Jack Colreavy

- Jul 4, 2023

- 4 min read

ABSI - Fading Hopes: China's Struggle to Reignite Economic Dragon After COVID Strategy Abandonment

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

When China officially scrapped their zero covid strategy at the start of 2023, many saw it as optimism that the Chinese dragon would roar back to life. Approximately six months later, and a few stimulus measures, that premonition has failed to materialise as the economy continues to stutter. ABSI this week will take a look at the Chinese problem.

The most important trait to underwrite a successful economy is confidence. Confidence encourages consumers to spend and businesses to invest. An economy without confidence is doomed to fail.

China has a confidence problem.

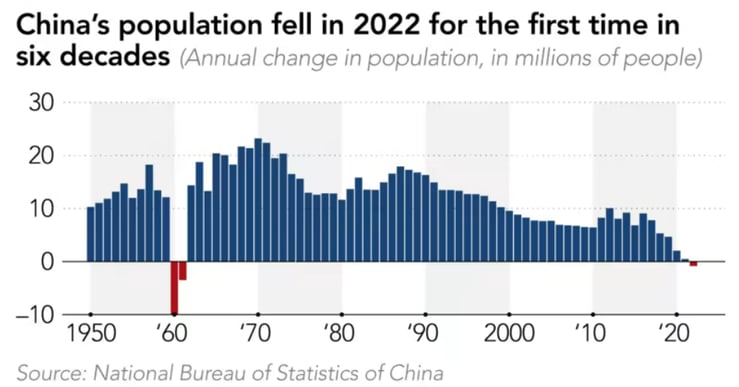

It is understandable why. The country went through very harsh lockdowns, due to the Covid pandemic, for three years. Youth unemployment (16-24 year old) recently hit a record high of 20.8%. The population is declining and ageing with estimates that over 30% of the population will be over the age of 65 by 2035 and marriages are at record lows. To top it off, the real estate market continues to struggle. It's understandable there is a confidence problem and it's the reason that analysts forecast GDP growth of between 4.4% and 6.2% which is a far cry from the 10% plus experienced in the early parts of the 21st century.

Source: Nikkei Asia

The Chinese government has always been quick to fix confidence problems in the country using monetary stimulus. During the GFC, a 4 trillion Yuan stimulus package was enacted. However, so far stimulus policies have been muted with really only central bank rate cuts to 3.55%. This hasn’t moved the needle just yet, and there are calls for more to be done. Commodity markets are sold on more China stimulus with London-listed miners catching a bid yesterday and iron ore September futures popping to US$113/t recently.

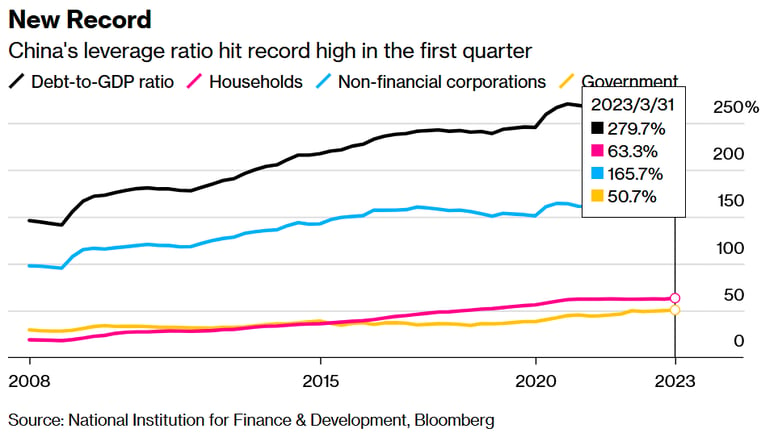

The CCP might be willing to introduce more stimulus measures but this might be a problem that money cannot fix. This is due to debt levels. As a percentage of GDP, total debt in China is 280%, the second highest after Japan. Even more concerning is that the debt doesn’t lie with the government, that’s a relatively modest 76.9%, but with companies and households. China’s private debt to GDP is a record 192%, the highest such ratio of any country (including Japan). S&P Global estimates Chinese corporate debt to be approximately US$29 trillion, only a few trillion shy of US government debt, making Chinese companies the most indebted in the world.

Source: Bloomberg

I believe the Chinese government officials are acutely aware of the debt woes and see the Japanese economy as a cautionary tale. As a result, the typical supply-side stimulus of the past won’t work in this instance. The right policy is a demand-led recovery but this requires confidence and a change of direction in what has been historically a supply-driven economy as the world’s manufacturing centre.

This is the long game, and the Chinese government has historically been good at long-term planning, but this is a new challenge. We’ll have to wait and see if they have the patience to ride this out or blink and issue more debt to try and revive the red dragon.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link