Jack Colreavy

- May 30, 2023

- 4 min read

ABSI - NVIDIA Soars to Trillion-Dollar Club

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

The news that grabbed financial headlines last week was American chipmaker NVIDIA after a large upgrade in revenue guidance put a rocket under the share price adding ~US$200 billion in market cap in a single day and putting the company in a rarefied field amongst the trillion dollar club. ABSI this week breaks down the company and the news that saw the market go all in on NVIDIA.

For the uninitiated, NVIDIA Corporation (NASDAQ:NVDA) is a multinational technology company specialising in the design and manufacture of graphics processing units (GPUs) and system-on-a-chip units (SoCs) for gaming, professional visualisation, data centres, and automotive markets. NVIDIA initially gained prominence in the gaming industry by producing high-performance GPUs for personal computers but over time NVIDIA expanded its focus to other areas such as scientific research, artificial intelligence, deep learning, and cryptocurrency mining.

In recent years, NVIDIA has made significant strides in the field of artificial intelligence (AI). Its GPUs have become crucial tools for training and running deep neural networks, a fundamental component of AI algorithms. This has fueled NVIDIA's involvement in the development of AI-powered applications, including autonomous vehicles, robotics, healthcare, and natural language processing.

This brings us to 2022, when NVIDIA released the H100, its most powerful processor ever built with a price tag to match - circa US$40,000. Unfortunately, the timing couldn’t have been worse, given the inflationary economic climate and the business struggled to garner demand resulting in the stock price hitting a low of US$112 in October 2022.

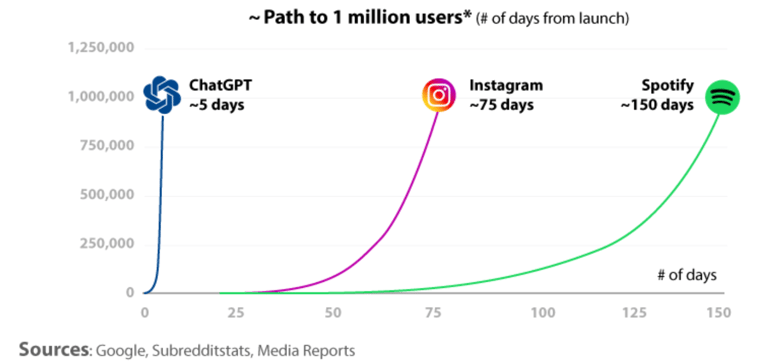

Then in November 2022, a little AI app called ChatGPT was launched to the public.

Source: ChatGPT Guide

The AI arms race had begun, creating instant demand for the H100, unanimously seen in the industry as the best chip in town. The popularity of the product was evidenced last week when NVIDIA announced its Q1 earnings. Revenue was up 19% Q/Q to US$7.2b and Net Profit was up 44% Q/Q to US$2b. However, what really caught investor attention was the guidance for Q2 earnings with revenue forecasted to be US$11b, a 50% Q/Q increase.

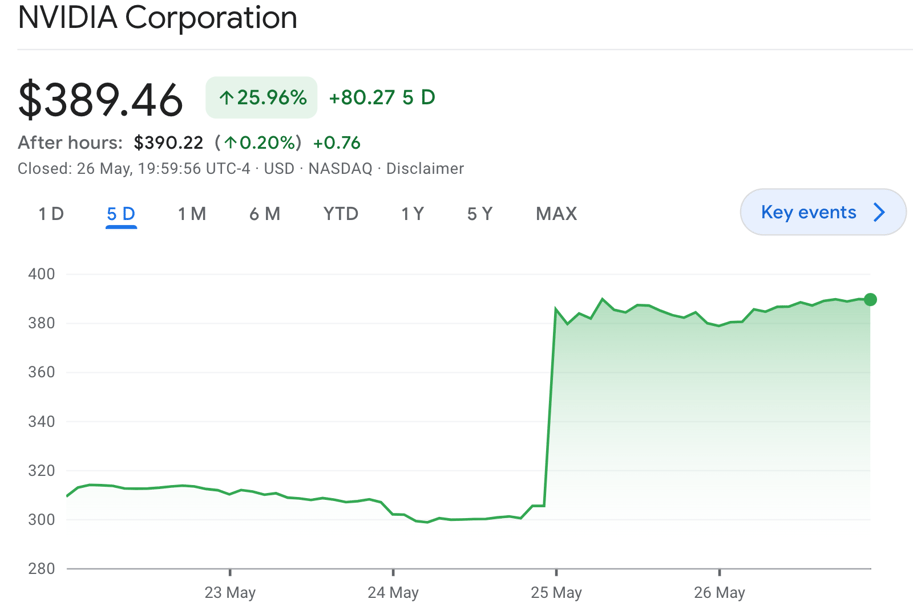

Source: Google Finance

The published results sent Wall Street into a frenzy, bidding the stock price from US$305 to US$386 by close of trading with higher bidding ongoing in the aftermarket. Today the stock is trading at ~US$390/share, a ~250% gain since Oct 2022. For context, the ~US$200 billion increase in market cap was the single biggest gain in US history and is more than the entire market cap of Disney, Nike, and Netflix.

While the increase in the share price is evidence that many investors have strong convictions for the AI boom and NVIDIA dominating as the GPU of choice, it is important to appreciate that many think this price action is lemming-like behaviour that will end in large losses. On a trailing basis, the stock is trading at 189x P/E ratio but if guidance is achieved then the current price represents 56x earnings.

It also seems like insiders at NVIDIA think the stock has run a little too hard. In the darkness of after-hours on Friday before a long weekend, the Company lodged notification of director share sales and a Form S-3 to raise $10 billion from the sale of new equity. An interesting turn of events for a company with US$15b in cash and was more recently conducting share buybacks rather than share sales. Personally, I can’t blame management for making hay while the sun shines.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link