Jack Colreavy

- Feb 20, 2024

- 6 min read

ABSI - Global Recession Watch: Japan & UK's Economic Slump

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

The (technical) recessions have started to hit with both Japan and the UK reporting a second consecutive quarter of negative GDP growth in Q4 2023. These macroeconomic events don’t come as a surprise to many given the countless forecasts for mass recessions as a result of the velocity in raising interest rates to combat inflation. While the global economy has held up reasonably well, considering the interest rate headwinds, it is unlikely these will be the only victims. This week, ABSI will assess the UK and Japanese recessions and highlight the candidates most likely to follow.

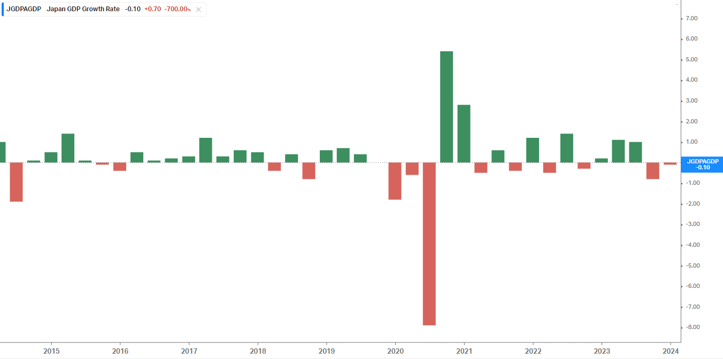

The gradual decline of the Japanese economy manifested itself last week as it officially slumped from the 3rd to the 4th largest global economy, usurped by Germany. The undesired milestone was a result of GDP data published that saw the economy contract by 0.1% in Q4 2023 in real terms. The economic print came as a surprise to many economists, given the consensus estimates were for a 0.3% increase. Instead, the second consecutive negative GDP print means that the Japanese economy is in a technical recession.

Japanese QoQ GDP Growth Rate

Source: Koyfin

Japan’s economic volatility is not news. The economy has been in a gradual state of decline for decades primarily because of unfavourable demographics. Japan has a rapidly ageing population, low birth rates, and low immigration levels contributing to a gradual decline in an economy that was once the 2nd largest and touted to overtake the United States at one stage. However, in a prime case study that the share market is decoupled from the economy, the Nikkei is on the cusp of recording an all-time record high last set in December 1989. An explanation for this can be attributed to the weak-yen boosting foreign earnings of Japanese companies and the fact that the Bank of Japan conducts quantitative easing which includes purchasing Japanese stocks.

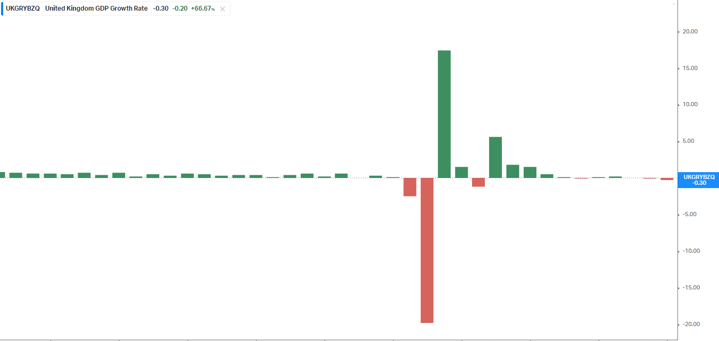

What wasn’t a surprise was the UK, which also reported its Q4 GDP figures last week. In a continuing post-Brexit slide for the UK economy, GDP printed at negative 0.3% to add to the negative 0.1% in Q3 and 0% in Q2. This wrapped up a pretty terrible 2023 for the UK which shrunk 0.2% in real terms across the 12 months. Inflation has been the key culprit for the UK’s economic woes, which peaked at 11.1% in October 2022. In some encouraging news, the economic slowdown, coupled with 5.25% interest rates, has pushed inflation down to 4%. If this trend continues the Bank of England can look to start to ease interest rates which will enable tailwinds for the economic recovery ahead.

United Kingdom QoQ GDP Growth Rate

Source: Koyfin

It took longer than most expected but the highly constrictive monetary policy, employed by most advanced economies, is finally having its desired effect of reducing inflation which comes with the undesired effect of reducing economic growth.

The question to ask now is what country is next?

If we look at the world’s largest economy, the United States, I think a recession is highly unlikely in 2024. The US economy is booming thanks to a strong reserve currency, a resilient consumer, and a very loose fiscal policy that is adding trillions to the debt load every year. There is continued speculation on when the Fed will start to ease interest rate levels but given GDP is growing at 3.3%, unemployment is holding at 3.7%, and inflation is starting to tick up slightly, there is growing chatter that the next move might be up not down.

Turning our gaze domestically, it is also highly unlikely for Australia to enter into a technical recession in 2024. While GDP growth is starting to sputter at 0.2% and unemployment has risen to 4.1%, Australia has a few tricks up its sleeve to help spur economic activity. Inflation is slowly tracking back to the target 2-3% range for the RBA to consider rate cuts while the government is holding onto a minor budget surplus. Turning the taps from constrictive to loose monetary and fiscal policy will give the economy the boost it needs. The government also has an immigration card, which has been historically used to boost economic growth.

So who is at risk of joining the technical recession club?

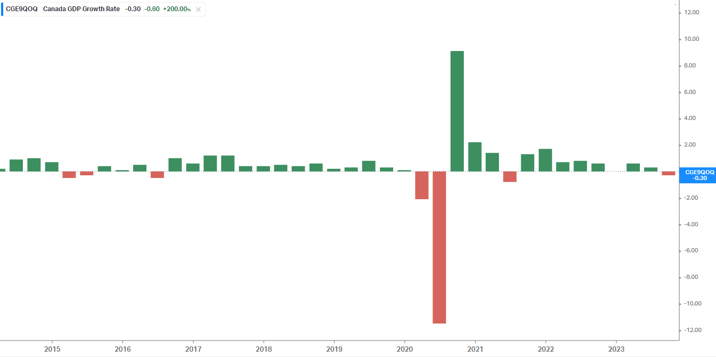

Canada QoQ GDP Growth Rate

Source: Koyfin

Canada is top of my list with Q4 GDP numbers due out next week. If consensus is correct in a 0.2% reduction this will complement the negative 0.3% in Q3 and add it to the technical recession club. Other economies also staring down the barrel of a technical recession include Germany, France, and Russia.

At the end of the day, we’re talking about a “technical” recession which may not be a true representation of an economy’s health. If you recall, there was widespread debate over the definition of a recession in 2022 when the US had two consecutive quarters of negative GDP. Since then, the US has bounced back and is in one of the strongest economic positions of the G20. I think that if people are keeping their jobs and businesses are reporting profits then the rest is just semantics.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season is set to kick off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer when announced. Until then, sign up and get tipping for Round 1.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link