Jack Colreavy

- Feb 6, 2024

- 5 min read

ABSI - RBA's New Era: Changes, Challenges and the Road Ahead

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

Today is the first Tuesday of February which means it is the first RBA monetary policy decision meeting of 2024. The significance of this meeting is it will be the first time new changes to the meeting format are enacted. ABSI this week will outline the new RBA approach and what investors can expect from interest rates in 2024.

In 2022, the federal government embarked on an independent review of the RBA which resulted in a swath of changes aimed to improve the setting of monetary policy and the governance of the RBA. In all, a total of 51 recommendations were made in the final report “An RBA Fit for the Future” with the major changes including a split from one to two boards - one for monetary policy and one for governance - meetings every 6 weeks instead of 4 weeks, two half-day meetings instead of a single half day, and introduction of a governor press conference immediately after the announcement.

Five Themes to Improve RBA Performance

Source: RBA

Yesterday, Monday 5th February, the RBA officially kicked off the new era by meeting at 2 pm on a Monday for the first time in its history. The time spent on the first day will involve presentations from RBA staff on various economic factors that should influence the decision of the board. Today, Tuesday 6th February, the board reconvened in the morning to discuss the previous day’s presentation, make the policy decision, and draft a written statement from the board explaining the decision. Finally, at approximately 3:30 pm, RBA Governor, Michele Bullock, will front for the first-ever post-meeting press conference at RBA HQ in Martin Place.

It is important to appreciate that the changes made to the process don’t change the foundational structure of how monetary policy is enacted in Australia. The inflation target is still 2-3% with a dual-purpose mandate of price stability and full employment. What the changes aim to achieve is better communication and transparency that will avoid mistakes made under Governor Lowe's tenure which resulted in material mis-forecasting of future interest rate expectations.

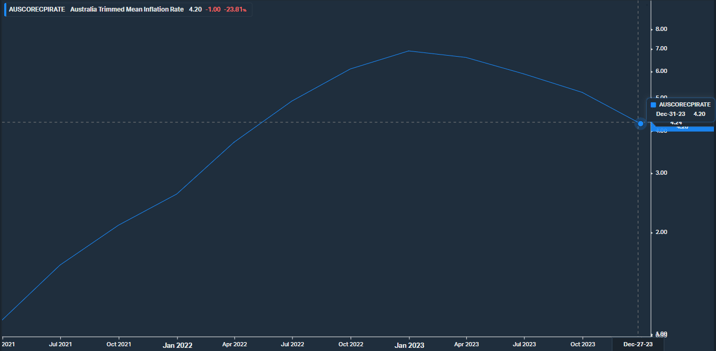

Australian Trimmed Mean Inflation Rate

Source: Koyfin

Turning to the outcome of this first meeting, which should hit the news headlines as this email hits your inbox, it is widely forecasted that there will be no change to the cash rate which is currently set at 4.35%. Market participants will be looking at the language from the press release and comments made by Governor Bullock at the press conference. Given the weakness in employment and GDP in recent economic data, the RBA will turn dovish and be looking towards the first opportunity to assist the economy by cutting rates. Inflation is the sole hurdle to see cuts to the cash rate. Despite annual inflation cooling faster than expected to 4.1% last quarter, the core number remains well above the 2-3% target.

In writing, the market, which has had an abysmal recent record of forecasting the cash rate, is prescribing a 40% chance of the first rate cut in May with a guaranteed cut by August and an additional cut by the end of 2024. Personally, I think May is too aggressive and the RBA will want to see annual inflation sub 3% before risking a cut to the cash rate. June Quarter CPI is released on the 31st of July, making August 5-6 meeting the prime target for rate relief.

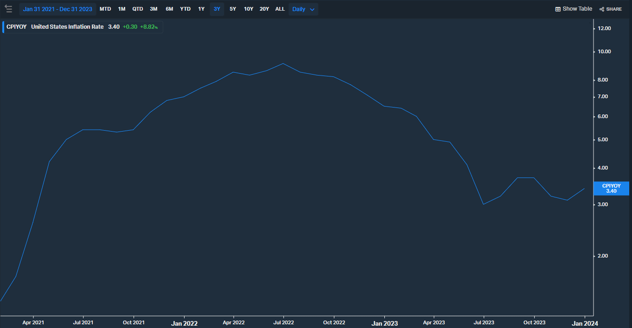

United States Annual Inflation Rate

Source: Koyfin

While on the subject of interest rates, it is important to keep an eye on the United States. If you recall, Fed Chair Powell turned surprisingly dovish in December 2023 which set financial markets on fire with anticipation of first rate cuts in March 2024. Since those comments, expectations for cuts have been paired back on fresh economic data that paints a picture of strength for the world’s biggest economy. Last week, nonfarm jobs bounced back to add 353k jobs in January, helping fuel GDP growth at 3.3%, and inflation edged back up from 3.1% to 3.4%. All these important economic indicators point to no reason for the Fed to cut interest rates and any cut will just stoke further inflationary flames.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link