Jack Colreavy

- Mar 12, 2024

- 5 min read

ABSI - Bitcoin Bull Run is Causing Energy Inflation

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

Bitcoin is officially back as the most popular cryptocurrency breached all-time record highs today with the price at US$72,427 at the time of writing. While there is plenty of speculation as to the primary drivers of the surge including the approval of Bitcoin ETFs and the upcoming halving event. The focus for ABSI this week will be on mining and the effect of its energy cost on the global macro environment.

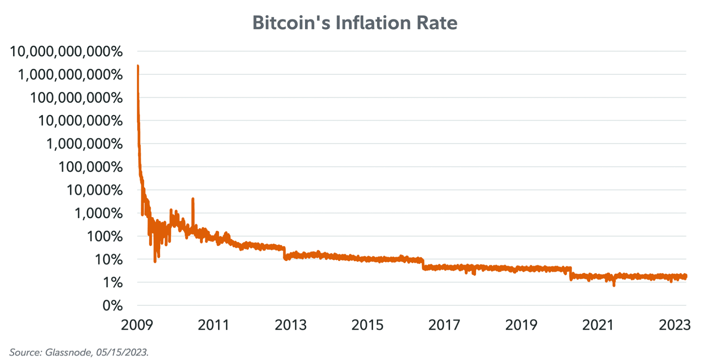

Economics 101 dictates that the market operates in a supply-and-demand function for price discovery. Bitcoin is the epitome of this law as an “asset” that has a finite supply; the protocol has a limit of 21m coins and is currently at ~19.6m. The democratisation of Bitcoin has begun with the launch of Bitcoin ETFs on American stock exchanges. The significance of the ETF is that it has significantly simplified the ability to purchase and store Bitcoin for the average investor, similar to gold ETFs back in 2004.

Demand for Bitcoin has never been higher but where does the supply come from?

Supply can only come from one of two places, the holder of existing coins or from miners who are rewarded with Bitcoin for enabling the network. The upcoming “halving”, an event that occurs every 210,000 blocks (which takes ~four years) that halves the Bitcoin reward for miners, will reduce the reward from 6.25 to 3.125 per block which means the daily supply will reduce from ~900 to ~450. Based on history, the price of Bitcoin generally increases post-halving as a function of the supply and demand equation.

Source: Fidelity Digital Assets

There are many articles on the internet that explain the Bitcoin mining process in more detail but a great analogy to explain the process is to imagine mining like a competitive puzzle competition. The task is to find a specific piece of the puzzle and miners compete to find that piece first (using computers to solve complex mathematical problems) with the winner being awarded the prize of Bitcoins. The faster you can do this trial & error process, known as the hash rate, the higher the probability you have to win. This process creates a high-security barrier but is incredibly inefficient from an energy perspective.

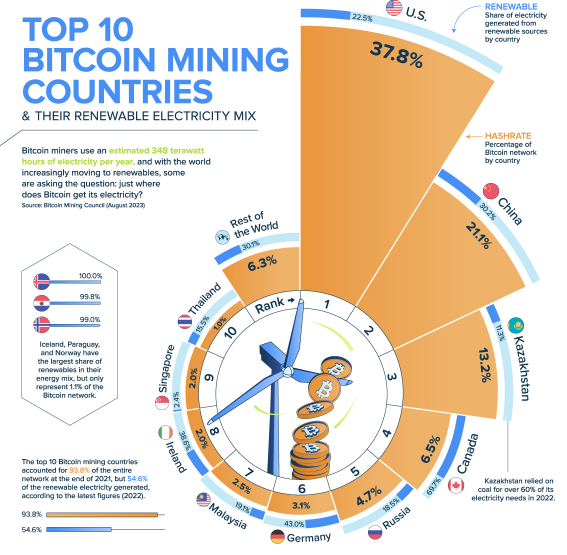

It is important to appreciate that estimates vary widely but Bitcoin miners use approx. 348 terawatt hours of electricity per year. To put that in perspective, Australia consumed 244 TWh of electricity in 2022, so the process of mining is about 1.5 times Australia’s annual electricity consumption.

Prior to a ban on mining in 2021, China was the clear market leader in mining. Today there are still underground mining operations but the USA leads the way with 37.8% of mining followed by China at 21.1% and Kazakhstan at 13.2%. Doing some rough back-of-the-envelope calculations, USA miners consume approx. 131.5 TWh of electricity per annum. Given electricity consumption in 2022 was ~4,070 TWh, Bitcoin mining contributes ~3.2% to the USA’s annual electricity consumption.

Source: Visual Capitalist

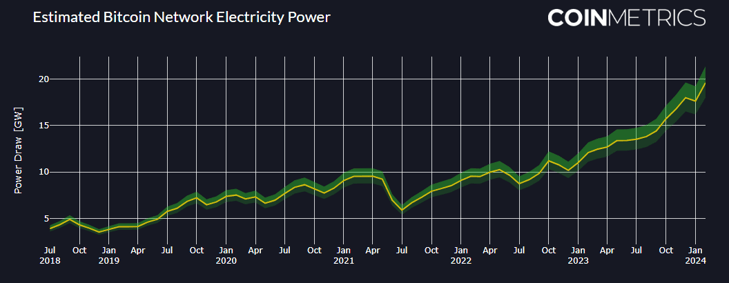

Naturally, there is a positive correlation between Bitcoin mining and the underlying price. So as the price of Bitcoin increases, the incentives to mine increase and therefore the hash rate. Critically, the Bitcoin protocol accounts for changes in the hash rate to maintain a consistent block time of ~10 minutes through a difficulty adjustment. As a result, every 2016 block (~2 weeks), there is an adjustment to the difficulty level to ensure that an increase in the hash rate won’t result in an increase in the mining block time but will increase the power consumption to run the network.

There is an extreme scenario that results in a price spiral in which the price of Bitcoin increases which increases the hash rate resulting in energy inflation which devalues the USD and incentivises the purchase of more Bitcoin as an inflation hedge reinforcing the cycle.

Source: Coinmetrics

This simulation is unlikely to eventuate as we come back to the issue of power pricing and the dynamics of competition. Roughly 80% of a miner's cost is electricity, so the best miners are the ones with the lowest cost of electricity. As new competition enters the market, the profitability per watt for the entire network decreases which results in the highest-cost producers to exit the market thus reducing the hash rate. The market dynamics ensure balance.

Having said that, it doesn’t exclude the fact that blockchain technology is an extremely energy-intensive industry to ensure the security of the network. Many don’t appreciate the benefits of the technology and see the electricity spent on mining as wasted potential. Regardless of where you stand on the argument, it is likely that the recent bull run in Bitcoin is contributing to a small amount of energy inflation in the USA as miners devour energy at a record pace.

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season is set to kick off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer when announced. Until then, sign up and get tipping for Round 1.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link