown policy.

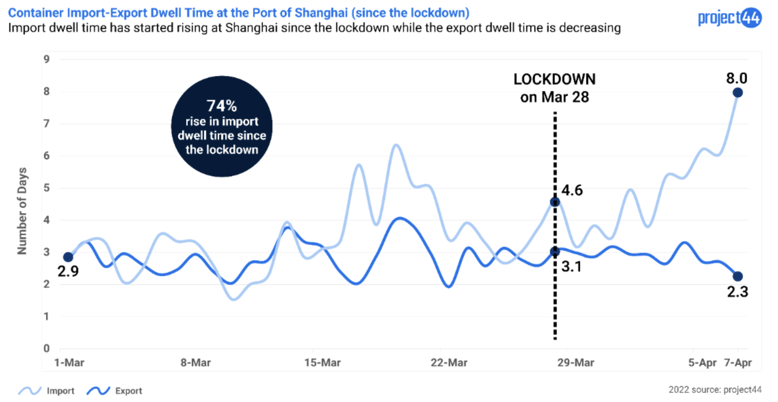

The Chinese people have not experienced such extensive lockdowns since the initial outbreak in Wuhan, back in 2020. Entering their 5th week, entire metropolises are in lockdown, including major cities Shanghai and Guangzhou, home to ~46 million people. The lockdown has shut down production of everything in these regions, from cars to smartphones. Additionally, major ports, such as Yangshan Container Terminal in Shanghai, critical to the global supply chain, are closed with cargo starting to pile up.

If we look back 12 months, the Port of Shenzhen had a 4 week reduction in productivity of 30% due to Covid, which caused a massive bottleneck in the supply chain for months following full reopening. The magnitude of the latest lockdown is materially higher, as it involves the largest container port in the world and 100% of the facility has been shut down with no sight of reopening.

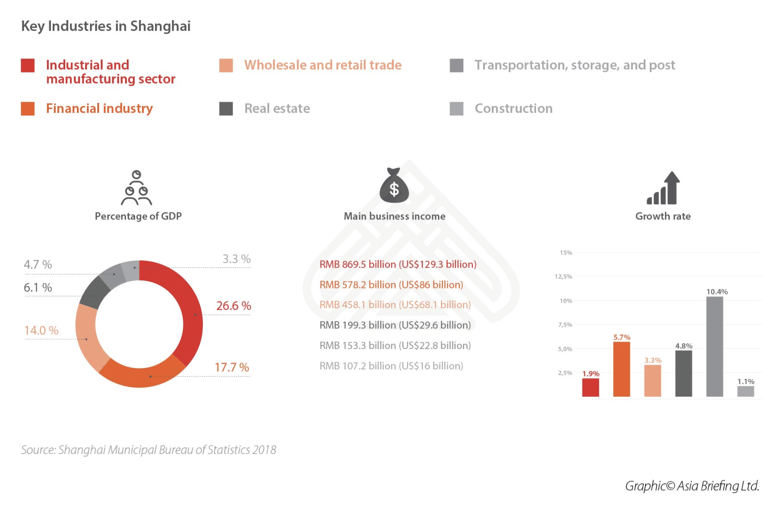

It’s difficult to overstate the importance of Shanghai as one of the world’s largest global manufacturing centres. It is the home to numerous international companies across a range of sectors but particularly, automotives and electronics. Tesla is a great example of the supply tsunami that is approaching with its gigafactory in Shanghai closed on March 28 and only recently begun limited operations again on April 17.

Giga Shanghai is Tesla’s largest production facility and produced 473,078 vehicles at a daily rate of ~2,100 cars per day. This shut down has resulted in a production loss of over 45,000 vehicles equating to about ~US$2b in revenue.

Unfortunately, just as the light at the end of the tunnel was approaching for China, through gradual ease in sanctions on Shanghai, there are reports of rising cases in Beijing which is sparking fears that a similar lockdown of the Chinese capital will wreak havoc. The city is home to ~20m residents and is the political epicentre of the country. As a result, Chinese stock prices were hit hard yesterday, iron ore futures slumped 11%, and oil dropped 3% to trade below US$100/barrel.

As the Covid-19 virus enters its endemic stage globally and life seemingly returns back to normal, it's frustrating to see China continue to maintain a Covid-zero policy. The effect of these policies will continue to exacerbate global supply chain logistics and stoke the fires of inflation, whilst creating headwinds for post-pandemic growth.

The Latest from BPC Research

A$10.73 Share Price | A$15.4b Market Cap

Source: Google Finance

In a recent, third-quarter trading update, BXB reported sales revenue from continuing operations of US$4,067m for the first nine months of FY22. This represented an increase of 7% reflecting ongoing strong price realisation to recover cost-to-serve increases in all regions, including sustained high levels of input cost inflation and increased capital cost of pallets. Group sales volumes were broadly in line with the prior period, while new business wins in EU pallets and Australian RPCs offsetting lower like-for-like volumes with existing customers in North American and EU pallets, as these businesses cycled strong demand in the prior year. Finally, pallet availability constraints also continued to limit current period growth with new and existing customers in all regions.

BXB full-year FY22 sales revenue growth is expected to be 8-9% (previous guidance of 6-8%) and underlying profit growth of 6-7% (previous guidance of 3-5%) including approximately US$50m of short-term transformation costs.

BXB currently trades on a one-year forward P/E ratio of 19.0x and has a gross yield of 3.5%.

BPC Research holds an UNDERPERFORM rating for BXB, with a target price of A$8.86.

Bega Cheese Limited (ASX:BGA) -

A$5.11 Share Price | A$1.6b Market Cap

BGA engages in receiving, processing, manufacturing, and distributing dairy and other food-related products in Australia for domestic and international markets.

BGA recently updated the market with a FY22 trading update that recognised that a series of unfortunate events would result in one-off costs impacting performance in excess of A$40m. In addition to Covid-related issues, the recent east coast flood disaster has significantly disrupted customer deliveries and will increase logistical costs in these regions. Furthermore, the war in Ukraine was resulting in inflation in several input costs such as wheat and fertiliser. Finally, the Shanghai lockdown is impacting product delivery schedules in China.

On the positive side, global dairy demand and commodity prices remain strong with the competition for milk being robust and transferring to higher farm gate milk prices. The Company will continue to execute its capital program with a particular focus on site and supply chain efficiencies, capacity increases, and product innovation in high growth segments. FY22 EBITDA earnings guidance will be between A$175m and A$190m. There is expectation that its leverage ratio will continue to reduce to ~2.0 by year end.

BGA currently trades on a one-year forward P/E ratio of 31.7x and has a gross yield of 2.7%.

BPC Research has a HOLD rating on BGA, with a target price of A$5.63.

H2X Global to supply Trelleborg with hydrogen buses

H2X Global Limited has recently announced that it has signed an MOU with Sweden’s Trelleborg Municipality. H2X will collaborate with Trelleborg Energi, a local energy company, to develop the City's first ever hydrogen high floor buses and a waste truck.

Read the Conversation:

Jack Colreavy:

“ COVID-19 hasn't been in the news too much lately, which is a refreshing change of pace. But one story which has really caught my eye is the lockdowns in China. Now, China is continuing to pursue a zero COVID policy, and this is leading to very strict lockdowns across the nation. Shanghai is the biggest city of note under a very strict lockdown because it is a manufacturing hub to likes of Tesla and several other major international companies, and it's also home to the world's biggest shipping facility. Now, 12 months ago, the Port of Shenzhen was throttled down 30% for four weeks, and this caused major issues in the supply chain. So looking at the biggest port in the world, enclosed a hundred percent for over four weeks with no end in sight, this is causing massive, massive issues in an industry that is already under enormous strain. So, what this means is it's gonna cause massive backlogs in transportation. It's stoking the fires of inflation, and it's really putting a headwind on the post pandemic growth. To learn more, please subscribe to, As Barclay Sees It in the link in the description.”

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link

.png?width=165&name=Bega%20Cheese%20Limited%20(BGA).png)