Jack Colreavy

- Jun 20, 2023

- 4 min read

ABSI - IPO Market in Turmoil: Unveiling the Challenges and Opportunities in 2023

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

The year 2021 was a surprise blockbuster for the IPO market fuelled by Covid stimulus. However, fortunes reversed dramatically in 2022 and as we approach the end of the first half of 2023, it is becoming clear that a rebound isn’t on the horizon. So much so, the ASX is on track for its first contraction in 18 years. ABSI this week looks at the underlying trends in the global IPO market for 2023.

According to the OnMarket IPO Report, 2021 was a record year with 204 new listings raising a combined A$13.4 billion. Moreover, the performance of these listings outperformed the ASX200 index registering 2.1% outperformance with a 15.2% gain. The ASX wasn’t alone in this trend with many global markets registering a bumper IPO market. For example, the London Stock Exchange (LSE) saw 126 new listings for the year, up from 50 in 2020, with a combined market capitalisation of £54 billion.

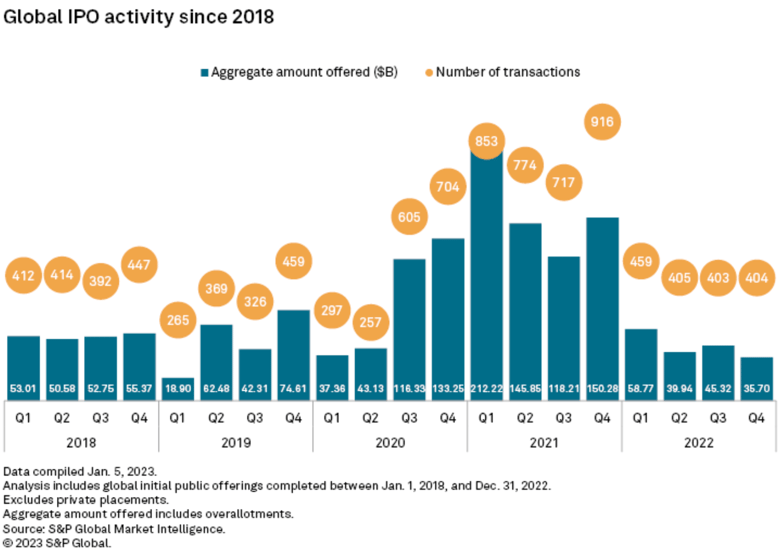

Source: S&P Global

In contrast, 2022 saw a reversal of the previous trends due to shaky financial markets as a result of high inflation and subsequent interest rate rises from global central banks. Last year, the ASX saw a reduction in listings to 89 raising a paltry A$1.1 billion. Noteworthy, most of these listings came in January to April off the tailwinds of 2021. Globally, exchanges saw 1,333 new listings which was a 45% reduction in the number of IPOs and a 61% decline in proceeds raised.

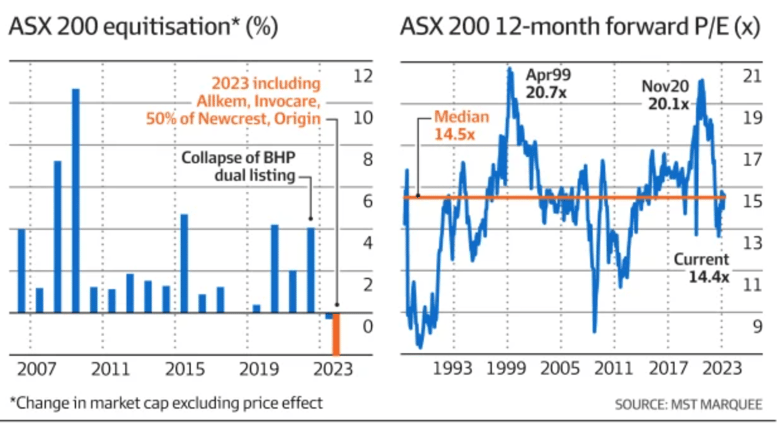

With the first half of the year fast approaching it is becoming clear that unless there is a major reversal, 2023 will be an even tougher year for IPOs. The ASX to date has seen 10 listings raising a total of A$113.6m. Couple the drought of new listings with the flurry of M&A activity and the ASX is on track to shrink by ~A$43 billion; the first time since 2005, when News Corp moved to Wall Street. Since the start of last year, A$65 billion in ASX shares have been delisted and there is another A$25 billion in the pipeline, led by Origin Energy.`

Source: AFR

There is an upside to this trend and that is the notion that limiting investor options results in higher valuations. For example, BHP’s acquisition of OZ Minerals has taken a significant copper pure-play off the table forcing those wanting listed exposure to the space to look elsewhere, such as the next biggest option Sandfire Resources (ASX:SFR). In April 2023 when Oz Minerals delisted, SFR stock surged to a 12-month high of ~A$7/share.

Ultimately, higher valuations on stocks will entice companies to enter the fray and look to list in order to capitalise so the IPO recession should turn around soon. Potentially as soon as the second half of 2023, with all eyes on chemicals distributor, Redox set to join the ASX boards in July thanks to a A$402 million raise valuing the company at A$1.3 billion. If it performs well, expect to see others test the market later in the year.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link