Jack Colreavy

- Jan 16, 2024

- 7 min read

ABSI - 2024 Kickoff: Bitcoin ETFs, Inflation Concerns, and Global Elections

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

The new year has begun and already we’re swimming in a deep pool of stories that could shape the year ahead. To kick off ABSI for 2024, we will take a look at some of the key stories from the first few weeks of the year and what it may mean for financial markets.

Green Light for Bitcoin ETFs

Last week the US Securities & Exchange Commission finally gave the green light for 11 companies to launch spot Bitcoin ETFs on American stock exchanges. The approval means that investors, who lack the technical sophistication to set up and operate a cryptocurrency wallet, will be able to gain exposure to Bitcoin through their regular stock broking account.

The approval was seen as a foregone conclusion by most in the market and was the primary reason for Bitcoin’s ~154% increase in price in 2023. This was due to traders “front-running”, meaning they bought Bitcoin in the market in anticipation of a surge in demand from the ETFs. Prior to approval, Bitcoin peaked at almost US$47k but has since retreated to ~US$42.5k as the traders exit their positions.

Source: Google Finance

Trading in the new ETFs has been strong to date with ~US$4.6 billion in transactions on the opening day. The biggest ETF is Grayscale, which had an existing Bitcoin trust, worth ~US$28 billion, that converted into an ETF. Other large institutions offering a product include Blackrock and Fidelity. As money continues to flow into these new products and Bitcoin ETFs are launched on other global exchanges, many analysts are forecasting a new record high for Bitcoin in 2024.

A potential comparable to look at was the launch of the first gold ETF in 2004. Following the launch, the ETF amassed over US$1 billion in demand in three days and was the start of a gold bull run that saw the price of the precious metal increase from ~US$400/oz to over US$2,000/oz today. It remains to be seen if Bitcoin ETFs can replicate the same success but their global approval is another step in the accessibility and democracy of Bitcoin adoption.

Hot US Inflation Data Dashes Rate Cut Hopes

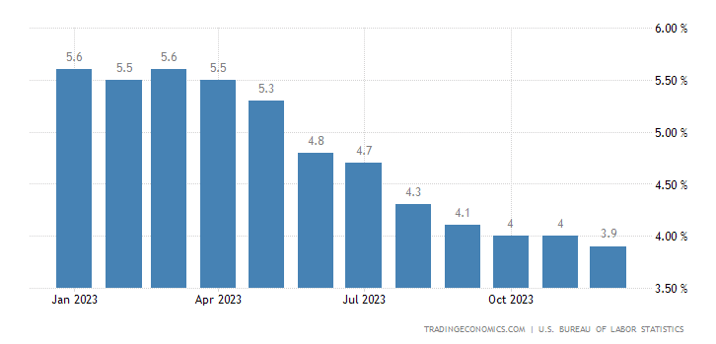

Last week, the US December inflation data was released with some bad news for investors. Prices increased 0.3% for the month reaccelerating the 12-month rate to 3.4% from 3.1%. Core inflation fell slightly from 4% to 3.9% but still remains stubbornly high due to shelter costs and motor vehicle insurance. What the result means though is the Fed will have to reassess their plans to cut in March.

Source: Trading Economics

If you recall on Dec 13 2023, Fed Chair Powell shocked the market with his explicit comments on looking towards rate cuts in 2024 despite just two weeks prior saying speculation on rate cuts was premature and the fact that core CPI was still double the 2% target. Over the past 90 years, the Fed has only ever cut rates when core CPI has been higher than unemployment (3.7%) on 5 occasions - being war and recession.

While geopolitical risks are uncomfortably high, the US isn’t in the midst of a hot war and GDP is flying at an annualised rate of 4.9%, which doesn’t suggest a recession is imminent…or is it? To date, all the talk has been about how the US is in for a soft landing and a recession will be avoided but perhaps these previous comments by Powell suggest that the Fed is worried about something in the tea leaves. We will know more at the end of the month when the Fed meets again for its interest rate decision. In the meantime, the two major data points from 2024 (CPI & unemployment) have taken the steam out of the market which ran red hot into Christmas 2023.

Taiwan Kicks Off a Big Year of Elections

The year 2024 will go down as the biggest year for democratic elections with over 40 countries holding elections including Russia, Iran, the UK, India, and the USA. Bangladesh kicked the season off with their general election on January 7 but all eyes have been firmly placed on Taiwan’s presidential election as a barometer for future relations between China and the same island country.

Last weekend, the Taiwanese people elected Lai Ching-te of the incumbent Democratic Progressive Party as their new president. The race was close with Ching-te earning 40.1% of the vote, edging out Hou Tu-ih of the Kuomintang (33.5%) and Ko Wen-je of the Taiwan People’s Party (26.5%). It will be the first presidential term for Ching-te but will be the third successive term for the DPP, who unfortunately lost its majority in the legislature and will need to work with minorities to pass legislation.

The result is being seen as a victory for Taiwanese independence and a blow to China’s plan to reunify the island to its rule. The DPP ran on a pledge to maintain political independence while KMT and TPP had run on commitments to engage with Beijing. However, China may feel it is making progress as the DPP lost 10 legislature seats while KMT and TPP gained 14 seats and 3 seats respectively. It feels like the CCP is happy to bide its time in Taiwan and will continue on its current strategy to see long-term reunification rather than resulting in an invasion.

Looking towards the rest of the 2024 election year, all eyes will be on the US presidential election circus which kicks off today (Jan 15 US time) with the first caucus meetings in Iowa for both major political parties. It is important to note that a caucus is different to a primary which follows a similar voting structure to the general election. In contrast, a traditional caucus requires voters to physically gather openly in agreed locations throughout the counties and engage in discussion on what candidate they wish to support.

The republican party still follows this structure and there has been fierce campaigning by the major candidates Trump, DeSantis, Haley, and Ramaswamy. Trump is the clear leader in the polls but the fight is tight amongst those candidates vying for second place, which can be a big boost as other candidates may drop from the race after Iowa if they produce underwhelming results.

Alternatively, the democratic party has pivoted away from tradition in this cycle and opted for a mail-in ballot system similar to a primary vote. Party members have until March 5 to mail in their choice of presidential nominee amongst a field of three - Joe Biden, Dean Phillips, and Marianne Williamson.

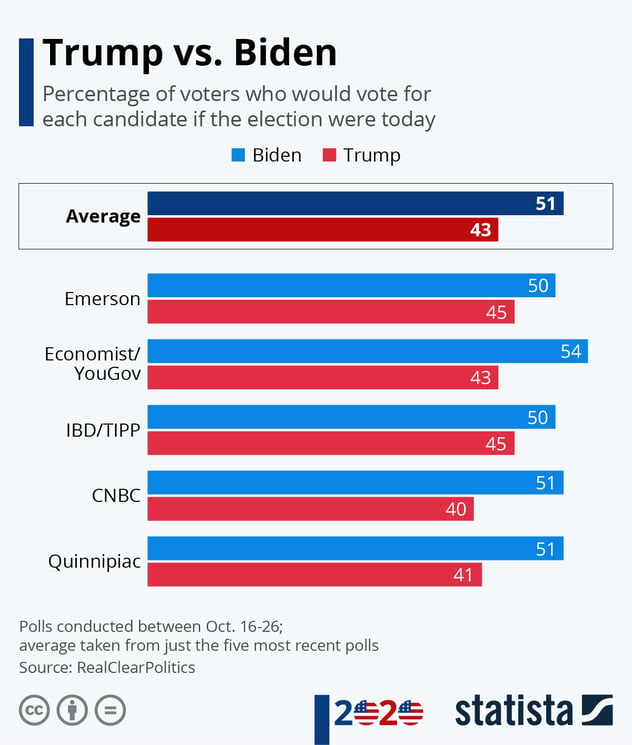

Source: Statista

After the Iowa caucus, all attention will then turn to New Hampshire which will hold primaries on January 23. The will precede a string of state primaries and caucus meetings which will ultimately decide the two major party presidential candidates by August (officially), though we should know the presumptive candidate by May/June. It will then be onto the general election which has been scheduled for Tuesday November 5 2024. Currently polling suggests a Biden vs. Trump rematch will see Trump emerge victorious, however there is a lot of campaigning between now and then and I guarantee things will change.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link