Jack Colreavy

- Jun 27, 2023

- 4 min read

ABSI - Doom and Gloom: Unveiling the Harsh Realities Plaguing Commercial Real Estate

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

News over the past month that Australian property prices are bucking the interest rate trend and starting to turn positive led by a surge in Sydney. Since April 2022, property prices in Australia have fallen by an average of 8.5% but in the last quarter the tides are turning with a small 0.6% uptick. Unfortunately, the same can’t be said for commercial real estate (CRE) with pricing continuing to come under pressure. ABSI this week analyses the reasons for the bleak outlook in CRE.

Thanks to the acceleration of remote work due to the Covid pandemic, a new term has emerged to describe the CRE offices that are more vacant than full; this is known as Zombie Real Estate (ZRE). This is an increasingly important issue because, according to Bloomberg, approx. US$1.5 trillion in CRE mortgages are due by 2025 and they’re sitting on US bank balance sheets already under pressure from mounting unrealised losses from government bonds.

It is important to note that when a company purchases an asset, it is usually recorded at “book value” - meaning at the price in which it was purchased. It is rare for companies to “mark-to-market” the value of these assets unless there is an intention to dispose of them. Therefore, many companies with ownership of CRE that were purchased in the last few years are most likely over-valuing their assets. The question many lenders are asking is if the book value is not accurate, what is the true value of the assets?

Source: The Economist

If we look at San Francisco, we can say that the market value is much lower than book value. According to real estate major Savils, SF vacancy has hit a new high of ~33% due to a combination of work from home and downturn in the tech industry prevalent in the SF Silicon Valley. Major companies are seeing the writing on the wall and are being ruthless to jettison underperforming assets. Earlier this month Westfield stopped mortgage repayments on a US$558 million loan on assets for a downtown SF mall. Likewise, Parks and Hotel Resorts defaulted on the building assets of the Hilton SF Union Square and Parc 55, two of the largest hotels in the bay area.

Big banks are aware of the situation and are scrambling to offload their bad debts at steep discounts. It has been widely reported that Wells Fargo is active in offloading CRE debt to strengthen its balance sheet in the event that the increasing interest rates and lower vacancies have a contagious effect on the broader US CRE market.

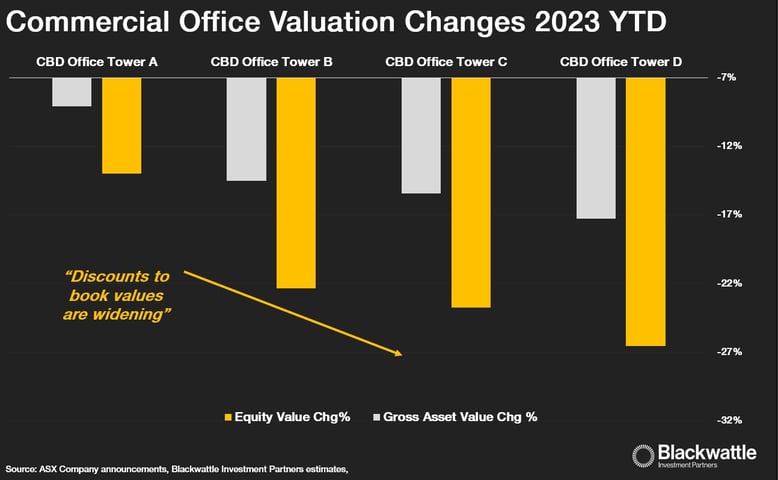

Source: Blackwattle

Financial markets are usually ahead of the curve with trends and it appears that Mr. Market is pricing in broader weakness for CRE across mature markets. The above chart from Blackwattle Investment Partners illustrates ASX listed real estate investment trusts (REITs) with exposure to CRE trading at significant discounts to NTA or book value of those CRE assets. When stocks trade at such a steep discount, it implies that the market value of those assets are lower than reported book value.

While residential real estate continues to defy the increase in interest rates as people look to spend more money on an asset that they will enviably spend more time in than previous generations, the commercial end of the spectrum is undergoing the opposite effect. Higher prevalence of remote workers and higher cost of borrowing are contributing to lower demand for CRE, which, if exacerbated, can turn quickly into a death spiral if companies choose to continue to default on repayments and add to supply glut of zombie buildings.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link