Jack Colreavy

- Dec 5, 2023

- 5 min read

ABSI - Gold is the New Gold

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

As we enter December and 2023 starts to draw to a close, it's important to remember that the financial markets may still have a surprise or two left. Yesterday was such a day when the gold price breached a new all-time record high in US dollars. This 2023 appreciation in gold is a little unusual given that generally gold holds a negative correlation to interest rates. ABSI this week will delve into the reasons why gold is the new gold.

In my final ABSI for 2022, I wrote about research from ANZ Bank that forecasted gold to outperform equities with a year-end price target of US$1,900/oz. Back in October 2022, gold was trading below US$1,700/oz and the all-time record was US$2,051/oz set in August 2020. I concurred with this analysis but was slightly more bullish, targeting an all-time high in the gold price. The reasons are a flight to safety in a 2023 recession and thinning physical inventory levels.

As 2023 draws to a close it appears this analysis was correct with gold breaching a new intraday all-time record high of US$2,135/oz on Monday 4th December. However, the underlying reasoning wasn’t entirely on point with no recession insight in 2023 and growing sentiment that a soft landing is on the cards.

It begs the question, what is the underlying driver causing this new resurgence with gold?

Source: FX Street

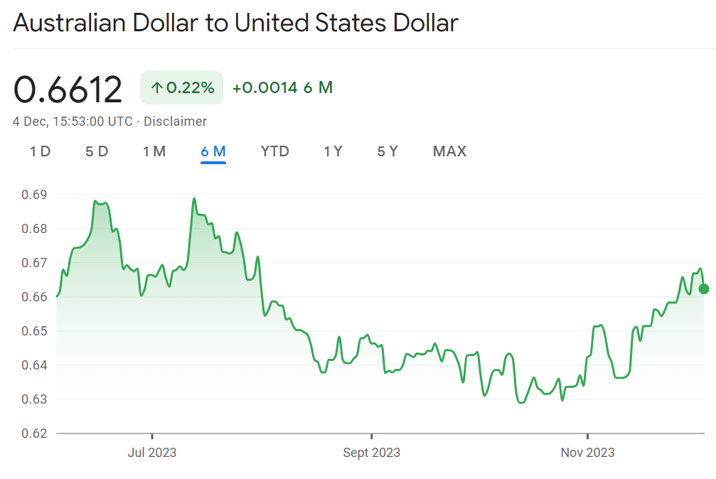

Unfortunately there is no simple answer to that question as there are a number of elements providing tailwinds for the price of gold. I would say that the key driver is gold’s ability to act as an alternative to fiat currencies. Given the sentiment that interest rates have peaked in the US and the next move from the Fed will be a cut has resulted in traders, who are long the US Dollar, looking to move their money to other currencies. It’s the reason why the Aussie Dollar has seen a resurgence in the past month, moving from sub US$0.63 to over US$0.66, and it's a key reason gold has printed new highs.

Last Friday, the Fed Chairman, Jerome Powell, tried to talk down the rate cut sentiment, stating that it was premature to speculate on cuts and that rate rises were still on the table. However, he also declared that monetary policy was well into restrictive territory and that the FOMC is very aware of the risks to the economy. This attempt at being hawkish was not sold to the market and when the futures market opened on Monday morning, gold rocketed higher.

Source: Google Finance

It is important to note that the tailwind isn’t just aimed at the prospect of incoming rate cuts. Another reason for the growth in gold is due to the fact that interest rates are so high. Across most developed economies, interest rates are at decade highs which should be a negative for gold given that the precious metal doesn’t offer any rate of return, in fact, there is an associated cost with storing and security of the physical asset (known as the cost of carry). However, what is different today is the extreme sovereign debt loads due in part to the fiscal decisions during the COVID-19 pandemic, but also decades of budget deficits. This new high-interest rate environment results in federal budgets dedicating an increasing amount to pay the interest bill. Again, the US is the poster child where the interest on its US$33.9 trillion is ~US$1 trillion per annum and rising. This new trend doesn’t instil a lot of confidence in the US Dollar and market participants are seeking fiat alternatives, such as gold and bitcoin.

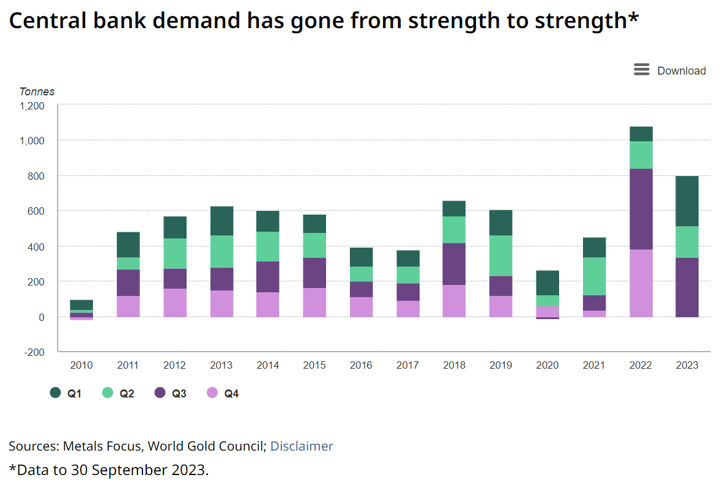

Source: Gold.org

Source: Gold.org

Finally, there is a growing demand for physical gold, particularly from global central banks. Year-to-date global central banks have accumulated over 800t of physical gold including 337t in Q3, the second-highest quarter on record. This is being led by China who appears to be trading US treasuries for physical gold, increasing reserves by 78t in Q3. Poland and Türkiye are two other standouts adding 57t and 39t in Q3 respectively. Moreover, there have been very few sales by central banks with Kazakhstan being the only seller at 4t. This surge in demand for physical gold is reflective of the underlying fiat currency issues stated above and is underwriting gold's record run.

At the time of writing, the price of gold has retreated to ~US$2,025. Discussion now turns to whether gold will consolidate these gains or retreat back. I think given the above reasons for gold’s ascension are still playing out there are no reasons for the price to pull back materially and I would expect the price to stay above US$2,000 in the months ahead.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link