Jack Colreavy

- May 2, 2023

- 4 min read

ABSI - Trouble Ahead? M2 Money Supply Contracts First Time in 90 Years

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

After a huge surge in the money supply globally, as a result of central bank money printing during the pandemic, we’re starting to see the pendulum swing the other way. Recent US data shows for the first time in 90+ years M2 money supply is contracting. ABSI this week discusses M2 and the implications of an unprecedented contraction.

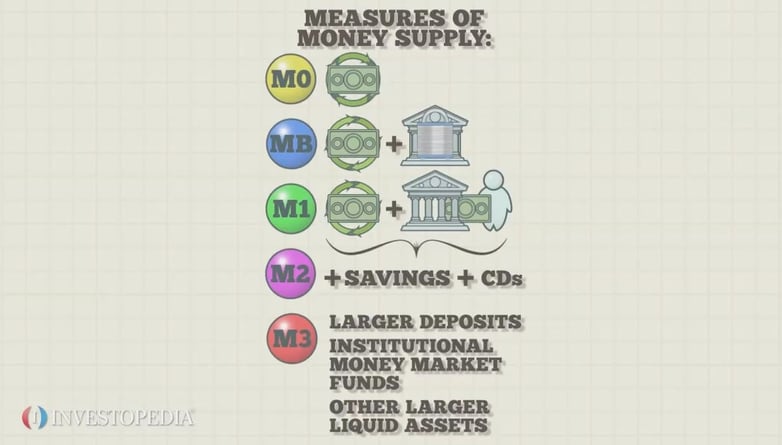

For the uninitiated, M2 money supply is a measure of the money supply that includes all the elements of M1 money supply (cash, checking deposits, and other highly liquid assets) plus certain types of savings deposits, money market securities, and time deposits with a value of less than $100,000. It is important to appreciate that M2 is often used as a gauge of economic activity and inflation, and is closely watched by policymakers and economists.

Source: Investopedia

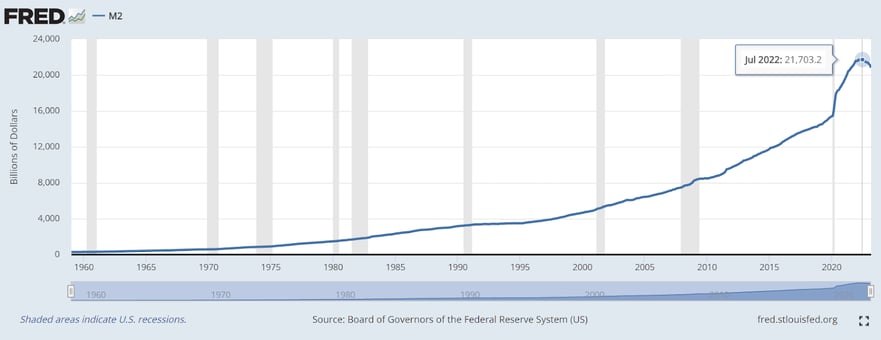

Critically, M2 money supply growth rates have fluctuated throughout history, the overall trend has been positive, indicating an increase in the amount of money in circulation. This is a result of central banks printing money and incorporating it into the system. While there have been times when the growth rate of the M2 money supply has slowed down or even briefly stalled due to changes in monetary policy or economic conditions, there hasn’t been an instance in the last 90 years whereby M2 growth has been negative…until now.

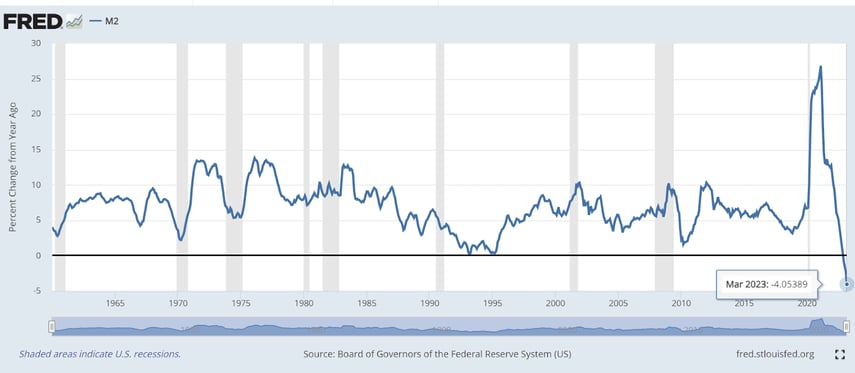

Source: St Louis Fed

Concerningly, recent data from the St Louis Fed shows that at the end of March 2023 the M2 growth rate was -4.05%. This takes the M2 money supply from a peak of US$21.7 trillion in July 2022 to a still elevated level of US$20.8 trillion in March 2023. Continually, given current inflation levels and the tightening on monetary policy, this is a trend that is unlikely to change anytime soon.

Source: St Louis Fed

While a reduction in M2 is good for the integrity of a currency, negative growth in the M2 money supply does mean a decrease in the overall amount of money in circulation in the economy which could have several potential implications for the economy:

- Reduced liquidity - less money available for individuals and businesses to spend, resulting in reduced liquidity and decreased economic activity.

- Deflationary pressure - less money available to purchase goods and services usually results in falling prices, which could further reduce economic activity.

- Higher borrowing costs - money supply decreases leads to higher borrowing costs, as there would be less money available for banks to lend to borrowers. This makes it more difficult and expensive for businesses and individuals to obtain credit, hampering economic activity.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link