Jack Colreavy

- Jan 30, 2024

- 5 min read

ABSI - Albanese's Tax Shake-Up: A Watershed Moment for Australia's Fiscal Policy

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

Anthony Albanese made arguably the biggest decision of his prime ministership by indicating that he would change the stage 3 tax cuts to reduce the benefit to high-income earners and redistribute to low-income earners. The move is seen as either political suicide or political genius, depending on how you look at things. Regardless, the whole event puts a spotlight on tax reform in Australia. ABSI this week will look at the changes needed in the Australian tax system.

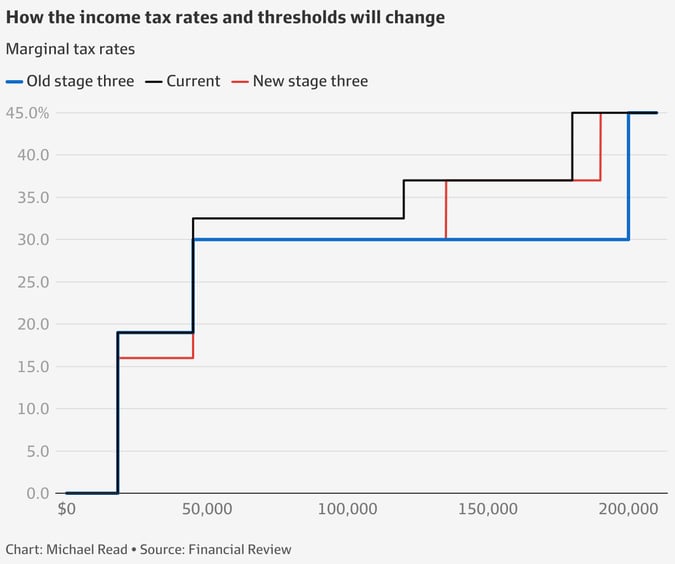

As an overview, the former Morrison Liberal government first legislated three stages of tax cuts back in 2018. Stage one increased the threshold for the 37% tax rate from A$87k to A$90k and introduced a temporary low-middle income tax offset, which has since expired. Stage two increased the 37% threshold again to A$120k while also raising the 32.5% threshold from A$37k to A$45k. Stage three, due to come into effect next financial year, was the largest change which effectively removed the 32.5% to 37% tax brackets to create a flat 30% bracket for those earning up to A$200k. This would also increase the top 45% tax bracket from A$180k to A$200k.

Source: AFR

Citing cost-of-living pressures, the Albanese government has tweaked the stage three cuts to include a benefit for all taxpayers and not just high-income earners. Under the proposed changes, the lowest tax bracket will be reduced from 19% to 16% for incomes up to A$45k, while the 37% tax bracket will be reinstated for incomes between A$135k and A$190k. The overall cost of the package is the same but some of the benefits will be shifted from those in the top bracket to the lowest-earning taxpayers.

The meaningless political fight has begun off the back of arguments about “broken promises” and the need for a “fairer system”. Most importantly, the whole fiasco has put the spotlight back on the reliance of the Australian government on income tax and the urgent need for tax reform.

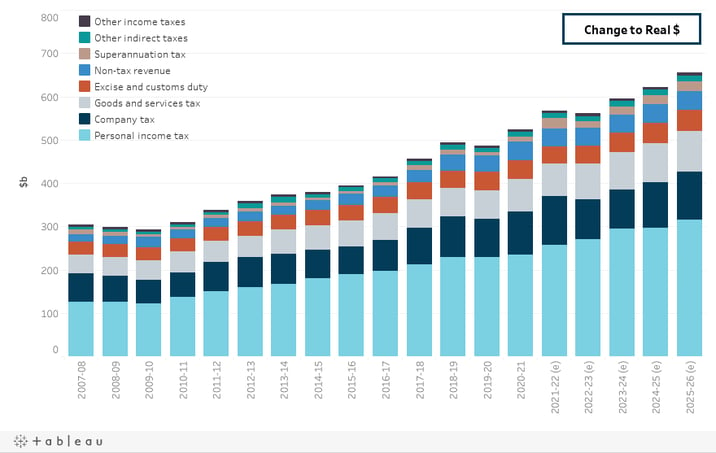

Australian Government Revenue by Source

Source: Parliament of Australia

Previous tax reform reports have indicated the overreliance on taxpayers to fund the Australian government. In 2021-22, GST contributed ~12.5%, company tax contributed ~23%, and income tax contributed ~46% of tax revenue with the top tax bracket kicking in at A$180k. In comparison, the UK had VAT contribute 17%, company tax contribute 11%, and income tax contribute 28% of government revenues with the top tax bracket of 45% kicking in at £150k ( ~A$260k).

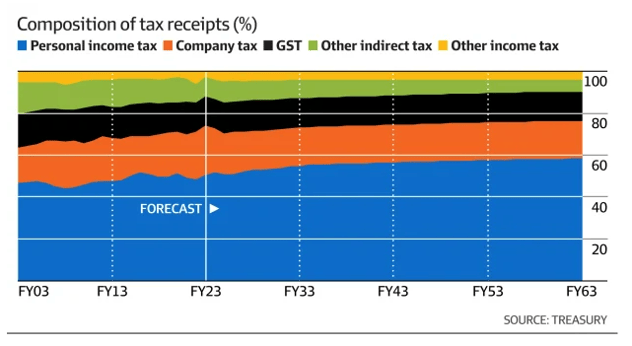

A recent intergenerational report highlights the fact that in 1980 there were 6.6 taxpayers for every person over the age of 65; today that is down to just under 4 with projections for 2.7 by 2060. Without change to the tax system, the Australian economy will simply fall apart.

Source: AFR

Meaningful tax reform is politically fraught, just ask Howard or Keating, and it takes rare leaders who have the political nous to be able to pull it off. If it is to be achieved, I believe it will take a shotgun approach that hits many targets rather than a slow and steady reform that can be brought down with a change of the political guard.

In a 2009 tax reform report by Dr Ken Henry, he advised a number of changes to reduce reliance on income and company taxes primarily by shifting from federal to state taxes. Unfortunately, the Rudd government only seized on part of the recommendations by introducing carbon and mining super profits taxes which were later repealed. Those recommendations still hold true today and can include increasing the GST, increasing taxes on economic rents or super profits, introducing a price on carbon, a comprehensive road user charge, and discounting the taxes on individuals, companies and capital gains.

Ultimately, the change to the stage three tax cuts won’t do much in the grand scheme of things. While the tax savings will hit a wider range of people, these savings could prove inflationary which may postpone future rate cuts. Additionally, taking away bracket creep and tax savings to high-income earners will just incentivise these groups to prioritise tax minimisation strategies, such as negative-gearing and expense redirection through company entities. Therefore, it is vital that both major political parties start to put together comprehensive tax reforms now to take to voters before the next election in 2025.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link